Highmark Accountants specializes in helping businesses comply with ESR Notifications and Reports in UAE, ensuring they meet regulatory obligations with precision and ease. The Economic Substance Regulation (ESR) was introduced to align the UAE with international standards, preventing tax avoidance and promoting transparent business practices. Companies engaged in specified activities are required to submit ESR Notifications and, where applicable, ESR Reports to demonstrate adequate economic presence in the UAE.

https://highmarkaccountants.com/compliance/ers-notification-and-reports-services-in-uae/

Who Needs to Submit ESR Notifications and Reports?

Entities in the UAE conducting relevant activities, such as banking, insurance, fund management, lease-finance, headquarters business, shipping, holding company operations, intellectual property (IP) activities, and distribution and service centers, must comply with ESR. Highmark Accountants helps businesses determine if they fall within the scope of these regulations and guides them through the compliance process.

Key Services by Highmark Accountants

Initial Assessment: Highmark provides an in-depth analysis to confirm whether a company’s operations are subject to ESR requirements.

Preparation and Filing of ESR Notifications: The team assists in accurately preparing and submitting ESR Notifications within the specified deadlines, ensuring that businesses report relevant activities as required by UAE regulations.

Detailed ESR Reports: Highmark supports the preparation of comprehensive ESR Reports for entities that meet the economic substance test, detailing their activities, employees, expenses, and premises to meet regulatory standards.

Compliance Review and Advisory: Ongoing guidance and regular reviews are provided to keep companies compliant, including support in responding to inquiries from regulatory authorities.

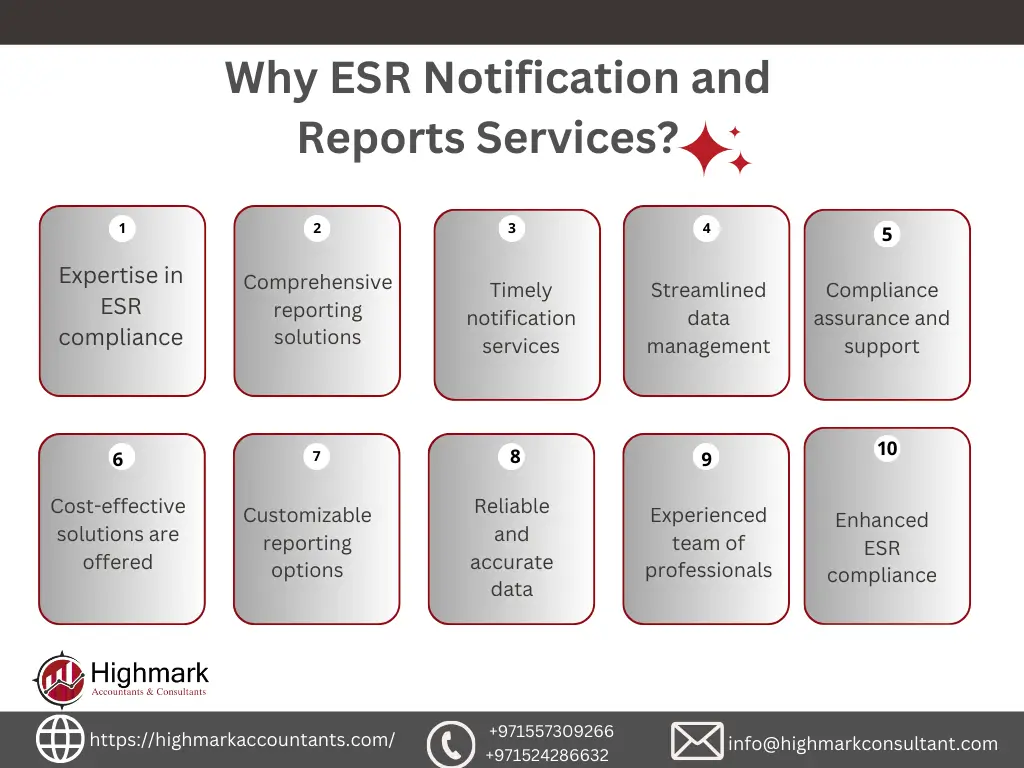

Why Choose Highmark Accountants for ESR Compliance?

Expert Knowledge: With a deep understanding of UAE regulatory requirements, Highmark offers accurate and tailored ESR compliance services.

End-to-End Support: From the initial analysis to the preparation of notifications and reports, Highmark ensures that businesses meet their obligations seamlessly.

Risk Management: By partnering with Highmark, businesses minimize the risk of non-compliance, avoiding potential fines and reputational damage.

Conclusion

Highmark Accountants is your reliable partner for navigating ESR Notifications and Reports in UAE. With comprehensive services, expert insights, and a commitment to client success, Highmark ensures that businesses remain compliant and focused on growth. Trust Highmark for all your ESR needs and achieve peace of mind knowing your business meets the highest standards of regulatory compliance.

https://highmarkaccountants.com/compliance/ers-notification-and-reports-services-in-uae/

Who Needs to Submit ESR Notifications and Reports?

Entities in the UAE conducting relevant activities, such as banking, insurance, fund management, lease-finance, headquarters business, shipping, holding company operations, intellectual property (IP) activities, and distribution and service centers, must comply with ESR. Highmark Accountants helps businesses determine if they fall within the scope of these regulations and guides them through the compliance process.

Key Services by Highmark Accountants

Initial Assessment: Highmark provides an in-depth analysis to confirm whether a company’s operations are subject to ESR requirements.

Preparation and Filing of ESR Notifications: The team assists in accurately preparing and submitting ESR Notifications within the specified deadlines, ensuring that businesses report relevant activities as required by UAE regulations.

Detailed ESR Reports: Highmark supports the preparation of comprehensive ESR Reports for entities that meet the economic substance test, detailing their activities, employees, expenses, and premises to meet regulatory standards.

Compliance Review and Advisory: Ongoing guidance and regular reviews are provided to keep companies compliant, including support in responding to inquiries from regulatory authorities.

Why Choose Highmark Accountants for ESR Compliance?

Expert Knowledge: With a deep understanding of UAE regulatory requirements, Highmark offers accurate and tailored ESR compliance services.

End-to-End Support: From the initial analysis to the preparation of notifications and reports, Highmark ensures that businesses meet their obligations seamlessly.

Risk Management: By partnering with Highmark, businesses minimize the risk of non-compliance, avoiding potential fines and reputational damage.

Conclusion

Highmark Accountants is your reliable partner for navigating ESR Notifications and Reports in UAE. With comprehensive services, expert insights, and a commitment to client success, Highmark ensures that businesses remain compliant and focused on growth. Trust Highmark for all your ESR needs and achieve peace of mind knowing your business meets the highest standards of regulatory compliance.

Highmark Accountants specializes in helping businesses comply with ESR Notifications and Reports in UAE, ensuring they meet regulatory obligations with precision and ease. The Economic Substance Regulation (ESR) was introduced to align the UAE with international standards, preventing tax avoidance and promoting transparent business practices. Companies engaged in specified activities are required to submit ESR Notifications and, where applicable, ESR Reports to demonstrate adequate economic presence in the UAE.

https://highmarkaccountants.com/compliance/ers-notification-and-reports-services-in-uae/

Who Needs to Submit ESR Notifications and Reports?

Entities in the UAE conducting relevant activities, such as banking, insurance, fund management, lease-finance, headquarters business, shipping, holding company operations, intellectual property (IP) activities, and distribution and service centers, must comply with ESR. Highmark Accountants helps businesses determine if they fall within the scope of these regulations and guides them through the compliance process.

Key Services by Highmark Accountants

Initial Assessment: Highmark provides an in-depth analysis to confirm whether a company’s operations are subject to ESR requirements.

Preparation and Filing of ESR Notifications: The team assists in accurately preparing and submitting ESR Notifications within the specified deadlines, ensuring that businesses report relevant activities as required by UAE regulations.

Detailed ESR Reports: Highmark supports the preparation of comprehensive ESR Reports for entities that meet the economic substance test, detailing their activities, employees, expenses, and premises to meet regulatory standards.

Compliance Review and Advisory: Ongoing guidance and regular reviews are provided to keep companies compliant, including support in responding to inquiries from regulatory authorities.

Why Choose Highmark Accountants for ESR Compliance?

Expert Knowledge: With a deep understanding of UAE regulatory requirements, Highmark offers accurate and tailored ESR compliance services.

End-to-End Support: From the initial analysis to the preparation of notifications and reports, Highmark ensures that businesses meet their obligations seamlessly.

Risk Management: By partnering with Highmark, businesses minimize the risk of non-compliance, avoiding potential fines and reputational damage.

Conclusion

Highmark Accountants is your reliable partner for navigating ESR Notifications and Reports in UAE. With comprehensive services, expert insights, and a commitment to client success, Highmark ensures that businesses remain compliant and focused on growth. Trust Highmark for all your ESR needs and achieve peace of mind knowing your business meets the highest standards of regulatory compliance.

0 Commentaires

0 Parts

94 Vue

0 Aperçu