Kamran Hussain, a 20-year-old SEO expert and avid blogger, passionate about optimizing digital content and crafting engaging blog posts.

-

15 Posts

-

1 Photos

-

0 Videos

-

Lives in UK

-

From UK

-

N/A

-

22/03/2004

-

Followed by 0 people

Recent Updates

-

Mr Dental: Leading Dental Supply Company in PakistanThe dental industry in Pakistan is rapidly advancing, with an increasing demand for high-quality dental products and equipment. Whether you are a dentist, dental hygienist, or a clinic owner, sourcing premium supplies is essential for delivering superior patient care. Mr Dental has emerged as a trusted dental supply company in Pakistan, offering top-grade products and unparalleled customer...0 Comments 0 Shares 123 Views 0 ReviewsPlease log in to like, share and comment!

-

Mr Dental: Your Trusted Dental Equipment Suppliers in PakistanIn the ever-evolving world of dentistry, having access to high-quality equipment is crucial for delivering exceptional patient care. Whether you're a seasoned dentist, a budding dental professional, or a dental institution, sourcing from a reliable supplier ensures efficiency, precision, and long-term success. Mr Dental has established itself as one of the leading dental equipment suppliers in...0 Comments 0 Shares 103 Views 0 Reviews

-

Haraz Dental Group is proud to be recognized as the best dentist in Fresno, CA. With a dedicated team of highly skilled professionals, they offer a range of dental services designed to meet the needs of every patient. Whether you're seeking routine check-ups, cosmetic dentistry, or advanced treatments, their state-of-the-art facilities ensure top-notch care. The team at Haraz Dental Group is committed to providing personalized care in a comfortable, welcoming environment, making your dental visit a positive experience. For those looking for reliable, expert dental services in Fresno, Haraz Dental Group is the name you can trust.

https://www.harazdentalgroup.com/Haraz Dental Group is proud to be recognized as the best dentist in Fresno, CA. With a dedicated team of highly skilled professionals, they offer a range of dental services designed to meet the needs of every patient. Whether you're seeking routine check-ups, cosmetic dentistry, or advanced treatments, their state-of-the-art facilities ensure top-notch care. The team at Haraz Dental Group is committed to providing personalized care in a comfortable, welcoming environment, making your dental visit a positive experience. For those looking for reliable, expert dental services in Fresno, Haraz Dental Group is the name you can trust. https://www.harazdentalgroup.com/Affordable Dental Clinic from the Best Dentists in Fresno, CAAt Haraz Dental Group, get the best dentist with affordable dental care in Fresno, CA. We offer Painless Dental Treatments & Same-Day Solutions.0 Comments 0 Shares 210 Views 0 Reviews -

Haraz Dental Group is a trusted dental clinic in Fresno, CA, offering a wide range of dental services for patients of all ages. Our team of skilled professionals is dedicated to providing high-quality care in a comfortable and welcoming environment. From routine check-ups and cleanings to advanced cosmetic and restorative treatments, we are committed to helping you achieve optimal oral health. Utilizing the latest technology and techniques, we ensure that every visit is efficient and effective. For compassionate care and a beautiful smile, visit Haraz Dental Group, your reliable dental clinic in Fresno, CA.

https://www.harazdentalgroup.com/Haraz Dental Group is a trusted dental clinic in Fresno, CA, offering a wide range of dental services for patients of all ages. Our team of skilled professionals is dedicated to providing high-quality care in a comfortable and welcoming environment. From routine check-ups and cleanings to advanced cosmetic and restorative treatments, we are committed to helping you achieve optimal oral health. Utilizing the latest technology and techniques, we ensure that every visit is efficient and effective. For compassionate care and a beautiful smile, visit Haraz Dental Group, your reliable dental clinic in Fresno, CA. https://www.harazdentalgroup.com/Affordable Dental Clinic from the Best Dentists in Fresno, CAAt Haraz Dental Group, get the best dentist with affordable dental care in Fresno, CA. We offer Painless Dental Treatments & Same-Day Solutions.0 Comments 0 Shares 120 Views 0 Reviews -

Cloud Accounting Service in UAE: Revolutionizing Business Finances with Cloud Accounting SoftwareIn today’s fast-evolving business landscape, technology plays a pivotal role in improving efficiency, reducing costs, and ensuring accuracy. One such technological advancement that has revolutionized financial management is cloud accounting. With businesses increasingly relying on digital solutions to streamline their operations, Cloud Accounting Services in the UAE have become essential...0 Comments 0 Shares 384 Views 0 Reviews

-

Backlog Accounting Services: A Solution for Your Business by Highmark Accountants in Dubai, UAEIn today’s fast-paced business world, maintaining up-to-date financial records is critical for the success and smooth operation of any organization. However, businesses, especially small and medium-sized enterprises (SMEs), often struggle with keeping their financial documentation accurate and timely due to various reasons. Whether it’s because of limited resources, a lack of...0 Comments 0 Shares 458 Views 0 Reviews

-

M. Faseeh Lall: A Top Entrepreneur in Pakistan Paving the Way for Digital TransformationIn the competitive and ever-evolving world of entrepreneurship, few names stand out as much as M. Faseeh Lall, a pioneering entrepreneur who has made significant contributions to Pakistan’s business landscape. Known for his innovative approach to business and his focus on digital transformation, Faseeh Lall has emerged as one of the top entrepreneurs in Pakistan. His career has been...0 Comments 0 Shares 584 Views 0 Reviews

-

Top 10 Male Entrepreneurs in Pakistan: Pioneers of Business InnovationPakistan has seen a dynamic rise in entrepreneurship over the past few decades. From the booming e-commerce sector to innovations in various industries, male entrepreneurs in Pakistan have not only shaped the economy but have also inspired future generations with their stories of resilience and success. Here’s a look at the Top 10 Male Entrepreneurs in Pakistan who have made their mark...0 Comments 0 Shares 331 Views 0 Reviews

-

M. Faseeh Lall: A Leading Example of Self-Made Entrepreneurs of PakistanThe entrepreneurial landscape of Pakistan is a rich tapestry woven with stories of determination, innovation, and perseverance. Among the many inspiring figures, M. Faseeh Lall stands out as a shining example of a self-made entrepreneur of Pakistan. His journey exemplifies the transformative power of hard work, ambition, and a relentless pursuit of excellence. The Rise of Self-Made...0 Comments 0 Shares 776 Views 0 Reviews

-

M. Faseeh Lall: A Top Entrepreneur in PakistanIn the dynamic and ever-evolving business landscape of Pakistan, one name stands out for his remarkable contributions and inspiring journey: M. Faseeh Lall. Recognized as a top entrepreneur in Pakistan, Faseeh Lall has redefined the entrepreneurial spirit with his visionary leadership, innovative ventures, and relentless commitment to excellence. The Rise of Entrepreneurship in Pakistan...0 Comments 0 Shares 623 Views 0 Reviews

-

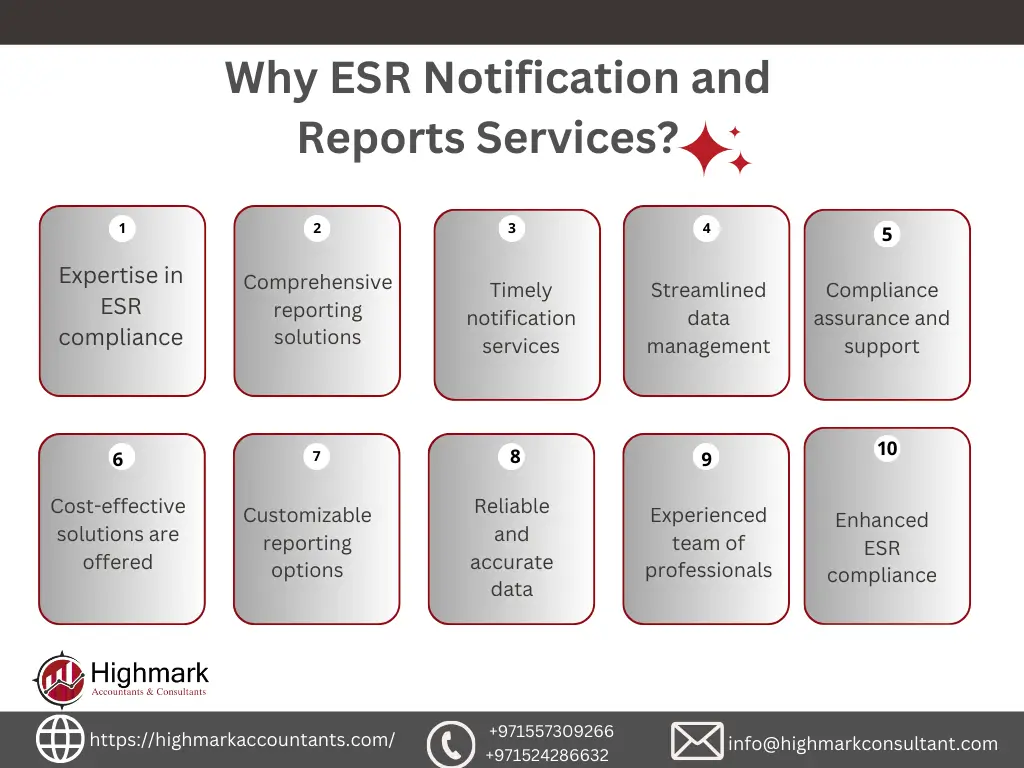

Highmark Accountants specializes in helping businesses comply with ESR Notifications and Reports in UAE, ensuring they meet regulatory obligations with precision and ease. The Economic Substance Regulation (ESR) was introduced to align the UAE with international standards, preventing tax avoidance and promoting transparent business practices. Companies engaged in specified activities are required to submit ESR Notifications and, where applicable, ESR Reports to demonstrate adequate economic presence in the UAE.

https://highmarkaccountants.com/compliance/ers-notification-and-reports-services-in-uae/

Who Needs to Submit ESR Notifications and Reports?

Entities in the UAE conducting relevant activities, such as banking, insurance, fund management, lease-finance, headquarters business, shipping, holding company operations, intellectual property (IP) activities, and distribution and service centers, must comply with ESR. Highmark Accountants helps businesses determine if they fall within the scope of these regulations and guides them through the compliance process.

Key Services by Highmark Accountants

Initial Assessment: Highmark provides an in-depth analysis to confirm whether a company’s operations are subject to ESR requirements.

Preparation and Filing of ESR Notifications: The team assists in accurately preparing and submitting ESR Notifications within the specified deadlines, ensuring that businesses report relevant activities as required by UAE regulations.

Detailed ESR Reports: Highmark supports the preparation of comprehensive ESR Reports for entities that meet the economic substance test, detailing their activities, employees, expenses, and premises to meet regulatory standards.

Compliance Review and Advisory: Ongoing guidance and regular reviews are provided to keep companies compliant, including support in responding to inquiries from regulatory authorities.

Why Choose Highmark Accountants for ESR Compliance?

Expert Knowledge: With a deep understanding of UAE regulatory requirements, Highmark offers accurate and tailored ESR compliance services.

End-to-End Support: From the initial analysis to the preparation of notifications and reports, Highmark ensures that businesses meet their obligations seamlessly.

Risk Management: By partnering with Highmark, businesses minimize the risk of non-compliance, avoiding potential fines and reputational damage.

Conclusion

Highmark Accountants is your reliable partner for navigating ESR Notifications and Reports in UAE. With comprehensive services, expert insights, and a commitment to client success, Highmark ensures that businesses remain compliant and focused on growth. Trust Highmark for all your ESR needs and achieve peace of mind knowing your business meets the highest standards of regulatory compliance.Highmark Accountants specializes in helping businesses comply with ESR Notifications and Reports in UAE, ensuring they meet regulatory obligations with precision and ease. The Economic Substance Regulation (ESR) was introduced to align the UAE with international standards, preventing tax avoidance and promoting transparent business practices. Companies engaged in specified activities are required to submit ESR Notifications and, where applicable, ESR Reports to demonstrate adequate economic presence in the UAE. https://highmarkaccountants.com/compliance/ers-notification-and-reports-services-in-uae/ Who Needs to Submit ESR Notifications and Reports? Entities in the UAE conducting relevant activities, such as banking, insurance, fund management, lease-finance, headquarters business, shipping, holding company operations, intellectual property (IP) activities, and distribution and service centers, must comply with ESR. Highmark Accountants helps businesses determine if they fall within the scope of these regulations and guides them through the compliance process. Key Services by Highmark Accountants Initial Assessment: Highmark provides an in-depth analysis to confirm whether a company’s operations are subject to ESR requirements. Preparation and Filing of ESR Notifications: The team assists in accurately preparing and submitting ESR Notifications within the specified deadlines, ensuring that businesses report relevant activities as required by UAE regulations. Detailed ESR Reports: Highmark supports the preparation of comprehensive ESR Reports for entities that meet the economic substance test, detailing their activities, employees, expenses, and premises to meet regulatory standards. Compliance Review and Advisory: Ongoing guidance and regular reviews are provided to keep companies compliant, including support in responding to inquiries from regulatory authorities. Why Choose Highmark Accountants for ESR Compliance? Expert Knowledge: With a deep understanding of UAE regulatory requirements, Highmark offers accurate and tailored ESR compliance services. End-to-End Support: From the initial analysis to the preparation of notifications and reports, Highmark ensures that businesses meet their obligations seamlessly. Risk Management: By partnering with Highmark, businesses minimize the risk of non-compliance, avoiding potential fines and reputational damage. Conclusion Highmark Accountants is your reliable partner for navigating ESR Notifications and Reports in UAE. With comprehensive services, expert insights, and a commitment to client success, Highmark ensures that businesses remain compliant and focused on growth. Trust Highmark for all your ESR needs and achieve peace of mind knowing your business meets the highest standards of regulatory compliance. HIGHMARKACCOUNTANTS.COMERS Notification and ReportsDate for submitting ESR Economic Substance Regulation notification & reports UAE fiscal year ended on March 31, 2022, is September 30, 2023.0 Comments 0 Shares 635 Views 0 Reviews

HIGHMARKACCOUNTANTS.COMERS Notification and ReportsDate for submitting ESR Economic Substance Regulation notification & reports UAE fiscal year ended on March 31, 2022, is September 30, 2023.0 Comments 0 Shares 635 Views 0 Reviews -

Highmark Accountants offers expert guidance on Economic Substance Regulation (ESR) compliance in Dubai, UAE, ensuring that businesses meet their regulatory obligations efficiently and effectively. Introduced to align the UAE with global standards set by the OECD and the European Union, the ESR mandates that entities engaged in specific activities demonstrate sufficient economic substance within the country. Failure to comply can result in significant penalties and reputational damage.

https://highmarkaccountants.com/compliance/economic-substance-regulationsers-services-in-uae/

Understanding Economic Substance Regulation in Dubai, UAE

The Economic Substance Regulation was implemented to prevent harmful tax practices and ensure that profits are reported where substantial economic activities are conducted. Companies operating in Dubai, UAE, that perform relevant activities such as banking, insurance, investment fund management, lease-finance, headquarters, shipping, holding company activities, intellectual property (IP), and distribution and service centers, must comply with ESR.

Compliance involves meeting requirements such as maintaining adequate employees, operational expenditure, and physical presence in the UAE. Additionally, companies must file an Economic Substance Notification and submit an Economic Substance Report if they engage in relevant activities.

Highmark Accountants: Your Partner for ESR Compliance

Navigating the complexities of ESR can be challenging for businesses unfamiliar with the regulation’s nuances. Highmark Accountants provides comprehensive ESR services, including:

Initial Assessment: Evaluating whether your business’s activities fall within the scope of ESR and identifying compliance obligations.

Gap Analysis: Assessing current business operations to identify any shortcomings that need to be addressed to achieve compliance.

Documentation Support: Assisting with the preparation and submission of required ESR filings and reports.

Ongoing Compliance Monitoring: Ensuring your business remains compliant by adapting to any changes in regulatory requirements and conducting periodic reviews.

Benefits of Partnering with Highmark Accountants

Expertise: Highmark’s team has extensive experience in UAE regulatory frameworks, ensuring that clients receive knowledgeable and tailored support.

Comprehensive Service: From initial evaluation to documentation and monitoring, Highmark offers end-to-end ESR services.

Reduced Risk: With Highmark’s meticulous approach, businesses can avoid non-compliance penalties and safeguard their reputation.

Highmark Accountants helps businesses in Dubai, UAE, navigate the Economic Substance Regulation with ease and confidence. By partnering with Highmark, companies can focus on their core activities, knowing that their compliance needs are managed by professionals. Trust Highmark Accountants for reliable, expert ESR guidance that ensures compliance and peace of mind.Highmark Accountants offers expert guidance on Economic Substance Regulation (ESR) compliance in Dubai, UAE, ensuring that businesses meet their regulatory obligations efficiently and effectively. Introduced to align the UAE with global standards set by the OECD and the European Union, the ESR mandates that entities engaged in specific activities demonstrate sufficient economic substance within the country. Failure to comply can result in significant penalties and reputational damage. https://highmarkaccountants.com/compliance/economic-substance-regulationsers-services-in-uae/ Understanding Economic Substance Regulation in Dubai, UAE The Economic Substance Regulation was implemented to prevent harmful tax practices and ensure that profits are reported where substantial economic activities are conducted. Companies operating in Dubai, UAE, that perform relevant activities such as banking, insurance, investment fund management, lease-finance, headquarters, shipping, holding company activities, intellectual property (IP), and distribution and service centers, must comply with ESR. Compliance involves meeting requirements such as maintaining adequate employees, operational expenditure, and physical presence in the UAE. Additionally, companies must file an Economic Substance Notification and submit an Economic Substance Report if they engage in relevant activities. Highmark Accountants: Your Partner for ESR Compliance Navigating the complexities of ESR can be challenging for businesses unfamiliar with the regulation’s nuances. Highmark Accountants provides comprehensive ESR services, including: Initial Assessment: Evaluating whether your business’s activities fall within the scope of ESR and identifying compliance obligations. Gap Analysis: Assessing current business operations to identify any shortcomings that need to be addressed to achieve compliance. Documentation Support: Assisting with the preparation and submission of required ESR filings and reports. Ongoing Compliance Monitoring: Ensuring your business remains compliant by adapting to any changes in regulatory requirements and conducting periodic reviews. Benefits of Partnering with Highmark Accountants Expertise: Highmark’s team has extensive experience in UAE regulatory frameworks, ensuring that clients receive knowledgeable and tailored support. Comprehensive Service: From initial evaluation to documentation and monitoring, Highmark offers end-to-end ESR services. Reduced Risk: With Highmark’s meticulous approach, businesses can avoid non-compliance penalties and safeguard their reputation. Highmark Accountants helps businesses in Dubai, UAE, navigate the Economic Substance Regulation with ease and confidence. By partnering with Highmark, companies can focus on their core activities, knowing that their compliance needs are managed by professionals. Trust Highmark Accountants for reliable, expert ESR guidance that ensures compliance and peace of mind. HIGHMARKACCOUNTANTS.COMEconomic Substance Regulations ESREconomic substance regulation UAE Est April 2019."relevant activity" participants, free Zone, offshore. Fiscal years begin after Jan 1,20190 Comments 0 Shares 772 Views 0 Reviews

HIGHMARKACCOUNTANTS.COMEconomic Substance Regulations ESREconomic substance regulation UAE Est April 2019."relevant activity" participants, free Zone, offshore. Fiscal years begin after Jan 1,20190 Comments 0 Shares 772 Views 0 Reviews

More Stories