Cryptocurrency Market Strengths and Competitive Landscape

Cryptocurrency 2024

Cryptocurrency has emerged as one of the most disruptive innovations in the financial world over the past decade. As a decentralized form of digital currency, it allows for peer-to-peer transactions without the need for traditional banking intermediaries. Blockchain technology, which underpins most cryptocurrencies, provides a transparent and secure way to record transactions, making it an attractive alternative to conventional financial systems. The rise of cryptocurrencies has spurred significant market interest, with businesses and individuals seeking ways to incorporate digital currencies into their operations. Cryptocurrency Market Trends indicate a continued growth trajectory, driven by increased adoption and evolving regulations.

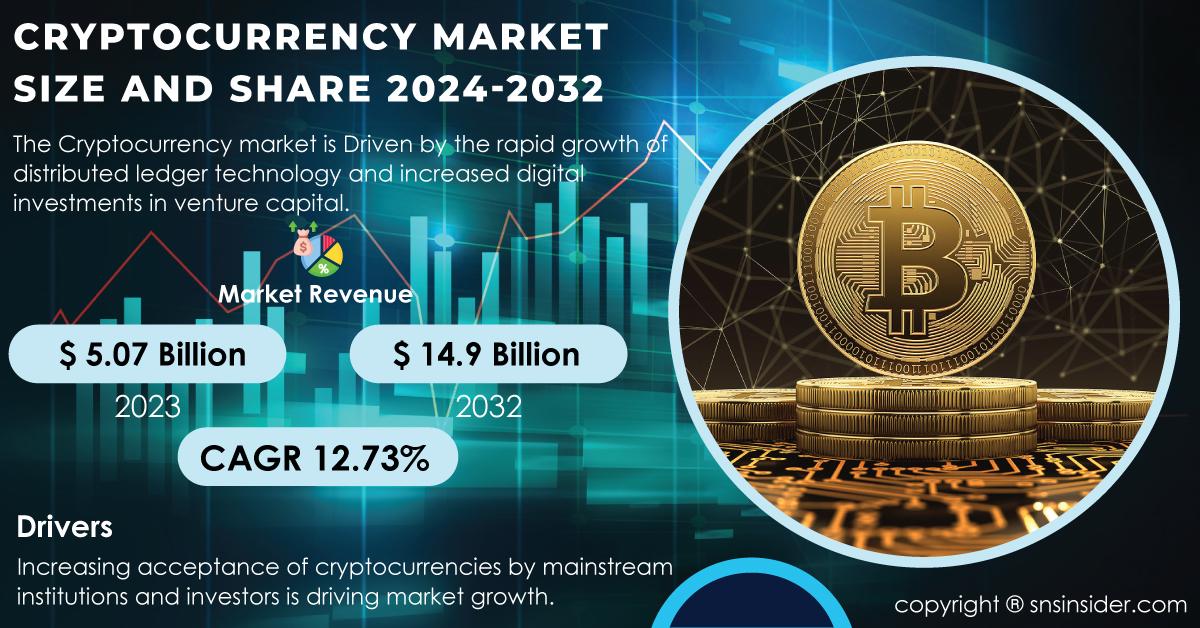

Cryptocurrency Market was valued at USD 5.07 Billion in 2023 and is expected to reach USD 14.9 Billion by 2032 and grow at a CAGR of 12.73% over the forecast period 2024-2032.

The Evolution of Cryptocurrency

The concept of cryptocurrency dates back to the early 1990s, but it was not until the creation of Bitcoin in 2009 that the market gained widespread attention. Bitcoin, created by an anonymous individual or group known as Satoshi Nakamoto, introduced the idea of a decentralized, digital currency based on blockchain technology. Since then, thousands of other cryptocurrencies have been developed, each with unique features, use cases, and underlying technologies. These include well-known cryptocurrencies such as Ethereum, Ripple, Litecoin, and many others.

The rapid rise of cryptocurrencies has attracted investors, developers, and businesses, with blockchain technology being recognized as a powerful tool for a variety of applications beyond just digital currencies. Cryptocurrencies have evolved from niche internet phenomena to a serious financial asset class, gaining acceptance from institutional investors, financial institutions, and even governments around the world.

The Role of Blockchain in Cryptocurrency

Blockchain technology, which is the foundation of most cryptocurrencies, is a distributed ledger system that records transactions in a secure, transparent, and immutable way. Each transaction is verified by a network of computers (or nodes) before being added to the blockchain, creating a permanent record that cannot be altered retroactively. This ensures the integrity of cryptocurrency transactions and makes it difficult for bad actors to manipulate the system.

Blockchain technology has also introduced the concept of "smart contracts," which are self-executing contracts with the terms of the agreement directly written into code. This innovation has expanded the possibilities for cryptocurrencies, allowing for automated, transparent, and efficient business operations in sectors such as finance, real estate, and supply chain management.

Adoption and Integration into Traditional Finance

Cryptocurrency's integration into traditional finance is one of the key drivers behind its growth. Many businesses now accept cryptocurrencies as a form of payment, and some countries are even exploring the concept of central bank digital currencies (CBDCs), which are government-backed cryptocurrencies. Additionally, major financial institutions are starting to offer cryptocurrency-related services, such as trading platforms, investment vehicles, and custodial services. The increasing acceptance of cryptocurrencies by the mainstream financial system has helped legitimize digital currencies and fostered greater confidence among investors.

Governments and regulators around the world have also begun to recognize the importance of cryptocurrency, though regulatory frameworks remain inconsistent across different jurisdictions. In some countries, like El Salvador, Bitcoin has been declared legal tender, while others have imposed stricter regulations or outright bans. As regulatory clarity improves, cryptocurrencies are expected to become more widely adopted and integrated into the global financial system.

Challenges and Future Prospects

Despite the tremendous growth, cryptocurrencies still face significant challenges. Price volatility remains one of the most prominent risks for investors, as digital currencies can experience significant price fluctuations in short periods. Furthermore, the environmental impact of cryptocurrency mining, particularly Bitcoin, has raised concerns due to the high energy consumption associated with the mining process.

Additionally, cybersecurity threats, such as hacking and fraud, continue to be major issues. High-profile security breaches and scams have made many potential investors cautious about entering the market. Ensuring the safety and security of digital assets will be critical to maintaining trust in cryptocurrencies and their long-term viability.

Despite these challenges, the future of cryptocurrency looks promising. As blockchain technology continues to evolve and regulatory frameworks become more established, the cryptocurrency market is expected to mature. Innovations in areas like decentralized finance (DeFi), non-fungible tokens (NFTs), and other blockchain-based applications are likely to drive further growth, expanding the use cases of cryptocurrencies beyond simple transactions.

Conclusion

Cryptocurrency has undoubtedly transformed the way we think about money, finance, and transactions. Its decentralized nature, coupled with the security and transparency offered by blockchain technology, has sparked a revolution in the financial industry. While there are challenges to overcome, including regulatory hurdles and security concerns, the growing adoption of cryptocurrencies and their integration into the broader financial ecosystem suggest that their influence will only continue to expand in the years to come. With its potential to reshape traditional finance, cryptocurrency is positioned to be a cornerstone of the digital economy in the future.

Contact Us:

Akash Anand – Head of Business Development & Strategy

info@snsinsider.com

Phone: +1-415-230-0044 (US) | +91-7798602273 (IND)

About Us

S&S Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

Read Our Other Reports:

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jogos

- Gardening

- Health

- Início

- Literature

- Music

- Networking

- Outro

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness