-

8 Posts

-

1 Photos

-

0 Videos

-

Lives in Delhi, India

-

From Delhi, India

-

Male

-

Followed by 0 people

Recent Updates

-

QuickBooks Live Bookkeeping: Expert Help for Your Business

QuickBooks Live Bookkeeping provides you with an additional service that connects you with a full-time bookkeeper. With this service, you will benefit from the assistance of a skilled custom writer who will handle your appropriate term papers, organize your qualitative primary data, and complete every other writing assignment. This means that instead of doing all the boring accounting work, you can simply actively run your business without worrying about any bookkeeping. QuickBooks Live Bookkeeping is tailored for busy small-scale business owners who do not wish to spend too much time on their accounting. Moreover, it perfectly fits into your QuickBooks account, giving you up-to-date information on your business’s financial status. The use of QuickBooks Live Bookkeeping allows you to cut down on time spent as well as frustrations equally especially when it comes to management of your finances by yourself.

visit here: https://www.wizxpert.com/quickbooks-live-bookkeeping/

QuickBooks Live Bookkeeping: Expert Help for Your Business QuickBooks Live Bookkeeping provides you with an additional service that connects you with a full-time bookkeeper. With this service, you will benefit from the assistance of a skilled custom writer who will handle your appropriate term papers, organize your qualitative primary data, and complete every other writing assignment. This means that instead of doing all the boring accounting work, you can simply actively run your business without worrying about any bookkeeping. QuickBooks Live Bookkeeping is tailored for busy small-scale business owners who do not wish to spend too much time on their accounting. Moreover, it perfectly fits into your QuickBooks account, giving you up-to-date information on your business’s financial status. The use of QuickBooks Live Bookkeeping allows you to cut down on time spent as well as frustrations equally especially when it comes to management of your finances by yourself. visit here: https://www.wizxpert.com/quickbooks-live-bookkeeping/ WWW.WIZXPERT.COMWhat is QuickBooks Live Bookkeeping: Benefits, Offered Services, & How it worksLearn about What is QuickBooks Live Bookkeeping, Best Virtual Bookkeeping Services: Benefits, Offered Services, and How it works.0 Comments 0 Shares 399 Views 0 ReviewsPlease log in to like, share and comment!

WWW.WIZXPERT.COMWhat is QuickBooks Live Bookkeeping: Benefits, Offered Services, & How it worksLearn about What is QuickBooks Live Bookkeeping, Best Virtual Bookkeeping Services: Benefits, Offered Services, and How it works.0 Comments 0 Shares 399 Views 0 ReviewsPlease log in to like, share and comment! -

QuickBooks System Requirements: Ensure Optimal Performance

This is a Post on QuickBooks System Requirements. there are System Requirements and Suitable Hardware You Have to Follow and Access in order to fully enjoy QuickBooks. For Desktop Quickbooks system requirements, the minimum operating system required is Windows 10 or older. In addition, there should also be no less than 4GB of RAM that can work with a 2.4GHz processor. On the other hand, for Mac users, QuickBooks Desktop is supported on macOS operating systems from 10.14 lockdown and above. Again, it is recommended to incorporate SSDs for a more optimized performance. When it comes to QuickBooks Online, it is less complex: all you need is a stable internet connection with a functional browser such as Google Chrome, Firefox, or Safari. Your system's compliance with the QuickBooks system requirements prevents unnecessary challenges such as delays in operations allowing you to carry out proper management of finances.

visit here: https://www.wizxpert.com/system-requirements-for-quickbooks/QuickBooks System Requirements: Ensure Optimal Performance This is a Post on QuickBooks System Requirements. there are System Requirements and Suitable Hardware You Have to Follow and Access in order to fully enjoy QuickBooks. For Desktop Quickbooks system requirements, the minimum operating system required is Windows 10 or older. In addition, there should also be no less than 4GB of RAM that can work with a 2.4GHz processor. On the other hand, for Mac users, QuickBooks Desktop is supported on macOS operating systems from 10.14 lockdown and above. Again, it is recommended to incorporate SSDs for a more optimized performance. When it comes to QuickBooks Online, it is less complex: all you need is a stable internet connection with a functional browser such as Google Chrome, Firefox, or Safari. Your system's compliance with the QuickBooks system requirements prevents unnecessary challenges such as delays in operations allowing you to carry out proper management of finances. visit here: https://www.wizxpert.com/system-requirements-for-quickbooks/ WWW.WIZXPERT.COMQuickBooks 2024 Minimum System Requirements (2023, 2022, & Older Version)Know about QuickBooks 2024 Minimum System Requirements that explains which version needs to work efficiently for all QB products (Enterprise, Desktop, for Mac).0 Comments 0 Shares 372 Views 0 Reviews

WWW.WIZXPERT.COMQuickBooks 2024 Minimum System Requirements (2023, 2022, & Older Version)Know about QuickBooks 2024 Minimum System Requirements that explains which version needs to work efficiently for all QB products (Enterprise, Desktop, for Mac).0 Comments 0 Shares 372 Views 0 Reviews -

The Ultimate Guide to QuickBooks Payroll Support

To manage the payroll effectively for your organization using QuickBooks, QuickBooks payroll support becomes necessary. Their support team assists in performing various tasks, including setting up payrolls, handling payments, managing payroll problems, and so on. You can reach out to the support team by telephone, instant messaging, or electronic mail and there are also several other resources provided by QuickBooks, such as how-to videos and question-and-answer sections on the internet. The support department assists with any problems that arise in the course of making tax calculations, and direct deposit transactions, as well as when it is taxing payrolls so that all payments are completed without any hitches. QuickBooks payroll support helps such firms remain within rules and reduce mistakes, which is why it is important for firms utilizing the payroll services QuickBooks has to offer.

visit here: https://www.wizxpert.com/quickbooks-online-payroll-support/The Ultimate Guide to QuickBooks Payroll Support To manage the payroll effectively for your organization using QuickBooks, QuickBooks payroll support becomes necessary. Their support team assists in performing various tasks, including setting up payrolls, handling payments, managing payroll problems, and so on. You can reach out to the support team by telephone, instant messaging, or electronic mail and there are also several other resources provided by QuickBooks, such as how-to videos and question-and-answer sections on the internet. The support department assists with any problems that arise in the course of making tax calculations, and direct deposit transactions, as well as when it is taxing payrolls so that all payments are completed without any hitches. QuickBooks payroll support helps such firms remain within rules and reduce mistakes, which is why it is important for firms utilizing the payroll services QuickBooks has to offer. visit here: https://www.wizxpert.com/quickbooks-online-payroll-support/ WWW.WIZXPERT.COMHow Do I Contact QuickBooks Online Payroll Support?Find out what is the phone number for QuickBooks Online payroll support? How do I talk to a live person?0 Comments 0 Shares 304 Views 0 Reviews

WWW.WIZXPERT.COMHow Do I Contact QuickBooks Online Payroll Support?Find out what is the phone number for QuickBooks Online payroll support? How do I talk to a live person?0 Comments 0 Shares 304 Views 0 Reviews -

Top Accounting Software for Mac

When looking for the best Accounting Software for Mac: the main factors would be ease of use, functionality, and integration. One of the popular options is QuickBooks Online which is well-known for its all-rounded features and cloud reliability. Xero is a very close second providing competitive invoicing, payroll, and reporting services. For those who desire convenience, Fresh Books would be perfect for most freelancers and small business owners. Wave Accounting is another great solution because it is free yet does those basic accounting functions quite well. These Top Accounting Software for Mac are specifically developed to enable organizations to perform financial functions effectively while using Apple devices, eliminating wastages and providing plenty of increase.

visit here: https://www.wizxpert.com/accounting-software-for-mac/

Top Accounting Software for Mac When looking for the best Accounting Software for Mac: the main factors would be ease of use, functionality, and integration. One of the popular options is QuickBooks Online which is well-known for its all-rounded features and cloud reliability. Xero is a very close second providing competitive invoicing, payroll, and reporting services. For those who desire convenience, Fresh Books would be perfect for most freelancers and small business owners. Wave Accounting is another great solution because it is free yet does those basic accounting functions quite well. These Top Accounting Software for Mac are specifically developed to enable organizations to perform financial functions effectively while using Apple devices, eliminating wastages and providing plenty of increase. visit here: https://www.wizxpert.com/accounting-software-for-mac/ WWW.WIZXPERT.COMThe Best Accounting Software for MacIf you discovered an accounting programme that somehow wasn't compatible with Mac, there are many Mac users who want to get best accounting software that run smoothly0 Comments 0 Shares 274 Views 0 Reviews

WWW.WIZXPERT.COMThe Best Accounting Software for MacIf you discovered an accounting programme that somehow wasn't compatible with Mac, there are many Mac users who want to get best accounting software that run smoothly0 Comments 0 Shares 274 Views 0 Reviews -

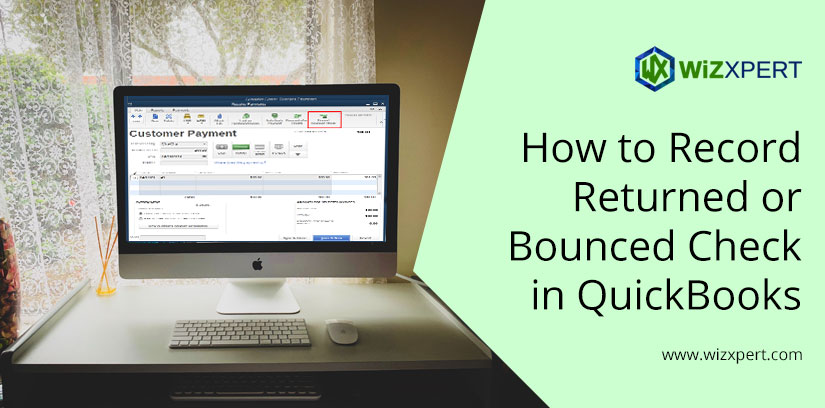

How to record a bounced check in QuickBooks Online

How to record a bounced check in the QuickBooks Online application, to enter a returned check, click on the Banking tab then proceed to the Record Payments option and search for the payment made that was later withdrawn or returned. You could void or correct the payment in question. Thereafter, incur an expense that captures any NSF (non-sufficient funds) services levied by the bank to which you wish to account charges like Bank Fees and fill in the charge. Lastly, confirm the entry. The benefit this provides is that helps to ascertain the integrity of the records, hence the maintenance of the system and the timeliness of the bank reconciliation procedures. This however calls for strict procedures and discipline in the entries made and any errors on the payment linkage or fee classifications may cause a variance in the accounting records.

visit here:https://www.wizxpert.com/how-to-record-returned-or-bounced-check-in-quickbooks/

How to record a bounced check in QuickBooks Online How to record a bounced check in the QuickBooks Online application, to enter a returned check, click on the Banking tab then proceed to the Record Payments option and search for the payment made that was later withdrawn or returned. You could void or correct the payment in question. Thereafter, incur an expense that captures any NSF (non-sufficient funds) services levied by the bank to which you wish to account charges like Bank Fees and fill in the charge. Lastly, confirm the entry. The benefit this provides is that helps to ascertain the integrity of the records, hence the maintenance of the system and the timeliness of the bank reconciliation procedures. This however calls for strict procedures and discipline in the entries made and any errors on the payment linkage or fee classifications may cause a variance in the accounting records. visit here:https://www.wizxpert.com/how-to-record-returned-or-bounced-check-in-quickbooks/ WWW.WIZXPERT.COMHow to Record Returned or Bounced Check in QuickBooksLearn how to record & enter returned or bounced check in QuickBooks. Follow these steps to handle it in QuickBooks Desktop & Online.0 Comments 0 Shares 263 Views 0 Reviews

WWW.WIZXPERT.COMHow to Record Returned or Bounced Check in QuickBooksLearn how to record & enter returned or bounced check in QuickBooks. Follow these steps to handle it in QuickBooks Desktop & Online.0 Comments 0 Shares 263 Views 0 Reviews -

How to delete a deposit in QuickBooks

In case you are thinking about How to delete a deposit in QuickBooks, it is a very easy technique but has advantages and disadvantages when applied. To delete a deposit go to Banking > Make Deposits, locate the deposit, and press the Delete button to remove it. This action of deleting a deposit comes in handy to fix errors like deposits made in error or wrong figures presented in the deposits ensuring the financial records are kept clean. The demerit, however, is the deletions of the deposits potentially hampers the bank reconciliation and the financial report. If one deposits and reconciles the transaction and later deletes that deposit, that will lead to a conflict in the figures, thus more costs in time to resolve matters. This brings into focus the fact that, if at all you intend to delete a deposit in QuickBooks, you should think twice before arriving at that decision.

visit here:https://www.wizxpert.com/how-to-delete-a-deposit-in-quickbooks/

How to delete a deposit in QuickBooks In case you are thinking about How to delete a deposit in QuickBooks, it is a very easy technique but has advantages and disadvantages when applied. To delete a deposit go to Banking > Make Deposits, locate the deposit, and press the Delete button to remove it. This action of deleting a deposit comes in handy to fix errors like deposits made in error or wrong figures presented in the deposits ensuring the financial records are kept clean. The demerit, however, is the deletions of the deposits potentially hampers the bank reconciliation and the financial report. If one deposits and reconciles the transaction and later deletes that deposit, that will lead to a conflict in the figures, thus more costs in time to resolve matters. This brings into focus the fact that, if at all you intend to delete a deposit in QuickBooks, you should think twice before arriving at that decision. visit here:https://www.wizxpert.com/how-to-delete-a-deposit-in-quickbooks/ WWW.WIZXPERT.COMHow to Delete a Deposit in QuickBooks Online & DesktopLearn how to delete a deposit in QuickBooks Online & Desktop. And, how to void, reverse and undo a deposit in QB for both deposited and undeposited funds.0 Comments 0 Shares 317 Views 0 Reviews

WWW.WIZXPERT.COMHow to Delete a Deposit in QuickBooks Online & DesktopLearn how to delete a deposit in QuickBooks Online & Desktop. And, how to void, reverse and undo a deposit in QB for both deposited and undeposited funds.0 Comments 0 Shares 317 Views 0 Reviews -

How to change the beginning balance in QuickBooks

To adjust the opening How to change the beginning balance in QuickBooks

take the following actions: Open QuickBooks first and go to the Company option from the menu. Then, choose Make General Journal Entries. In the journal entry screen, type in the date of the new balance then debit the opening balance account. Remember, the total debits and credits should be equal to the starting balance that you provided. Alternatively, you can change certain particular accounts like bank or equity accounts depending on your changes. After you’ve finished, remember to save and edit the entry. In QuickBooks Online, click the Settings gear icon, click Chart of Accounts, and click the Begin balance edit option for the respective account. Changing the beginning balance brings advantages that include proper reporting of the financial information and the smooth flow of the reporting system over time. One disadvantage, however, is that it can disturb the accounting records and compromise the pricing of goods and services if there are unnecessary alterations. Always proofread the entries to prevent any form of complications when there are changes in the starting balance in QuickBooks.

visit here:https://www.wizxpert.com/record-opening-balance-in-quickbooks/

How to change the beginning balance in QuickBooks To adjust the opening How to change the beginning balance in QuickBooks take the following actions: Open QuickBooks first and go to the Company option from the menu. Then, choose Make General Journal Entries. In the journal entry screen, type in the date of the new balance then debit the opening balance account. Remember, the total debits and credits should be equal to the starting balance that you provided. Alternatively, you can change certain particular accounts like bank or equity accounts depending on your changes. After you’ve finished, remember to save and edit the entry. In QuickBooks Online, click the Settings gear icon, click Chart of Accounts, and click the Begin balance edit option for the respective account. Changing the beginning balance brings advantages that include proper reporting of the financial information and the smooth flow of the reporting system over time. One disadvantage, however, is that it can disturb the accounting records and compromise the pricing of goods and services if there are unnecessary alterations. Always proofread the entries to prevent any form of complications when there are changes in the starting balance in QuickBooks. visit here:https://www.wizxpert.com/record-opening-balance-in-quickbooks/ WWW.WIZXPERT.COMHow To Add, Enter, or Edit Opening Balance In QuickBooks?Learn how to add, enter, and change the opening balance in QuickBooks Desktop for bank or credit card accounts.0 Comments 0 Shares 397 Views 0 Reviews

WWW.WIZXPERT.COMHow To Add, Enter, or Edit Opening Balance In QuickBooks?Learn how to add, enter, and change the opening balance in QuickBooks Desktop for bank or credit card accounts.0 Comments 0 Shares 397 Views 0 Reviews -

Jase Maanadded 1 photos to the album: QuickBooks File Doctor: Fix OUR Company Your Ultimate Solution for internet issues2024-10-21 09:31:21 - TranslateThe QuickBooks File Doctor comes in handy for spotting and rectifying complications that may arise in your QuickBooks firm’s files. For example, it can detect and fix things like a corrupt file or a network connection problem. https://www.wizxpert.com/quickbooks-file-doctor/

With the help of the QuickBooks File Doctor you will be able to look for problems. within the company file and assess the installation of QuickBooks for related problems. If you are unable to access your company file due to error messages or are unable to find it, the next step in troubleshooting would be running the QuickBooks File Doctor.

There are numerous benefit associated with use of QuickBooks File. treatment that will improve your enjoyment of the QuickBooks File Doctor Application.

The QuickBooks File Doctor comes in handy for spotting and rectifying complications that may arise in your QuickBooks firm’s files. For example, it can detect and fix things like a corrupt file or a network connection problem. https://www.wizxpert.com/quickbooks-file-doctor/ With the help of the QuickBooks File Doctor you will be able to look for problems. within the company file and assess the installation of QuickBooks for related problems. If you are unable to access your company file due to error messages or are unable to find it, the next step in troubleshooting would be running the QuickBooks File Doctor. There are numerous benefit associated with use of QuickBooks File. treatment that will improve your enjoyment of the QuickBooks File Doctor Application.0 Comments 0 Shares 279 Views 0 Reviews

More Stories