Fraud Hunters Market Opportunities: Growth, Share, Value, Size, and Insights , Industry Overview and Forecast to 2029

"Fraud Hunters Market Size And Forecast by 2029

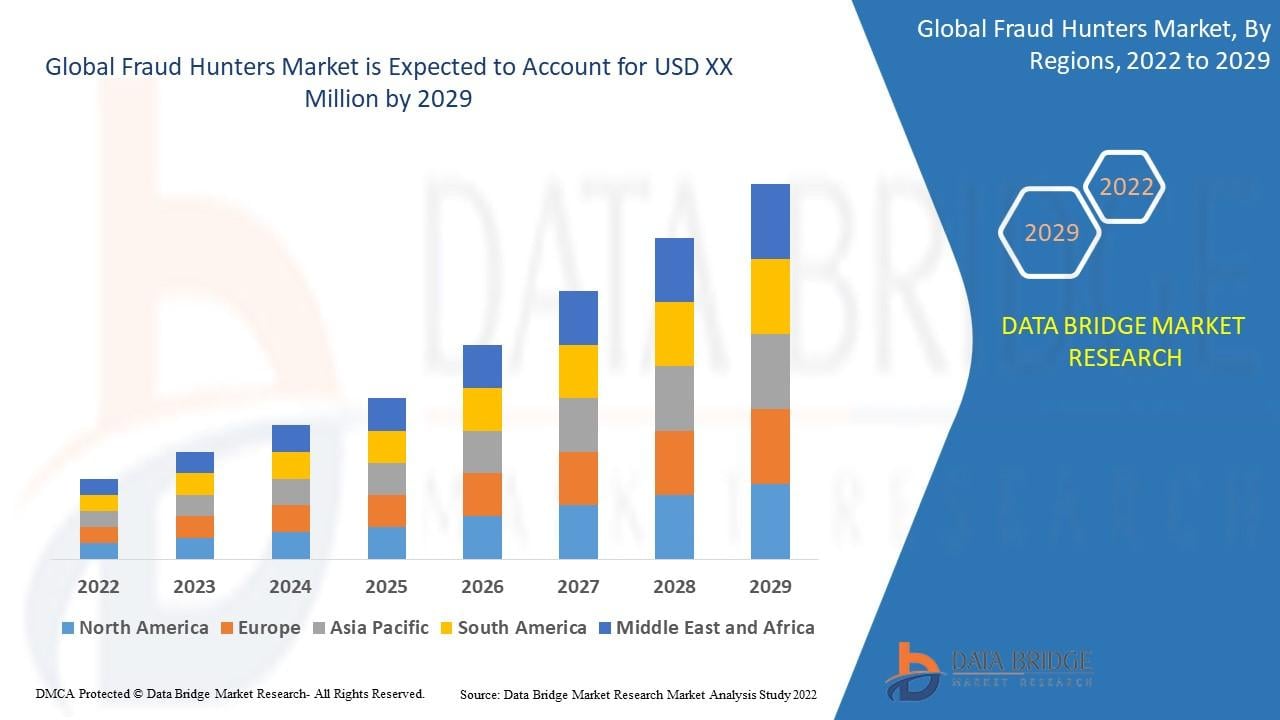

Data Bridge Market Research analyses that the fraud hunters market was valued at USD 6.95 billion in 2021 and is likely to reach USD by 2029, and will grow at a CAGR of 16.30% during the forecast period of 2022 to 2029.

Rising demand for Fraud Hunters Market solutions has been a primary driver of market growth, fueled by evolving consumer needs and industry-specific requirements. As companies invest in cutting-edge technologies and expand their reach, the market is set to experience significant revenue growth. This research report delves into the industry’s trends, statistics, and share, offering stakeholders valuable insights into its current performance and future potential.

Get a Sample PDF of Report - https://www.databridgemarketresearch.com/request-a-sample/?dbmr=global-fraud-hunters-market

Nucleus is a secure, cloud-based platform designed to streamline data transfer and management for businesses. Its intuitive interface offers practice administrators and financial managers advanced filtering options, enhancing operational efficiency. By integrating various data sources, Nucleus enables effective prioritization of critical exposures, incorporating business context and threat intelligence to bolster security measures. Additionally, Nucleus supports seamless collaboration among multiple users across different applications, fostering rapid iteration and teamwork. Its deployment flexibility allows installation on-premises or via preferred cloud service providers, ensuring scalability and adaptability to meet diverse organizational needs.

Get More Detail: https://www.databridgemarketresearch.com/nucleus/global-fraud-hunters-market

Which are the top companies operating in the Fraud Hunters Market?

The Top 10 Companies in Fraud Hunters Market are prominent leaders known for their strong influence and significant market share. These include well-established companies which have built a reputation for their high-quality products and services. These companies are recognized for their innovation, customer satisfaction, and ability to adapt to market trends, playing a key role in shaping the growth and direction of the Fraud Hunters Market.

**Segments**

- **Component:** The global fraud hunters market can be segmented based on components into software and services. The software segment is expected to witness significant growth due to the increasing adoption of fraud detection and prevention solutions by organizations to safeguard their financial assets and data.

- **Deployment Type:** In terms of deployment type, the market can be categorized into cloud-based and on-premises solutions. Cloud-based deployment is gaining traction as it offers scalability, cost-efficiency, and accessibility from anywhere, enabling organizations to enhance their fraud detection capabilities.

- **Organization Size:** The market can also be segmented based on organization size, including small and medium-sized enterprises (SMEs) and large enterprises. SMEs are increasingly investing in fraud detection solutions to protect their businesses from financial losses and reputational damage, driving the growth of the market.

**Market Players**

- **IBM Corporation:** IBM offers a range of fraud detection and prevention solutions that combine advanced analytics, artificial intelligence, and machine learning functionalities to help organizations identify and mitigate fraud risks effectively.

- **SAP SE:** SAP provides fraud management solutions that enable businesses to detect and investigate fraudulent activities in real-time, helping them minimize financial losses and protect their brand reputation.

- **SAS Institute Inc.:** SAS Institute offers fraud detection software that leverages predictive analytics and anomaly detection techniques to identify suspicious patterns and behaviors, empowering organizations to proactively combat fraud schemes.

- **Fiserv, Inc.:** Fiserv delivers fraud prevention solutions that utilize biometric authentication, transaction monitoring, and fraud intelligence capabilities to safeguard financial transactions and sensitive data from cyber threats.

- **Oracle Corporation:** Oracle offers a comprehensive suite of fraud detection and prevention tools that enable organizations to detect, investigate, and mitigate fraudulent activities across different channels and touchpoints.

The global fraud hunters market is witnessing significant growth driven by the rising incidence of financial frauds, increasing regulatory compliance requirements, and the growing adoption of digital payment methods. Organizations across various industries areThe global fraud hunters market is experiencing robust growth, propelled by several key factors. One of the primary drivers is the escalating rates of financial fraud across industries, leading organizations to prioritize investing in advanced fraud detection and prevention solutions. As businesses aim to safeguard their financial assets and data from fraudulent activities, the demand for sophisticated tools and technologies that can identify and mitigate risks continues to surge. Additionally, stringent regulatory compliance requirements compel organizations to implement robust fraud management systems to ensure adherence to industry standards and protect against potential penalties and reputational damage.

Moreover, the rapid proliferation of digital payment methods and the increasing digitization of financial transactions have created new challenges in terms of cybersecurity and fraud prevention. The shift towards online platforms and mobile applications has expanded the attack surface for cybercriminals, necessitating the deployment of proactive fraud detection solutions to counter evolving threats effectively. Organizations are recognizing the importance of adopting comprehensive fraud prevention strategies that leverage advanced analytics, artificial intelligence, and machine learning capabilities to stay ahead of potential fraud schemes and protect their operations.

In terms of market segmentation, the component division into software and services highlights the critical role of technology in combating fraud. The software segment is anticipated to witness significant growth, driven by the heightened demand for innovative fraud detection tools that can analyze vast amounts of data to identify anomalies and suspicious patterns. On the other hand, the services segment, encompassing consultancy, implementation, and support services, plays a crucial role in assisting organizations in deploying and optimizing fraud prevention solutions to meet their specific requirements.

The deployment type segmentation between cloud-based and on-premises solutions underscores the shifting preference towards cloud-based deployment models due to their scalability, cost efficiency, and accessibility benefits. Cloud-based fraud detection platforms offer organizations the flexibility to scale their operations rapidly, adapt to changing fraud patterns, and access real-time insights from any location, enhancing their overall fraud detection capabilities.

Furthermore, the organization size segmentation into SMEs and large enterprises highlights the inclusive nature of the fraud hunters market, catering to businesses of varying scales. SMEs**Market Players:**

- Experian Information Solutions, Inc. (U.S)

- SAS Institute Inc., (U.S)

- Oracle (U.S)

- IBM (U.S)

- FICO (U.S)

- Fiserv, Inc., (U.S)

- FIS.(U.S)

- SAP SE (Germany)

- ACI Worldwide (U.S)

- NCR Corporation (U.S)

The global fraud hunters market is a dynamic and rapidly evolving sector driven by the escalating rates of financial frauds, regulatory compliance requirements, and the increasing adoption of digital payment methods. Companies across industries are recognizing the importance of investing in advanced fraud detection and prevention solutions to protect their financial assets and data. The market is experiencing robust growth as organizations seek to mitigate risks, adhere to regulatory standards, and safeguard their brand reputation from potential fraud incidents. The demand for innovative technologies, such as advanced analytics, artificial intelligence, and machine learning, is on the rise as businesses strive to stay ahead of sophisticated fraud schemes.

In terms of segmentation, the component division into software and services indicates the pivotal role of technology in combating fraud. The software segment is anticipated to witness significant growth as organizations look for cutting-edge solutions to analyze vast volumes of data and identify fraudulent activities effectively. Services play a crucial role in supporting companies in deploying and optimizing fraud prevention strategies tailored to their specific needs. The deployment type segmentation between cloud-based and on-premises solutions underscores the industry's shift towards cloud-based platforms for

Explore Further Details about This Research Fraud Hunters Market Report https://www.databridgemarketresearch.com/reports/global-fraud-hunters-market

Key Insights from the Global Fraud Hunters Market :

- Comprehensive Market Overview: The Fraud Hunters Market is witnessing rapid growth, fueled by innovation and an increasing shift towards digital solutions.

- Industry Trends and Projections: The market is forecasted to grow at a CAGR of X%, with trends such as automation and sustainability gaining momentum.

- Emerging Opportunities: Growing demand for personalized and green technologies offers emerging business opportunities for new entrants.

- Focus on R&D: Companies are heavily investing in research and development to create next-generation solutions and maintain competitive edges.

- Leading Player Profiles: Dominant players the market with their advanced offerings and strategic expansions.

- Market Composition: The market is a mix of established industry giants and innovative startups, fostering competition and rapid innovation.

- Revenue Growth: Consistent revenue growth is driven by rising consumer demand, technological advancements, and new product introductions.

- Commercial Opportunities: Expanding into untapped regions and investing in emerging technologies presents substantial commercial opportunities for businesses.

Get More Reports:

Bookbinding Materials Market Size, Share, and Trends Analysis Report – Industry Overview and Forecast to 2031

Vitamin A Ingredient Market Size, Share, and Trends Analysis Report – Industry Overview and Forecast to 2029

Middle East and Africa Digital Signage Market Size, Share, and Trends Analysis Report – Industry Overview and Forecast to 2028

Calcimimetics Market Size, Share, and Trends Analysis Report – Industry Overview and Forecast to 2029

Maternity Innerwear Market Size, Share, and Trends Analysis Report – Industry Overview and Forecast to 2028

Docosahexaenoic Acid Market Size, Share, and Trends Analysis Report – Industry Overview and Forecast to 2032

Asia-Pacific Third Party Logistics Market Size, Share, and Trends Analysis Report – Industry Overview and Forecast to 2031

Internet of Things (IoT) in Warehouse Market Size, Share, and Trends Analysis Report – Industry Overview and Forecast to 2028

Crow`s Feet Treatment Market Size, Share, and Trends Analysis Report – Industry Overview and Forecast to 2028

Online Movie Ticket Market Size, Share, and Trends Analysis Report – Industry Overview and Forecast to 2028

Middle East and Africa Tracheostomy Products Market Size, Share, and Trends Analysis Report – Industry Overview and Forecast to 2030

Asia-Pacific Cleaning Robot Market Size, Share, and Trends Analysis Report – Industry Overview and Forecast to 2029

Data Bridge Market Research:

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC: +653 1251 975

Email:- [email protected]"

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Oyunlar

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness