AI in Fintech Market Key Players Analysis, Size, Share

AI in Fintech 2024

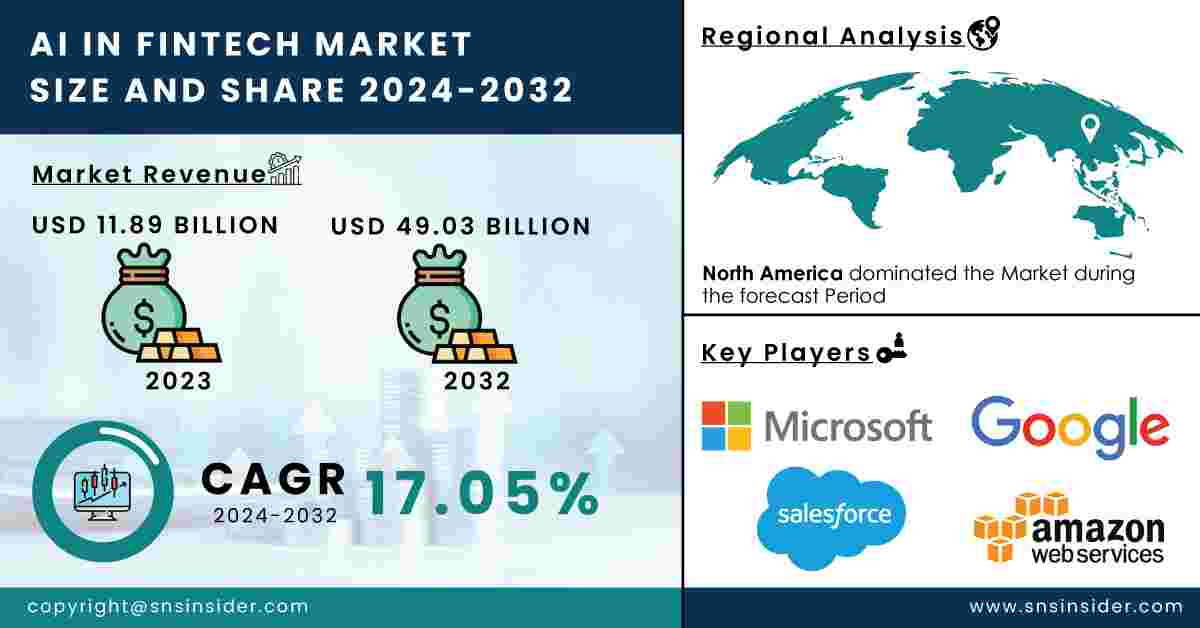

Artificial Intelligence (AI) is revolutionizing various sectors, and the financial technology (fintech) industry is at the forefront of this transformation. By integrating AI into financial services, companies are enhancing customer experiences, streamlining operations, and increasing profitability. The AI in Fintech Market Growth reflects this trend, with a valuation of USD 11.89 billion in 2023, projected to reach USD 49.03 billion by 2032, and growing at a CAGR of 17.05% over the forecast period from 2024 to 2032.

Understanding AI's Impact on Fintech

AI encompasses a range of technologies, including machine learning, natural language processing, and data analytics, which enable systems to learn from data, identify patterns, and make informed decisions. In the fintech sector, AI-driven tools and applications are reshaping the landscape by enhancing risk management, fraud detection, customer service, and investment strategies.

The infusion of AI into fintech is primarily driven by the vast amounts of data generated by financial transactions. Traditional data processing methods often fall short in analyzing this data quickly and effectively. AI algorithms, on the other hand, can sift through large datasets, identify trends, and generate actionable insights. This capability is essential for companies aiming to stay competitive in an increasingly complex market.

Enhanced Risk Management and Fraud Detection

One of the most significant advantages of AI in fintech is its ability to improve risk management and fraud detection processes. Financial institutions face constant threats from fraudulent activities, making it crucial to have robust detection mechanisms in place. AI-powered systems can analyze transaction patterns in real time, flagging any unusual activity for further investigation. This proactive approach not only mitigates financial losses but also enhances customer trust.

Furthermore, AI assists in credit scoring and risk assessment by analyzing a broader range of data points, including alternative data sources such as social media activity and payment history. This allows lenders to make more informed decisions when extending credit, enabling them to offer loans to a wider audience while minimizing risk.

Personalized Customer Experiences

In today's digital landscape, customers expect personalized experiences that cater to their unique needs. AI helps fintech companies achieve this by utilizing data analytics to understand customer behaviors and preferences. By analyzing past interactions, purchase histories, and even sentiment analysis from social media, AI can tailor product recommendations, marketing campaigns, and customer support to individual users.

Chatbots and virtual assistants powered by AI have also transformed customer service in the fintech sector. These tools provide 24/7 support, answering common queries, processing transactions, and assisting users in navigating complex financial products. By enhancing customer engagement and satisfaction, AI-driven solutions contribute to customer loyalty and retention.

Streamlined Operations and Cost Efficiency

Beyond customer interactions, AI plays a crucial role in streamlining operations within fintech companies. Automated processes powered by AI reduce the need for manual interventions, thus minimizing errors and operational costs. For example, AI can automate compliance checks and regulatory reporting, ensuring that firms adhere to legal standards without dedicating extensive human resources.

Robotic Process Automation (RPA) is another application of AI that enhances efficiency by automating repetitive tasks such as data entry and report generation. By freeing up employees from mundane tasks, organizations can redirect their efforts toward strategic initiatives, fostering innovation and growth.

Challenges and Considerations

Despite the numerous benefits, the integration of AI into fintech is not without challenges. Data privacy and security are paramount concerns, as financial institutions handle sensitive customer information. Ensuring compliance with data protection regulations is essential to maintaining customer trust.

Additionally, the complexity of AI algorithms can lead to transparency issues. Customers may find it challenging to understand how decisions are made, particularly in areas like credit scoring or investment recommendations. To address this, fintech companies must prioritize transparency and explainability in their AI systems.

The Future of AI in Fintech

As the fintech industry continues to evolve, the role of AI will only grow. Emerging technologies, such as blockchain and advanced analytics, will further enhance AI's capabilities. Additionally, the increasing demand for sustainable finance solutions will push fintech companies to leverage AI for environmental, social, and governance (ESG) assessments.

The ongoing collaboration between fintech firms and regulatory bodies will also shape the future landscape, ensuring that innovation occurs alongside robust safeguards for consumers.

Conclusion

AI is a game-changer in the fintech sector, driving innovation, enhancing customer experiences, and improving operational efficiency. As the market continues to expand, fintech companies that embrace AI technologies will position themselves for long-term success. The projected AI in Fintech Market Growth highlights the significant impact AI will have in shaping the future of financial services, paving the way for a more efficient, transparent, and customer-centric industry.

Contact Us:

Akash Anand – Head of Business Development & Strategy

info@snsinsider.com

Phone: +1-415-230-0044 (US) | +91-7798602273 (IND)

About Us

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

Read Our Other Reports:

Software Defined Data Center Market Trends

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jocuri

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Alte

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness