Business Travel Accident Insurance Market Dynamics: Key Drivers and Restraints 2023 –2030

"The Business Travel Accident Insurance Market sector is undergoing rapid transformation, with significant growth and innovations expected by 2030. In-depth market research offers a thorough analysis of market size, share, and emerging trends, providing essential insights into its expansion potential. The report explores market segmentation and definitions, emphasizing key components and growth drivers. Through the use of SWOT and PESTEL analyses, it evaluates the sector’s strengths, weaknesses, opportunities, and threats, while considering political, economic, social, technological, environmental, and legal influences. Expert evaluations of competitor strategies and recent developments shed light on geographical trends and forecast the market’s future direction, creating a solid framework for strategic planning and investment decisions.

Brief Overview of the Business Travel Accident Insurance Market:

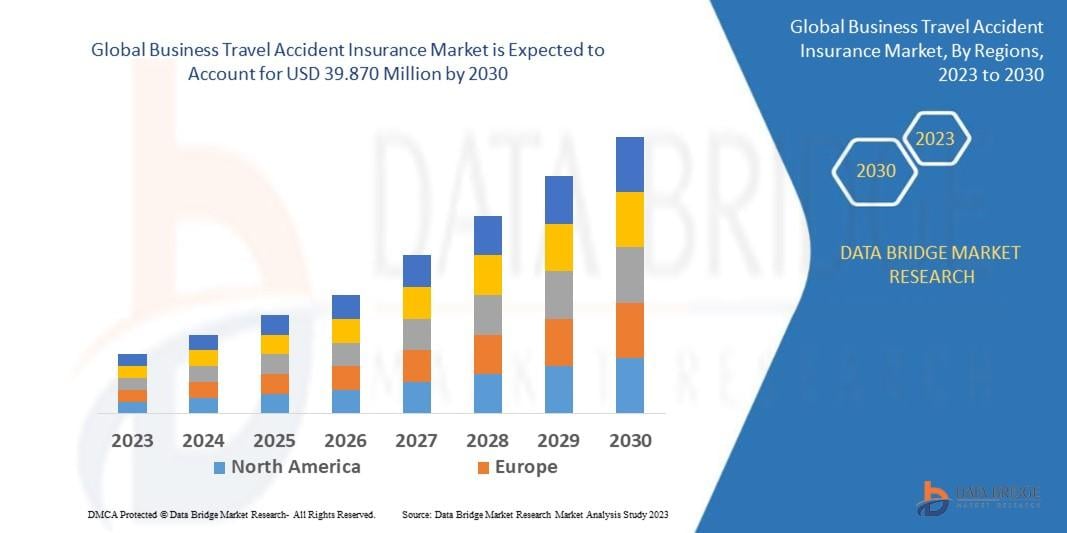

The global Business Travel Accident Insurance Market is expected to experience substantial growth between 2024 and 2031. Starting from a steady growth rate in 2023, the market is anticipated to accelerate due to increasing strategic initiatives by key market players throughout the forecast period.

Get a Sample PDF of Report - https://www.databridgemarketresearch.com/request-a-sample/?dbmr=global-business-travel-accident-insurance-market

Which are the top companies operating in the Business Travel Accident Insurance Market?

The report profiles noticeable organizations working in the water purifier showcase and the triumphant methodologies received by them. It likewise reveals insights about the share held by each organization and their contribution to the market's extension. This Global Business Travel Accident Insurance Market report provides the information of the Top Companies in Business Travel Accident Insurance Market in the market their business strategy, financial situation etc.

Assicurazioni Generali S.P.A. (Italy), MetLife Services and Solutions Inc. (India), Nationwide Mutual Insurance Company (U.S.), AWP Australia Pty Ltd. (Australia), AXA (France), American International Group, Inc. (U.S.), Chubb (Switzerland), Tokio Marine Holdings, Inc. (Japan), Woodward Markwell Insurance Brokers (U.K.), The Hartford (U.S.), Tata AIG General Insurance Company Limited (India), and Starr International Company Inc. (U.S.)

Report Scope and Market Segmentation

Which are the driving factors of the Business Travel Accident Insurance Market?

The driving factors of the Business Travel Accident Insurance Market are multifaceted and crucial for its growth and development. Technological advancements play a significant role by enhancing product efficiency, reducing costs, and introducing innovative features that cater to evolving consumer demands. Rising consumer interest and demand for keyword-related products and services further fuel market expansion. Favorable economic conditions, including increased disposable incomes, enable higher consumer spending, which benefits the market. Supportive regulatory environments, with policies that provide incentives and subsidies, also encourage growth, while globalization opens new opportunities by expanding market reach and international trade.

Business Travel Accident Insurance Market - Competitive and Segmentation Analysis:

**Segments**

- By Type: The market for global business travel accident insurance can be segmented by type into business travel accident insurance, and business travel health insurance. The business travel accident insurance segment is expected to dominate the market due to the increasing emphasis on ensuring the safety and security of employees during their business travels.

- By Coverage: On the basis of coverage, the market can be segmented into medical treatment, trip inconvenience coverage, and others. Medical treatment coverage is anticipated to hold a significant share as it provides financial assistance for medical emergencies that may occur during business trips.

- By Distribution Channel: The distribution channel segment includes insurance companies, online platforms, and others. The online platforms segment is likely to witness substantial growth as more businesses opt for digital platforms to purchase insurance policies conveniently.

**Market Players**

- Allianz Global Corporate & Specialty

- AIG

- Chubb

- AXA

- Zurich

- Liberty Mutual

- Berkshire Hathaway

- Tokio Marine Holdings

- Munich Re

- Sompo Holdings

These market players are anticipated to play a crucial role in shaping the global business travel accident insurance market through strategic initiatives such as partnerships, product developments, and mergers and acquisitions. With their extensive product portfolios and strong distribution networks, these companies are well-positioned to cater to the evolving needs of businesses and travelers in the forecast period.

https://www.databridgemarketresearch.com/reports/global-business-travel-accident-insurance-marketThe global business travel accident insurance market is anticipated to experience significant growth in the coming years driven by various factors such as the increasing awareness among businesses about the importance of safeguarding employees during their work-related travels. The market can be segmented by type into business travel accident insurance and business travel health insurance, with the former expected to dominate the market due to the rising emphasis on employee safety and security. Businesses are increasingly recognizing the need to provide adequate insurance coverage to mitigate the financial risks associated with accidents or other unforeseen events that may occur during business trips.

Furthermore, segmentation by coverage reveals key categories such as medical treatment, trip inconvenience coverage, and others. Medical treatment coverage is expected to hold a substantial share as it offers financial support for medical emergencies that employees may encounter while traveling for work. With the growing number of business trips being undertaken globally, the demand for comprehensive coverage options that encompass various aspects of travel-related risks is on the rise.

In terms of distribution channels, the market can be segmented into insurance companies, online platforms, and others. The online platforms segment is poised for significant growth as businesses increasingly prefer the convenience and efficiency of digital channels for purchasing insurance policies. The ease of access to information, streamlined processes, and flexibility in policy selection offered by online platforms make them an attractive choice for businesses looking to procure travel insurance for their employees efficiently.

The market players in the global business travel accident insurance sector, including industry giants like Allianz Global Corporate & Specialty, AIG, Chubb, AXA, Zurich, Liberty Mutual, Berkshire Hathaway, Tokio Marine Holdings, Munich Re, and Sompo Holdings, are expected to drive market growth through strategic collaborations, innovative product developments, and strategic mergers and acquisitions. These companies possess extensive product portfolios and robust distribution networks, enabling them to address the evolving needs of businesses and travelers effectively.

Overall, the global business travel accident insurance market is poised for continued expansion as businesses increasingly prioritize the safety and well-being of their employees during work-related travels. The**Market Players**

- Assicurazioni Generali S.P.A. (Italy)

- MetLife Services and Solutions Inc. (India)

- Nationwide Mutual Insurance Company (U.S.)

- AWP Australia Pty Ltd. (Australia)

- AXA (France)

- American International Group, Inc. (U.S.)

- Chubb (Switzerland)

- Tokio Marine Holdings, Inc. (Japan)

- Woodward Markwell Insurance Brokers (U.K.)

- The Hartford (U.S.)

- Tata AIG General Insurance Company Limited (India)

- Starr International Company Inc. (U.S.)

The global business travel accident insurance market is positioned for substantial growth in the foreseeable future, driven by escalating awareness among businesses regarding the necessity of safeguarding employees during their work-related travels. Segmented by type into business travel accident insurance and health insurance, the former is projected to lead the market owing to the increasing focus on employee safety and security. Businesses are acknowledging the importance of providing sufficient insurance coverage to mitigate financial risks associated with accidents or unforeseen events that may occur during business trips.

Moreover, the segmentation by coverage categories such as medical treatment, trip inconvenience coverage, and others indicates that medical treatment coverage is expected to hold a significant share due to its provision of financial support for medical emergencies faced by employees during work-related travel. As the number of business trips undertaken globally continues to rise, the demand for comprehensive coverage options addressing various travel-related risks is on an upward trajectory.

Within the distribution channels segment

North America, particularly the United States, will continue to exert significant influence that cannot be overlooked. Any shifts in the United States could impact the development trajectory of the Business Travel Accident Insurance Market. The North American market is poised for substantial growth over the forecast period. The region benefits from widespread adoption of advanced technologies and the presence of major industry players, creating abundant growth opportunities.

Similarly, Europe plays a crucial role in the global Business Travel Accident Insurance Market, expected to exhibit impressive growth in CAGR from 2024 to 2030.

Explore Further Details about This Research Business Travel Accident Insurance Market Report https://www.databridgemarketresearch.com/reports/global-business-travel-accident-insurance-market

Key Benefits for Industry Participants and Stakeholders: –

- Industry drivers, trends, restraints, and opportunities are covered in the study.

- Neutral perspective on the Business Travel Accident Insurance Market scenario

- Recent industry growth and new developments

- Competitive landscape and strategies of key companies

- The Historical, current, and estimated Business Travel Accident Insurance Market size in terms of value and size

- In-depth, comprehensive analysis and forecasting of the Business Travel Accident Insurance Market

Geographically, the detailed analysis of consumption, revenue, market share and growth rate, historical data and forecast (2024-2031) of the following regions are covered in Chapters

The countries covered in the Business Travel Accident Insurance Market report are U.S., Canada and Mexico in North America, Brazil, Argentina and Rest of South America as part of South America, Germany, Italy, U.K., France, Spain, Netherlands, Belgium, Switzerland, Turkey, Russia, Rest of Europe in Europe, Japan, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA

Detailed TOC of Business Travel Accident Insurance Market Insights and Forecast to 2030

Part 01: Executive Summary

Part 02: Scope Of The Report

Part 03: Research Methodology

Part 04: Business Travel Accident Insurance Market Landscape

Part 05: Pipeline Analysis

Part 06: Business Travel Accident Insurance Market Sizing

Part 07: Five Forces Analysis

Part 08: Business Travel Accident Insurance Market Segmentation

Part 09: Customer Landscape

Part 10: Regional Landscape

Part 11: Decision Framework

Part 12: Drivers And Challenges

Part 13: Business Travel Accident Insurance Market Trends

Part 14: Vendor Landscape

Part 15: Vendor Analysis

Part 16: Appendix

Browse More Reports:

Japan: https://www.databridgemarketresearch.com/jp/reports/global-business-travel-accident-insurance-market

China: https://www.databridgemarketresearch.com/zh/reports/global-business-travel-accident-insurance-market

Arabic: https://www.databridgemarketresearch.com/ar/reports/global-business-travel-accident-insurance-market

Portuguese: https://www.databridgemarketresearch.com/pt/reports/global-business-travel-accident-insurance-market

German: https://www.databridgemarketresearch.com/de/reports/global-business-travel-accident-insurance-market

French: https://www.databridgemarketresearch.com/fr/reports/global-business-travel-accident-insurance-market

Spanish: https://www.databridgemarketresearch.com/es/reports/global-business-travel-accident-insurance-market

Korean: https://www.databridgemarketresearch.com/ko/reports/global-business-travel-accident-insurance-market

Russian: https://www.databridgemarketresearch.com/ru/reports/global-business-travel-accident-insurance-market

Data Bridge Market Research:

Today's trends are a great way to predict future events!

Data Bridge Market Research is a market research and consulting company that stands out for its innovative and distinctive approach, as well as its unmatched resilience and integrated methods. We are dedicated to identifying the best market opportunities, and providing insightful information that will help your business thrive in the marketplace. Data Bridge offers tailored solutions to complex business challenges. This facilitates a smooth decision-making process. Data Bridge was founded in Pune in 2015. It is the product of deep wisdom and experience.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC: +653 1251 1201

Email:- [email protected]

"

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Giochi

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Altre informazioni

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness