Exploring the Differences Between Bai' al-Dayn and Tawarruq Contracts in Islamic Banking

Islamic banking has grown to be a substantial pillar within the global financial system, imparting moral options to traditional banking practices. Among the numerous economic contracts in Islamic banking, Bai' al-Dayn and Tawarruq stand out as precise tools with distinct purposes. These contracts play pivotal roles in facilitating liquidity while adhering to Shariah concepts. For those looking for an in-depth understanding of Islamic finance, pursuing specialized information through certifications may additionally provide insights better than the diploma in Islamic finance KPM certification.

Understanding Bai' al-Dayn Contracts

Bai' al-Dayn, or the sale of debt, is a financial contract in which an existing debt is bought to a third party. This transaction enables the unique creditor to transfer ownership of the debt for immediate liquidity.

Key Features of Bai' al-Dayn

-

Shariah Principles: The transaction ought to follow Islamic jurisprudence, ensuring no factors of riba (hobby), gharar (excessive uncertainty), or maysir (playing).

-

Debt Sale: The debt is typically bought at a discounted charge to account for fast liquidity.

-

Usage: Bai' al-Dayn is commonly used for financing short-term liquidity desires in trade and trade.

While a few students allow Bai' al-Dayn underneath specific conditions, others argue its permissibility is limited because of the potential resemblance to hobby-based practices.

Exploring Tawarruq Contracts

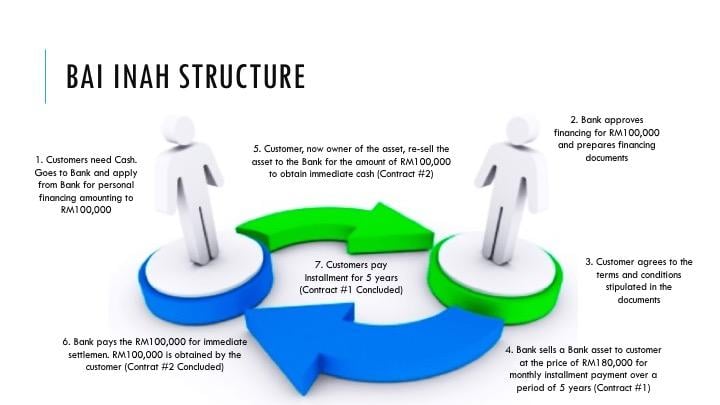

Tawarruq, additionally referred to as "monetization," is another economic device used in Islamic banking. This agreement includes purchasing an asset on a deferred fee basis and selling it to a third party for immediate cash.

How Tawarruq Works

-

Purchase on Credit: The consumer acquires an asset from a seller on a deferred charge basis.

-

Resale: The buyer immediately sells the asset to a third party for cash at a decrease fee than the deferred charge obligation.

-

Liquidity Generation: This permits the purchaser to access cash at the same time as adhering to Shariah principles.

Applications of Tawarruq

-

Personal Financing: Commonly utilized by individuals searching for Shariah-compliant loans.

-

Corporate Financing: Businesses use it for liquidity without undertaking interest-based borrowing.

Differences Between Bai' al-Dayn and Tawarruq

Although both contracts aim to enhance liquidity, their mechanisms and Shariah considerations vary considerably.

-

Nature of Asset: Bai' al-Dayn involves debt because the underlying asset, at the same time as Tawarruq makes use of tangible or tradeable belongings.

-

Permissibility: Bai' al-Dayn faces stricter scrutiny from Islamic scholars, whereas Tawarruq is extensively acceptable.

Relevance of Shariah-Compliant Contracts in Islamic Banking

Islamic banking revolves around upholding Shariah principles, ensuring ethical and truthful economic practices. Contracts like Bai' al-Dayn and Tawarruq exemplify the adaptability of Islamic finance in addressing modern-day financial challenges. However, understanding these concepts requires an in-depth study of Islamic monetary principles, inclusive of musharakah meaning and its function in promoting equitable risk-sharing among stakeholders.

Musharakah: A Brief Overview

Musharakah is a partnership agreement in which all parties contribute capital and share earnings or losses based on predetermined ratios. This settlement is critical to Islamic banking, fostering mutual cooperation and ethical profit-sharing.

To delve deeper into the idea and forms of Musharakah, exploring academic assets can provide valuable insights into its realistic packages.

Challenges and Criticisms

Despite their importance, Bai' al-Dayn and Tawarruq contracts face criticisms:

-

Shariah Compliance: Scholars debate the permissibility of these contracts, particularly Bai' al-Dayn.

-

Complexity: The structures of these contracts can be problematic, potentially leading to misunderstandings.

-

Ethical Concerns: There is a need to ensure these contracts align with the spirit of Islamic finance and do not mimic traditional practices.

The Role of Technology in Islamic Finance

The financial sector has witnessed a surge in technological improvements, influencing Islamic banking as well. Blockchain and cryptocurrencies are hot topics, with many questioning their compatibility with Islamic principles.

For instance, is crypto trading haram in islam? Opinions vary among scholars, but the underlying principles of transparency, fairness, and the absence of speculation are vital in determining its permissibility.

Conclusion

Bai' al-Dayn and Tawarruq contracts are vital components of Islamic banking, imparting progressive answers for liquidity control while adhering to Shariah principles. However, those contracts require careful application and understanding to avoid ethical pitfalls.

By analyzing standards like musharakah meaning and exploring the boundaries of rising technology, Islamic finance can continue to evolve responsibly.

For those passionate about Islamic banking, pursuing advanced training and certifications can offer deeper insights into these complicated contracts and help shape a more ethical financial future.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Giochi

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Altre informazioni

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness