How to Start a Cryptocurrency Exchange in 7 Easy Steps

The growing popularity of cryptocurrencies has opened up lucrative opportunities for entrepreneurs looking to start their own cryptocurrency exchanges. Whether you're interested in a centralized or decentralized platform, building a secure and user-friendly exchange requires careful planning. This guide outlines How to Start a Crypto Exchange in seven straightforward steps, ensuring you understand the key considerations for launching a successful platform.

1. Conduct Market Research

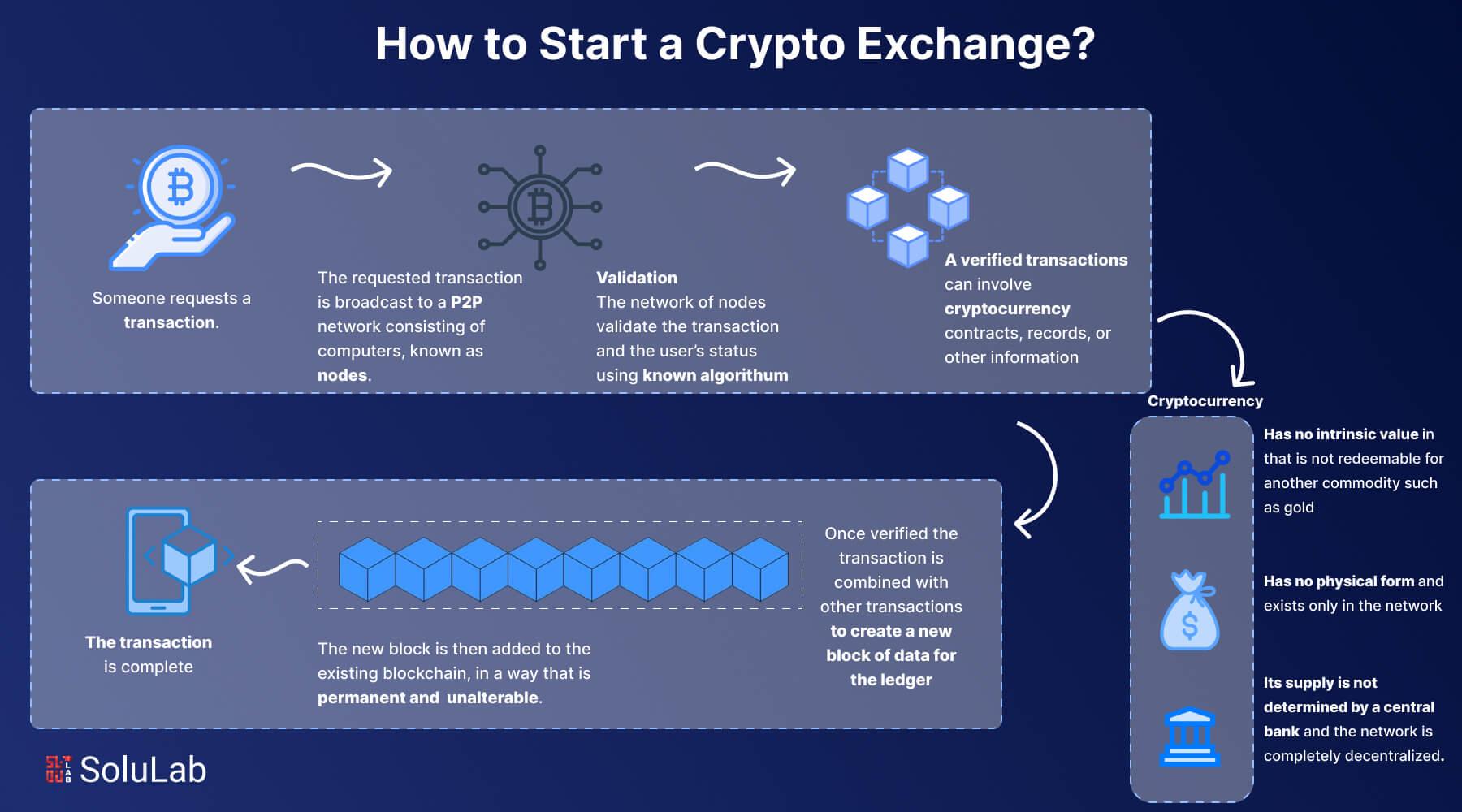

Before diving into How to Start a Crypto Exchange, conducting thorough market research is essential. Analyze the current market trends, identify your target audience, and study your competitors. There are several types of exchanges—centralized, decentralized, or peer-to-peer (P2P). Decide on the type of exchange you want to develop based on user needs and preferences. The goal is to identify potential gaps and opportunities in the market that your exchange can address.

2. Choose the Right Jurisdiction and Acquire Legal Licenses

Compliance with legal and regulatory frameworks is crucial for starting a crypto exchange. Different countries have varying regulations regarding cryptocurrency trading. Selecting the right jurisdiction involves finding a region with crypto-friendly regulations. Popular regions for launching exchanges include Estonia, Singapore, and Malta.

3. Partner with a P2P Crypto Exchange Development Company

Choosing the right technology partner is one of the most critical decisions you’ll make when starting a crypto exchange. A P2P crypto exchange development company can offer expertise in building peer-to-peer exchanges, where users can trade directly with each other without intermediaries. Look for a development company with a strong portfolio of crypto exchange projects, robust security protocols, and scalable solutions.

Key components that your development partner should provide include:

- Trading engine: To match orders between buyers and sellers.

- User-friendly interface: To ensure a seamless user experience.

- Security measures: Implement encryption, two-factor authentication (2FA), and anti-DDoS solutions to protect the platform.

4. Integrate Secure Payment Gateways

A seamless transaction experience is vital for the success of your exchange. Your platform needs to support multiple payment gateways, including bank transfers, credit/debit cards, and even crypto-to-crypto transactions. Make sure to integrate secure and trusted payment gateways that offer smooth transactions for your users.

5. Incorporate Liquidity Options

Liquidity is a crucial factor in ensuring smooth operations on any cryptocurrency exchange. Without adequate liquidity, users may struggle to execute trades at their desired price. There are several ways to enhance liquidity on your exchange:

- Market makers: These entities help generate liquidity by continuously buying and selling assets on your platform.

- Integration with external exchanges: You can connect your exchange to larger platforms to access their liquidity pools.

- P2P transactions: In P2P crypto exchanges, liquidity comes from users directly buying and selling with each other, which can create a more natural trading environment.

6. Implement Security Features

Security is non-negotiable when it comes to building a cryptocurrency exchange. Hackers are constantly targeting crypto platforms, making it essential to have a solid security framework. Some crucial security features include:

- Cold wallet storage: Store most funds offline in cold wallets to prevent online hacks.

- Two-factor authentication (2FA): Require users to verify their identity through a second authentication method.

- Anti-DDoS protection: Ensure your platform can withstand Distributed Denial of Service (DDoS) attacks, which are common in crypto exchanges.

- Encryption: Use the latest encryption standards to secure user data and funds.

A P2P crypto exchange development company can help implement these security features to ensure the platform is robust and resilient to cyber threats.

7. Launch and Market Your Crypto Exchange

Once your exchange is built, tested, and legally compliant, it's time to launch. However, simply launching isn't enough; you'll need a comprehensive marketing strategy to attract users to your platform. Focus on building trust and credibility through community engagement, social media, and partnerships with crypto influencers.

Your marketing strategy should focus on:

- Content marketing: Provide educational content about cryptocurrencies and trading to attract a knowledgeable user base.

- Search engine optimization (SEO): Optimize your website for keywords like How to Start a Crypto Exchange to attract users who are searching for crypto-related platforms.

- Referral programs: Encourage users to refer others by offering bonuses or discounts.

A well-executed marketing plan can boost your platform's visibility and help it gain traction quickly.

Conclusion

Starting a cryptocurrency exchange is a complex but rewarding venture. Following these seven steps will guide you through How to Start a Crypto Exchange with a clear focus on regulatory compliance, security, liquidity, and user experience. Whether you choose to work with a crypto exchange development company or build a centralized platform, ensuring the right technology and legal framework will set you up for success. With the right approach, your exchange can thrive in this rapidly evolving market.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Oyunlar

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness