Make Payroll Shine with These Winning Salary Slip Formats

A salary slip is an important document for a salaried employee. Since it is issued every month, the employer breaks down the salaries and deductions of the salaried employee. This being a routine document, the significance of the salary slip continues to be significant for all the employees and organisations as well. It proves income, aids in financial planning, and keeps salary structures transparent.

In this blog, we shall explore the key components of a salary slip, its ideal format, and why understanding this document is crucial for both employees and employers.

What is a Salary Slip?

A salary slip is a proof of a salary payment to the employee issued by the employer. It mainly comes at the end of every month. The usual details it will have involve gross earnings, deductions, and the net amount credited.

For employees, the salary slip is essential for tax filing, loan application, and monitoring income. For the employer, it ensures a transparent record of the remuneration process and legal compliance with labour laws.

Purpose and Importance of a Salary Slip

Proof of Income

Salary slips are essential documents for financial transactions, including applying for loans, credit cards, or even renting an apartment. They are the most reliable proof of regular income for financial institutions.

Taxation and Compliance

A salary slip gives all the details of taxable income and deductions, which helps employees file their income tax returns correctly. Besides, it also makes employers comply with tax laws as well as statutory obligations, such as Provident Fund and Employee State Insurance.

Compensation Transparency

The salary slip helps ensure the employees know that what they receive is within the structure of their respective salaries, the amounts they generate, and what amounts are deducted for certain purposes. This practice instills confidence between an employer and the employee.

Legal Document

A payslip is an employment record stating salary payments on record if a dispute or any lawful matter arises between an employee and a salary earner.

How to Write a Salary Slip

A standard salary slip is divided into earnings and deductions along with additional details. Here's a close-up look at the details in it:

Basic Information

This includes:

-

Employee's Name

-

Employee ID

-

Designation

-

Department

-

Employer's Name and Address

-

Month and Year of Salary

Earning Part

The earning part tells the gross salary of the employee under different heads as follows:

-

Basic Salary: It is the fixed component of salary that forms a base for all other adjustments.

-

House Rent Allowance (HRA): Compensation for rent expenses, often tax-exempt up to certain limits.

-

Conveyance Allowance: Provided for commuting expenses.

-

Special Allowance: Any additional benefits provided by the employer.

-

Incentives/Bonuses: Performance-based earnings.

-

Overtime Pay: Compensation for extra hours worked.

Deductions Section

This section includes all statutory and voluntary deductions:

-

Income Tax (TDS): Tax deducted at source based on the employee's income tax slab.

-

Provident Fund (PF): Contributions made by both employee and employer towards the retirement fund.

-

Professional Tax: A state-imposed tax deducted monthly.

-

Employee State Insurance (ESI): Contributions for health insurance.

-

Loan or Advance Repayments: Any salary deductions for loans or advances taken.

Net Pay

This is the amount credited to the employee's account after all deductions. It is calculated as: Net Pay = Gross Earnings - Total Deductions

Additional Details

Some salary slips also include:

-

Leave Balances

-

Overtime Hours

-

Taxable and Non-Taxable Components of Salary

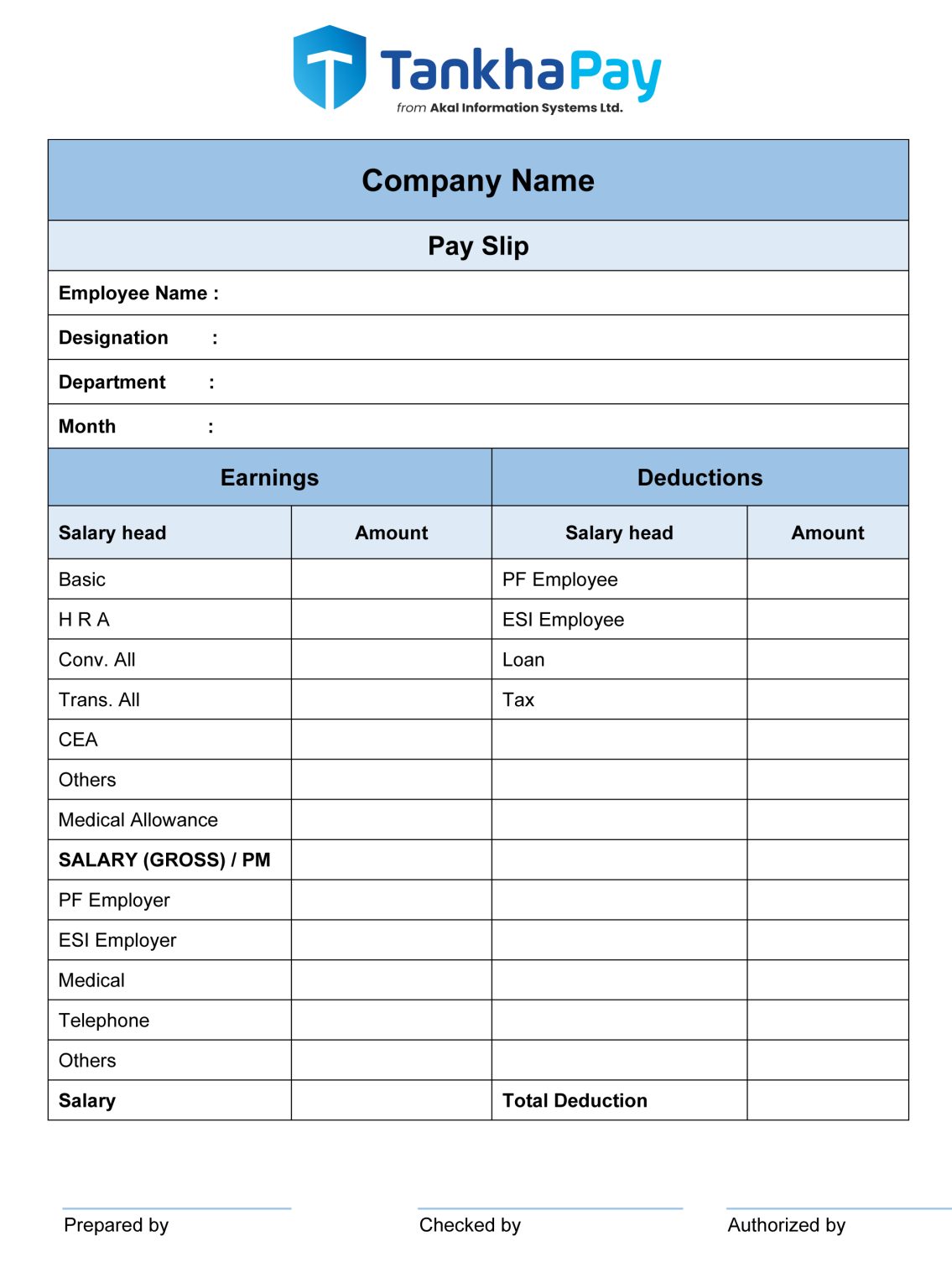

Sample Salary Slip Format

Here is the perfect format of a salary slip:

Best Practices in Salary Slip Design

Clearly Format to Use

The format must be very readable, with clearly labeled earnings, deductions, and net pay.

Include All Relevant Details

All parts of the salary, be it allowances or deductions, should be included in the slips.

Accuracy

Re-check figures so that there are no mistakes that could raise suspicion and mistrust.

Digital Access

Salary slips can be digitally issued through e-mail or through HR portals for easier access and documentation.

Compliance with Statutory Provisions

The format should be adapted as per regional law and tax provisions.

Salary Slips in the Digital Age

Payroll software can automatically print salary slips during this period of digitization, an activity supported by TankhaPay. Here's the efficiency:

-

Generation of salary slip - auto: With accuracy and no scope for duplication or wrong data using a template prepared beforehand.

-

Sending online: To the employees securely via internet portals or application.

-

Guarantee on Statutory compliance, such as TDS, PF, ESI through payroll.

-

Centralized Records: The employer can keep the records organized and easily accessible for audits or disputes.

Common Errors to Be Avoided

Missing Information

The salary slip must include all the required information, including tax deductions and employer contributions.

Calculation Errors

Calculation mistakes can result in dissatisfaction among employees and legal issues.

Lack of Personalization

Incorporating information such as the employee's name and job title gives the document a professional and authentic look.

Non-Compliance with Laws

The format of the salary slip must be in accordance with regional labor and tax laws.

Conclusion

A salary slip is more than an account of the month - it's a record, a financial planning tool, and also a bridge of trust that an employer can build with its employees. A well-formatted salary slip will create transparency, simplify tax compliance, and keep a good professional relationship afloat.

As companies continue embracing digital solutions, the automation of salaries is sure to ensure that this is done accurately and in an efficient manner so as not to inconvenience employers but employees as well. An employee seeking clarity or the employer striving for compliance: Comprehension of importance and the layout of a salary slip is the next step to generating an all-around clear and efficient system of payroll.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Oyunlar

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness