The Role of a Business Valuator in Determining a Company’s Worth

A business valuator is a financial professional who specializes in determining the value of a company. Whether for mergers and acquisitions, litigation, estate planning, or financial reporting, the services of a business valuator are essential in providing an accurate and credible assessment of a business’s worth. Their expertise ensures that stakeholders can make informed decisions based on a clear understanding of the company’s value.

Responsibilities of a Business Valuator

A professional business valuator in Toronto conducts comprehensive evaluations by analyzing a variety of financial and non-financial factors. Their responsibilities typically include:

-

Financial Analysis: They examine financial statements, including balance sheets, income statements, and cash flow reports, to assess the company’s profitability, liquidity, and solvency.

-

Market Research: Understanding the market landscape is crucial. Business valuators study industry trends, economic conditions, and comparable company transactions to gauge the company’s competitive position.

-

Valuation Methods: Depending on the nature of the business and the purpose of the valuation, different methods are employed, such as:

- Income Approach: Projects future cash flows and discounts them to present value.

- Market Approach: Compares the business to similar companies recently sold in the market.

- Asset-Based Approach: Calculates the net value of the company’s assets minus liabilities.

-

Risk Assessment: Valuators assess factors like market competition, management expertise, customer concentration, and operational risks that could impact the company’s future performance.

-

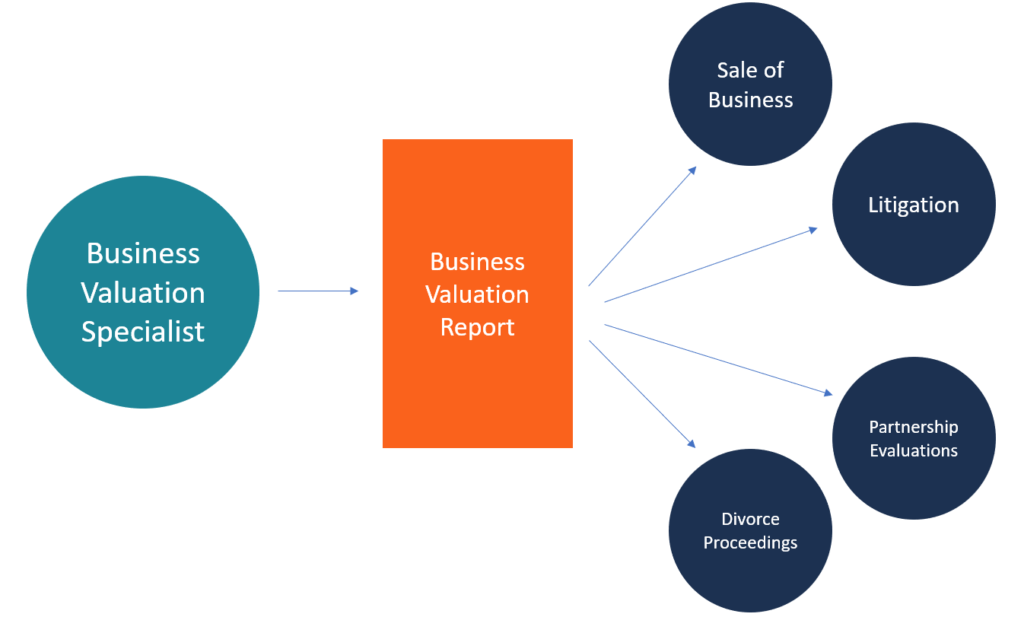

Report Preparation: After the analysis, they compile their findings into a detailed valuation report. This document outlines the methodology, assumptions, and final valuation figure, which can be presented to stakeholders, investors, or in legal proceedings.

When to Hire a Business Valuator

Businesses may require valuation services in various scenarios:

- Mergers & Acquisitions: To negotiate a fair sale or purchase price.

- Litigation Support: In divorce settlements, shareholder disputes, or bankruptcy proceedings.

- Tax Planning: For estate planning, gift taxes, or charitable contributions involving business interests.

- Financial Reporting: To comply with regulatory requirements for financial disclosures. Refer Link: https://www.aldrin.ca

The Importance of a Business Valuator

Accurate business valuation is critical in financial decision-making. A skilled business valuator provides impartial, well-supported valuations, helping businesses, investors, and legal entities make sound strategic decisions with confidence. Their expertise ensures that the value derived is fair, transparent, and reflective of the company’s true potential.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Παιχνίδια

- Gardening

- Health

- Κεντρική Σελίδα

- Literature

- Music

- Networking

- άλλο

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness