Banking as a Service Market Competitive Landscape, Regional Analysis

Banking as a Service 2024

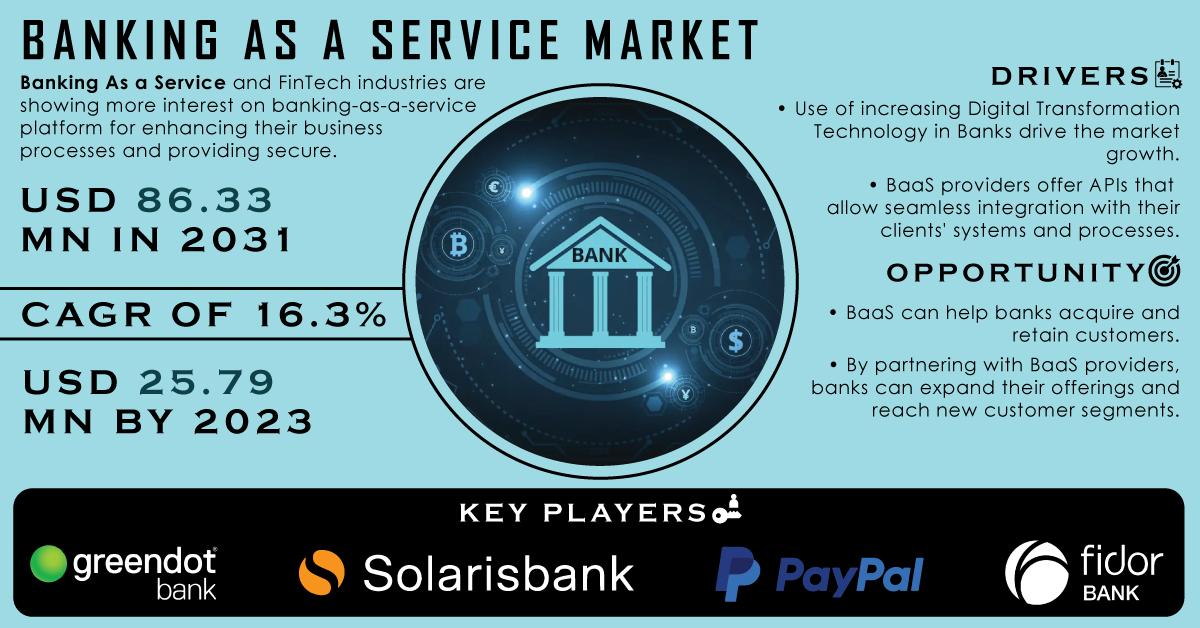

Banking as a Service (BaaS) is rapidly transforming the financial services industry by enabling non-banking companies to offer financial products directly to their customers. This innovative model allows fintech companies, e-commerce platforms, and other non-financial players to embed banking services such as payments, loans, and savings accounts within their platforms. As a result, the traditional banking landscape is being reshaped, with the Banking as a Service Market Share expanding as more companies leverage this opportunity.

How BaaS Works

At its core, Banking as a Service operates through open banking infrastructure, where licensed banks offer their platforms, APIs, and compliance tools to third parties. These third parties, such as fintechs or other businesses, can integrate financial services directly into their offerings, providing customers with seamless banking experiences without interacting with a traditional bank. Banking as a Service Market size was USD 21.27 billion in 2023 and is expected to reach USD 85.73 billion by 2032 and grow at a CAGR of 16.76% over the forecast period of 2024-2032.

Benefits for Banks and Businesses

The BaaS model offers significant advantages for both traditional banks and non-banking companies. Banks can tap into new revenue streams by partnering with technology-driven companies, expanding their customer base without the need for extensive infrastructure or marketing efforts. For non-banking companies, BaaS provides a fast track to offering financial services without the need to obtain complex banking licenses or navigate regulatory challenges. This collaboration enables businesses to deliver personalized banking solutions, driving customer engagement and increasing brand loyalty.

Expanding Financial Inclusion

One of the key strengths of BaaS is its potential to promote financial inclusion. Many fintech companies utilizing BaaS models are targeting underserved populations, offering banking services to those who may not have access to traditional financial institutions. By providing essential services such as savings accounts, digital payments, and microloans through easy-to-use platforms, BaaS is helping to bridge the gap between the banked and the unbanked. This creates a more inclusive financial ecosystem and helps empower individuals and communities with better access to financial resources.

Industry Applications and Growth

A wide range of industries is now integrating BaaS into their business models. E-commerce platforms are embedding payment systems and offering consumer loans, while ride-sharing and telecommunications companies are launching digital wallets and financial services. This flexibility allows nearly any company with a substantial customer base to introduce tailored financial solutions, enhancing user experiences and driving new revenue streams.

The scalability of BaaS makes it a highly attractive option for businesses across industries. Companies can launch banking services rapidly and scale them based on demand, providing an adaptable solution for evolving market needs.

Regulatory and Security Challenges

As BaaS continues to gain momentum, regulatory and security concerns have come to the forefront. Non-banking companies entering the financial space must adhere to strict regulations, including anti-money laundering (AML) and know-your-customer (KYC) protocols. The integration of third-party platforms with traditional banking systems also increases the risk of cybersecurity threats, making data protection and security a top priority for BaaS providers. Regulatory bodies are closely monitoring the sector to ensure compliance and safeguard consumers from potential risks.

The Future of BaaS: AI, Machine Learning, and Blockchain

Looking ahead, the future of BaaS is set to be shaped by technological advancements. Artificial intelligence (AI) and machine learning (ML) will enable BaaS providers to offer more personalized and predictive financial services. AI-driven analytics can help businesses better understand customer preferences, allowing them to offer tailored products like instant credit scoring and investment advice.

Blockchain technology also holds significant promise for the BaaS market. Its decentralized and transparent nature can enhance security, reduce transaction costs, and improve the overall efficiency of financial operations. As blockchain adoption grows, it is likely to become a key component in the evolution of BaaS platforms.

Conclusion

Banking as a Service is revolutionizing the financial services landscape, allowing non-banking companies to seamlessly integrate financial solutions into their offerings. This new model benefits both businesses and consumers, driving financial inclusion and creating new growth opportunities. As technological innovations such as AI and blockchain continue to influence the industry, BaaS is poised to play an even more significant role in the future of finance. For businesses seeking to stay competitive and meet the demands of digital consumers, adopting BaaS will be a key strategy moving forward.

Contact Us:

Akash Anand – Head of Business Development & Strategy

info@snsinsider.com

Phone: +1-415-230-0044 (US) | +91-7798602273 (IND)

About Us

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

Read Our Other Reports:

- Banking_as_a_Service_Market

- Banking_as_a_Service_Market_Size

- Banking_as_a_Service_Market_Share

- Banking_as_a_Service_Market_Growth

- Banking_as_a_Service_Market_Trends

- Banking_as_a_Service_Market_Report

- Banking_as_a_Service_Market_Analysis

- Banking_as_a_Service_Market_Forecast

- Banking_as_a_Service_Industry

- Banking_as_a_Service_Market_Research

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jogos

- Gardening

- Health

- Início

- Literature

- Music

- Networking

- Outro

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness