Fintech as a Service Market | Detailed Forecast and Industry Trends

Fintech as a Service 2024

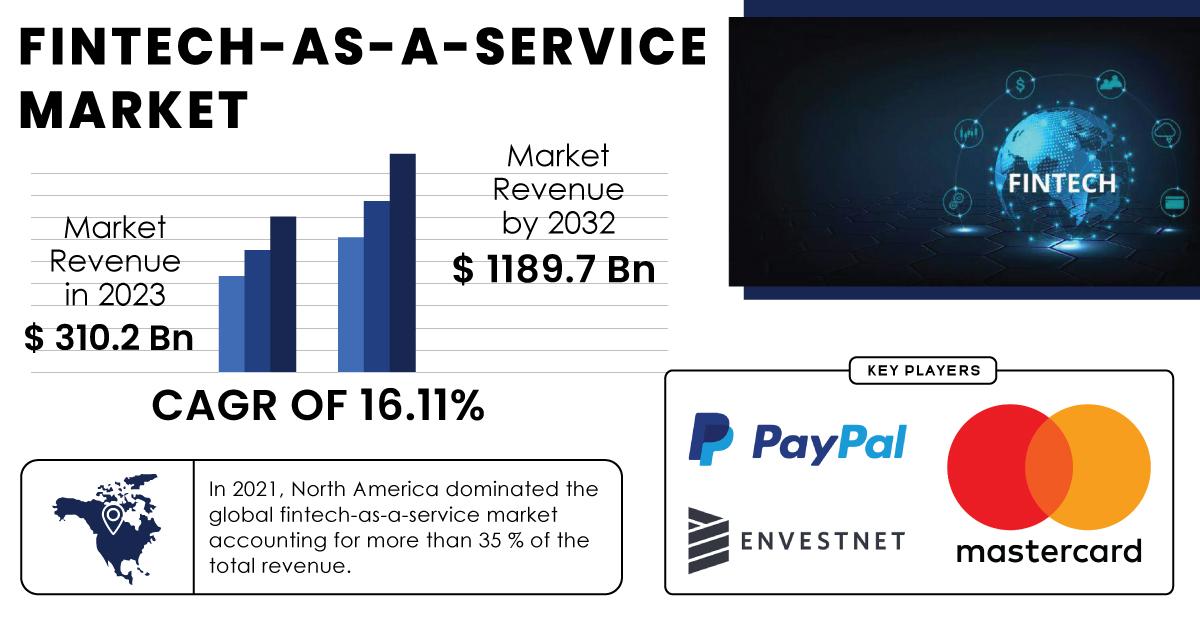

In recent years, the financial services industry has experienced a significant transformation, driven primarily by technological advancements and changing consumer preferences. One of the most notable developments in this space is the rise of Fintech as a Service (FaaS), a model that provides financial technology solutions through cloud-based platforms. This approach enables businesses, including traditional banks, startups, and fintech companies, to leverage innovative financial services without the need for extensive infrastructure or development resources. The Fintech as a Service Market Share reflects this trend, with a market size of USD 308.9 billion in 2023, projected to grow at a compound annual growth rate (CAGR) of 17.4% over the period from 2024 to 2032, ultimately reaching USD 1305.7 billion by 2032. This article delves into the various aspects of Fintech as a Service, its benefits, challenges, and its impact on the financial landscape.

Understanding Fintech as a Service

Fintech as a Service refers to the delivery of financial technology solutions through APIs (Application Programming Interfaces) and cloud-based platforms, allowing businesses to integrate advanced financial services into their existing operations with minimal disruption. This model enables organizations to access a wide range of financial tools, including payment processing, lending, wealth management, and regulatory compliance, without having to build and maintain their own technology infrastructure.

The FaaS model is particularly appealing to businesses that want to innovate and remain competitive in the fast-paced financial landscape while minimizing costs and complexity. By leveraging the expertise of third-party fintech providers, organizations can quickly adopt new technologies and respond to changing market demands.

Benefits of Fintech as a Service

The advantages of adopting Fintech as a Service are numerous and varied. One of the primary benefits is cost efficiency. By utilizing cloud-based solutions, businesses can significantly reduce their capital expenditures on technology infrastructure and maintenance. Instead of investing in expensive hardware and software, organizations can pay for the services they need on a subscription basis, allowing them to allocate resources to other strategic initiatives.

Another key benefit of FaaS is the speed of deployment. Traditional financial institutions often face lengthy development cycles when launching new products or services. In contrast, FaaS providers offer ready-to-use solutions that can be integrated into existing systems quickly, enabling organizations to bring new offerings to market faster. This agility is crucial in an industry where consumer preferences and regulatory requirements can change rapidly.

Scalability is another significant advantage of Fintech as a Service. As businesses grow and their needs evolve, FaaS solutions can easily scale to accommodate increased demand. This flexibility allows organizations to expand their offerings and serve a broader customer base without being constrained by their technology infrastructure.

Moreover, FaaS enhances innovation by providing businesses access to cutting-edge technologies and expertise. Fintech providers are often at the forefront of technological advancements, investing heavily in research and development. By partnering with these providers, organizations can leverage the latest innovations in areas such as artificial intelligence, blockchain, and data analytics, enabling them to enhance their service offerings and improve customer experiences.

Challenges Facing Fintech as a Service

Despite its many advantages, the Fintech as a Service model also presents challenges that organizations must navigate. One of the most pressing concerns is data security and compliance. As financial services involve sensitive customer information, businesses must ensure that the FaaS providers they partner with adhere to stringent security protocols and regulatory requirements. Any data breaches or compliance failures can have severe repercussions, both financially and reputationally.

Additionally, businesses may face challenges in integrating FaaS solutions with their existing systems. While FaaS providers strive to offer seamless integration, organizations may encounter compatibility issues or require additional customization to meet their specific needs. This can lead to delays in deployment and increased costs if not managed effectively.

Furthermore, organizations must carefully evaluate the reputation and reliability of FaaS providers. With a plethora of options available, it can be challenging to identify trustworthy partners that will deliver consistent service and support. Due diligence is essential to ensure that organizations are aligning with reputable fintech providers that have a proven track record of success.

The Impact of Fintech as a Service on the Financial Landscape

The rise of Fintech as a Service is reshaping the financial landscape in several significant ways. Traditional banks and financial institutions are increasingly adopting FaaS solutions to remain competitive in a market that is rapidly evolving due to technological advancements and changing consumer preferences. By leveraging FaaS, these institutions can offer innovative services and improve operational efficiency, ultimately enhancing customer satisfaction.

The FaaS model is also fostering the growth of fintech startups and challenger banks, which can quickly establish themselves in the market by leveraging existing technologies and infrastructure. This democratization of financial services is enabling smaller players to compete with established institutions, driving innovation and improving service offerings for consumers.

Additionally, Fintech as a Service is enhancing financial inclusion by making it easier for underserved populations to access financial services. Through FaaS solutions, organizations can develop tailored products that cater to specific demographic needs, such as microloans, digital wallets, and savings accounts with low fees. This increased accessibility empowers individuals and small businesses to participate in the financial ecosystem, driving economic growth and stability.

The Future of Fintech as a Service

As the demand for innovative financial solutions continues to grow, the future of Fintech as a Service looks promising. The market is expected to witness significant advancements in areas such as artificial intelligence, machine learning, and data analytics, further enhancing the capabilities of FaaS providers. These technologies will enable businesses to offer personalized financial solutions, improving customer experiences and driving engagement.

Moreover, the rise of open banking is likely to accelerate the growth of the FaaS market. Open banking initiatives, which promote the secure sharing of financial data between banks and third-party providers, will create new opportunities for innovation and collaboration. FaaS providers will play a crucial role in facilitating these partnerships, enabling organizations to deliver a broader range of services to their customers.

As regulatory environments evolve, FaaS providers will need to adapt to new compliance requirements. This may lead to increased collaboration between fintech companies and regulators to ensure that financial services remain secure and transparent. By proactively addressing regulatory challenges, FaaS providers can build trust and confidence among consumers and businesses alike.

Conclusion

Fintech as a Service is revolutionizing the financial services industry, providing organizations with the tools and technologies they need to innovate, scale, and remain competitive. With numerous benefits, including cost efficiency, speed of deployment, and access to cutting-edge technologies, FaaS is becoming an increasingly attractive option for businesses across sectors. However, challenges such as data security and integration must be carefully managed to ensure successful implementation. As the market continues to grow and evolve, the impact of Fintech as a Service on the financial landscape will be profound, driving innovation, improving financial inclusion, and reshaping how consumers and businesses interact with financial services. The future of FaaS is bright, and its potential to transform the financial ecosystem is only beginning to be realized.

Contact Us:

Akash Anand – Head of Business Development & Strategy

info@snsinsider.com

Phone: +1-415-230-0044 (US) | +91-7798602273 (IND)

About Us

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

Read Our Other Reports:

Virtual Meeting Software Market Report

- Fintech_as_a_Service_Market

- Fintech_as_a_Service_Market_Size

- Fintech_as_a_Service_Market_Share

- Fintech_as_a_Service_Market_Growth

- Fintech_as_a_Service_Market_Trends

- Fintech_as_a_Service_Market_Report

- Fintech_as_a_Service_Market_Analysis

- Fintech_as_a_Service_Market_Forecast

- Fintech_as_a_Service_Industry

- Fintech_as_a_Service_Market_Research

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- الألعاب

- Gardening

- Health

- الرئيسية

- Literature

- Music

- Networking

- أخرى

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness