Digital Lending Platform Market Competitive Analysis, Regional Outlook

Digital Lending Platform 2024

The financial sector is undergoing a significant transformation, with digital technologies revolutionizing how loans are processed, approved, and disbursed. One of the most impactful innovations in this space is the rise of digital lending platforms. These platforms leverage advanced technologies such as artificial intelligence (AI), machine learning, and big data analytics to offer quick, efficient, and transparent lending solutions. Digital Lending Platform Market Trends show that the growing demand for faster, more accessible credit, particularly among underserved populations, is driving the rapid growth of these platforms across the globe.

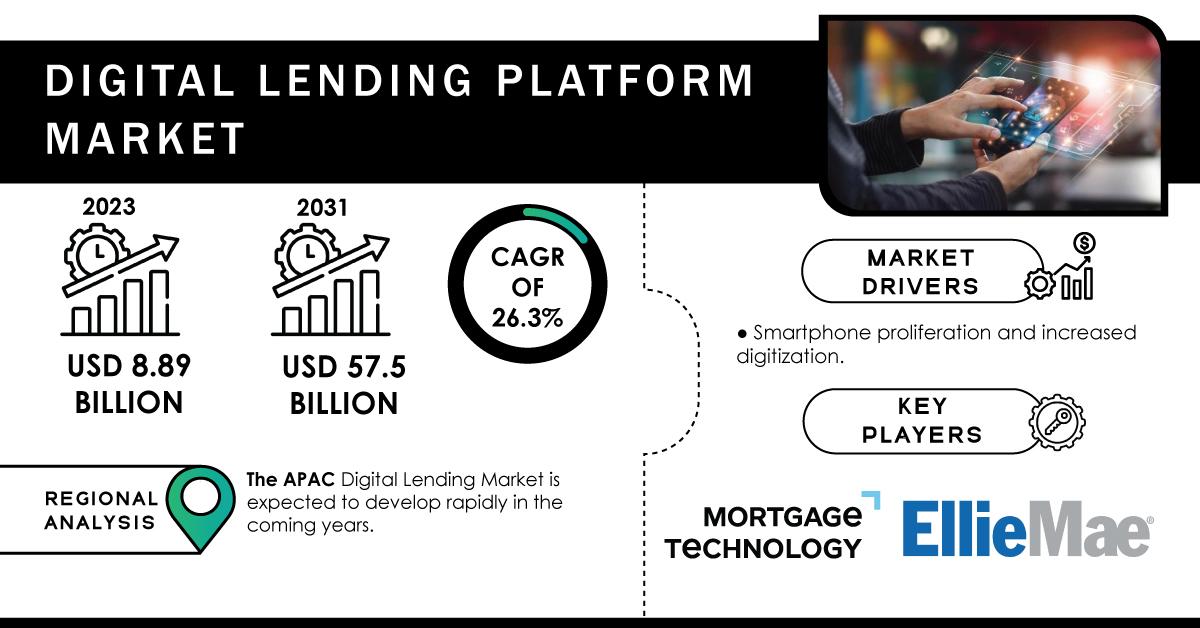

Digital Lending Platform Market was valued at USD 8.89 billion in 2023 and is expected to reach USD 57.5 billion by 2031 and grow at a CAGR of 26.3% over the forecast period 2024-2031. This explosive growth reflects the increasing shift towards digital solutions in the financial sector, driven by consumer preferences for seamless, hassle-free, and on-demand access to financial services.

What is a Digital Lending Platform?

A digital lending platform is an online system that connects borrowers and lenders in a streamlined, automated environment. Unlike traditional lending processes that often involve lengthy paperwork, manual verifications, and in-person interactions, digital lending platforms facilitate loan applications, approvals, and disbursements entirely online. These platforms utilize advanced algorithms and digital tools to assess borrowers' creditworthiness, determine loan terms, and process transactions in a matter of minutes, offering a fast and user-friendly experience.

Digital lending platforms offer a variety of loan products, including personal loans, business loans, mortgages, and payday loans. These platforms use data-driven models and AI technologies to assess borrower risk, improving decision-making speed and accuracy. As a result, borrowers receive instant approvals, and lenders are able to expand their reach to a broader customer base while mitigating the risk of loan defaults.

Key Benefits of Digital Lending Platforms

One of the most significant advantages of digital lending platforms is convenience. Borrowers no longer need to visit banks or financial institutions to apply for loans; instead, they can submit applications from the comfort of their homes using their smartphones or computers. The simplified application process, combined with quick approvals and flexible repayment terms, makes digital lending platforms highly attractive to consumers, especially millennials and Gen Z.

Another key benefit is enhanced efficiency. Traditional lending processes are often slow, requiring manual paperwork, multiple verifications, and prolonged waiting periods. Digital platforms, on the other hand, automate much of the process, significantly reducing the time needed for loan approval and disbursement. This efficiency is particularly beneficial for borrowers who need quick access to funds, such as in the case of emergency loans or business financing.

Moreover, digital lending platforms are reshaping the financial inclusion landscape. They provide underserved and unbanked populations with access to credit, as these platforms typically use alternative data sources—such as social media activity, payment history, and transaction records—to evaluate a borrower’s creditworthiness. This is especially important in regions with low banking penetration, where traditional financial institutions may not be present or accessible.

Challenges and Considerations

Despite their numerous advantages, digital lending platforms also face challenges. One of the most significant concerns is data security. As these platforms handle sensitive personal and financial data, ensuring robust cybersecurity measures is crucial to prevent data breaches and maintain consumer trust. Regulatory compliance is another area that digital lending platforms must navigate carefully. Different regions have varying laws and regulations regarding lending practices, which can complicate the operation of these platforms across borders.

Additionally, the risk of fraud and loan defaults remains a concern. While AI and machine learning models help improve credit risk assessments, there are still instances where borrowers may default on their loans. Digital lending platforms need to continuously evolve their algorithms to account for changing market conditions and borrower behavior, ensuring that both lenders and borrowers are protected.

The Future of Digital Lending Platforms

The future of digital lending platforms is incredibly promising, driven by the ongoing adoption of digital banking solutions, the proliferation of smartphones, and increasing consumer demand for fast, transparent, and personalized financial services. As more fintech companies enter the market, digital lending platforms will continue to innovate, offering new products and services tailored to the needs of consumers and businesses alike.

Furthermore, as regulatory frameworks around digital lending evolve, these platforms will likely become more integrated into the broader financial ecosystem, offering services such as credit scoring, debt recovery, and integrated payment solutions. With advances in AI, blockchain technology, and data analytics, digital lending platforms are set to enhance their capabilities, offering even more efficient and secure loan products to meet the growing global demand for credit.

In conclusion, digital lending platforms are redefining the lending process, offering convenience, speed, and financial inclusion to a broader range of consumers. As technology continues to advance and market demand rises, these platforms will play an increasingly vital role in the global financial landscape, providing accessible, efficient, and secure lending solutions for the future.

Contact Us:

Akash Anand – Head of Business Development & Strategy

info@snsinsider.com

Phone: +1-415-230-0044 (US) | +91-7798602273 (IND)

About Us

S&S Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

Read Our Other Reports:

Intelligent Document Processing Market Report

- Digital_Lending_Platform

- Digital_Lending_Platform_Market

- Digital_Lending_Platform_Market_Size

- Digital_Lending_Platform_Market_Share

- Digital_Lending_Platform_Market_Growth

- Digital_Lending_Platform_Market_Trends

- Digital_Lending_Platform_Market_Report

- Digital_Lending_Platform_Market_Analysis

- Digital_Lending_Platform_Market_Forecast

- Digital_Lending_Platform_Market_Research

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Juegos

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness