Unlocking the Secrets of Self Storage Success with Stacy Rossetti’s Book

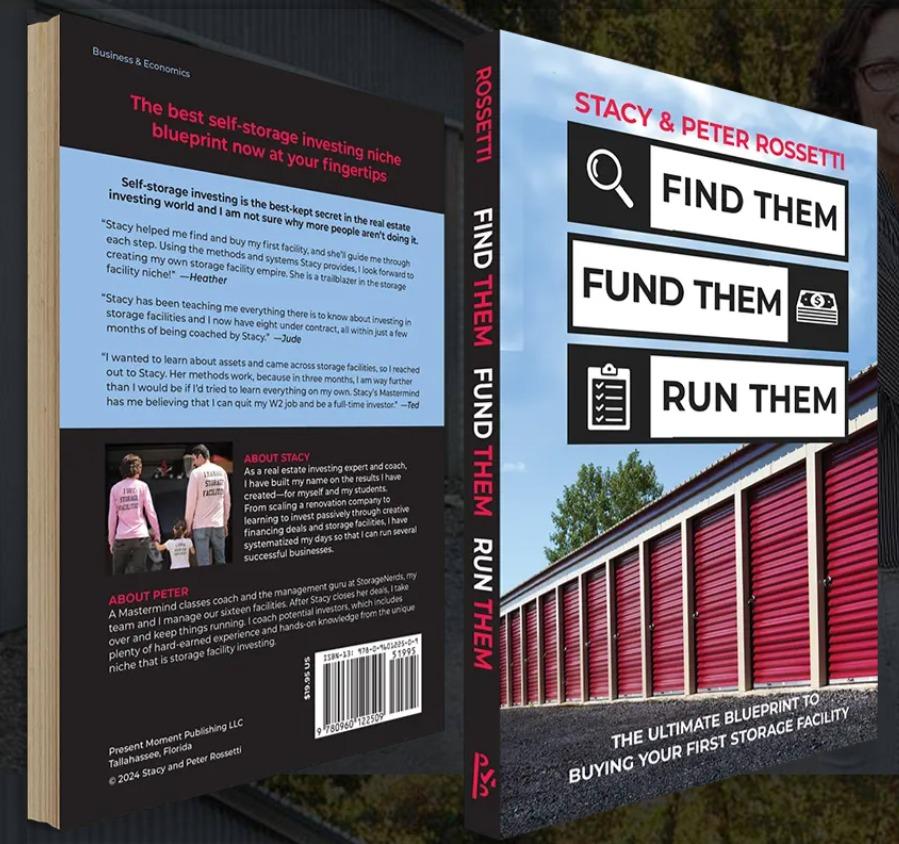

Self storage investing is becoming one of the most lucrative ventures in real estate, offering consistent cash flow and significant returns. Stacy Rossetti, an acclaimed self storage investor and educator, has distilled her expertise into Storage Unit Investing: Find Them, Fund Them, and Run Them. This comprehensive guide is a must-read for anyone looking to break into the self storage business or scale their existing operations.

Rossetti’s book takes readers on a transformative journey through the three pillars of self storage investing: Find, Fund, and Run. Let’s delve deeper into what makes her approach a game-changer for both novice and seasoned investors.

Find: Master the Art of Identifying Profitable Self Storage Units

The first challenge in self storage investing is identifying the right facilities. This requires more than just spotting a vacant lot or a poorly managed facility; it’s about analyzing market dynamics and financial viability. Stacy Rossetti simplifies this seemingly complex process in her book by offering step-by-step guidance on:

- Conducting Market Research

Understand Local Demand: Rossetti emphasizes the importance of assessing local demographics and demand. She explains how population density, income levels, and residential turnover rates impact the success of self storage units.

Competition Analysis: Knowing your competitors is key. Stacy provides tips on evaluating existing facilities in the area and identifying gaps in the market, such as underserved neighborhoods or niche storage needs. - Spotting Lucrative Opportunities

Value-Add Facilities: One of Rossetti’s core principles is to look for “value-add” opportunities—facilities that can be improved to increase revenue. For example, upgrading security systems, adding climate-controlled units, or enhancing curb appeal.

Distressed Properties: She encourages investors to target poorly managed or distressed properties that can be acquired at a lower cost and revitalized for higher returns. - Evaluating Key Metrics

The book breaks down critical metrics every investor should consider, such as:

Occupancy Rates: Ideal facilities maintain high but not full occupancy, ensuring room for growth.

Revenue per Square Foot: A vital measure of a facility’s profitability.

Net Operating Income (NOI): Stacy walks readers through calculating NOI to assess potential returns.

By the end of this section, readers are equipped with the tools to confidently identify self storage opportunities with strong earning potential.

Fund: Unlock Financing Strategies for Self Storage Investing

Securing the capital to invest in self storage can be daunting, especially for first-time investors. Stacy Rossetti book demystifies the financing process, offering creative and practical solutions to fund your investment.

- Traditional Financing

Rossetti provides insights into conventional loan options, including:

Commercial Real Estate Loans: Tailored for self storage investments, these loans offer competitive rates but require detailed business plans.

Small Business Administration (SBA) Loans: Stacy explains how SBA loans can be leveraged to fund self storage facilities, especially for first-time buyers.

- Creative Financing Options

For those without substantial upfront capital, Rossetti introduces innovative financing strategies, such as:

Seller Financing: Negotiating with the current owner to spread payment over time instead of a lump sum upfront.

Private Lenders: Building relationships with private investors who can provide funding in exchange for equity or interest.

Partnerships: Pooling resources with other investors to share costs and profits.

- Financial Planning and Risk Management

Beyond funding, Rossetti emphasizes the importance of financial acumen. Key takeaways include:

Building a detailed pro forma to forecast cash flows and expenses.

Understanding debt-service coverage ratios to ensure sustainable borrowing.

Preparing for unexpected costs through reserve funds.

With these strategies, readers learn to overcome financial barriers and enter the self storage market with confidence.

Run: Efficiently Manage Your Self Storage Facility

Owning a self storage facility is just the beginning; effective management is critical for sustained profitability. Stacy Rossetti dedicates the final section of her book to operational excellence, offering practical advice on managing facilities efficiently.

- Tenant Management

A well-run self storage facility prioritizes tenant satisfaction. Rossetti shares tips on:

Streamlined Leasing: Implementing user-friendly digital platforms for lease agreements and payments.

Customer Retention: Enhancing the tenant experience with features like 24/7 access, flexible rental terms, and responsive customer service.

- Profit Maximization

Stacy outlines strategies to boost income, including:

Dynamic Pricing: Adjusting rental rates based on demand, seasonality, and market trends.

Upselling and Ancillary Services: Offering additional services like moving supplies, insurance, or truck rentals to increase revenue streams.

- Operational Efficiency

To minimize costs and improve operations, Rossetti highlights:

Automating Processes: From online payments to AI-driven security, automation can save time and reduce overheads.

Maintenance Best Practices: Proactive maintenance prevents costly repairs and keeps tenants satisfied.

By mastering these management strategies, investors can transform their facilities into thriving businesses that generate consistent cash flow.

Why Choose Stacy Rossetti’s Book?

Stacy Rossetti’s experience as a successful self storage investor and educator sets her book apart from generic investment guides. Key reasons to pick up Storage Unit Investing include:

Actionable Advice: The book is packed with real-world examples and actionable tips that readers can immediately apply.

Comprehensive Approach: From finding and funding to managing facilities, Rossetti covers the entire investment lifecycle.

Beginner-Friendly: Even readers new to self storage will find the concepts accessible and the steps easy to follow.

Conclusion

Storage Unit Investing: Find Them, Fund Them, and Run Them by Stacy Rossetti is more than a book; it’s a blueprint for self storage success. Whether you’re a budding investor or a seasoned entrepreneur looking to diversify your portfolio, Rossetti’s insights will guide you toward profitable and sustainable investments in the self storage market.

Ready to take the first step? Grab a copy of Stacy Rossetti’s book and unlock the door to your self storage empire.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Игры

- Gardening

- Health

- Главная

- Literature

- Music

- Networking

- Другое

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness