Digital Payments Market | Detailed Forecast and Industry Trends

Digital Payments 2024

The evolution of digital technology has significantly reshaped the way we conduct financial transactions, with digital payments emerging as one of the most influential trends in the global economy. Digital payments enable consumers and businesses to make transactions electronically, bypassing traditional methods like cash or paper-based payments. The rise of smartphones, the internet, and innovative fintech solutions has propelled this transformation, allowing for more secure, efficient, and accessible payment methods. As businesses and consumers embrace digitalization, Digital Payments Market Trends indicate that this sector is experiencing rapid growth, driven by the adoption of mobile wallets, contactless payments, and peer-to-peer (P2P) payment platforms.

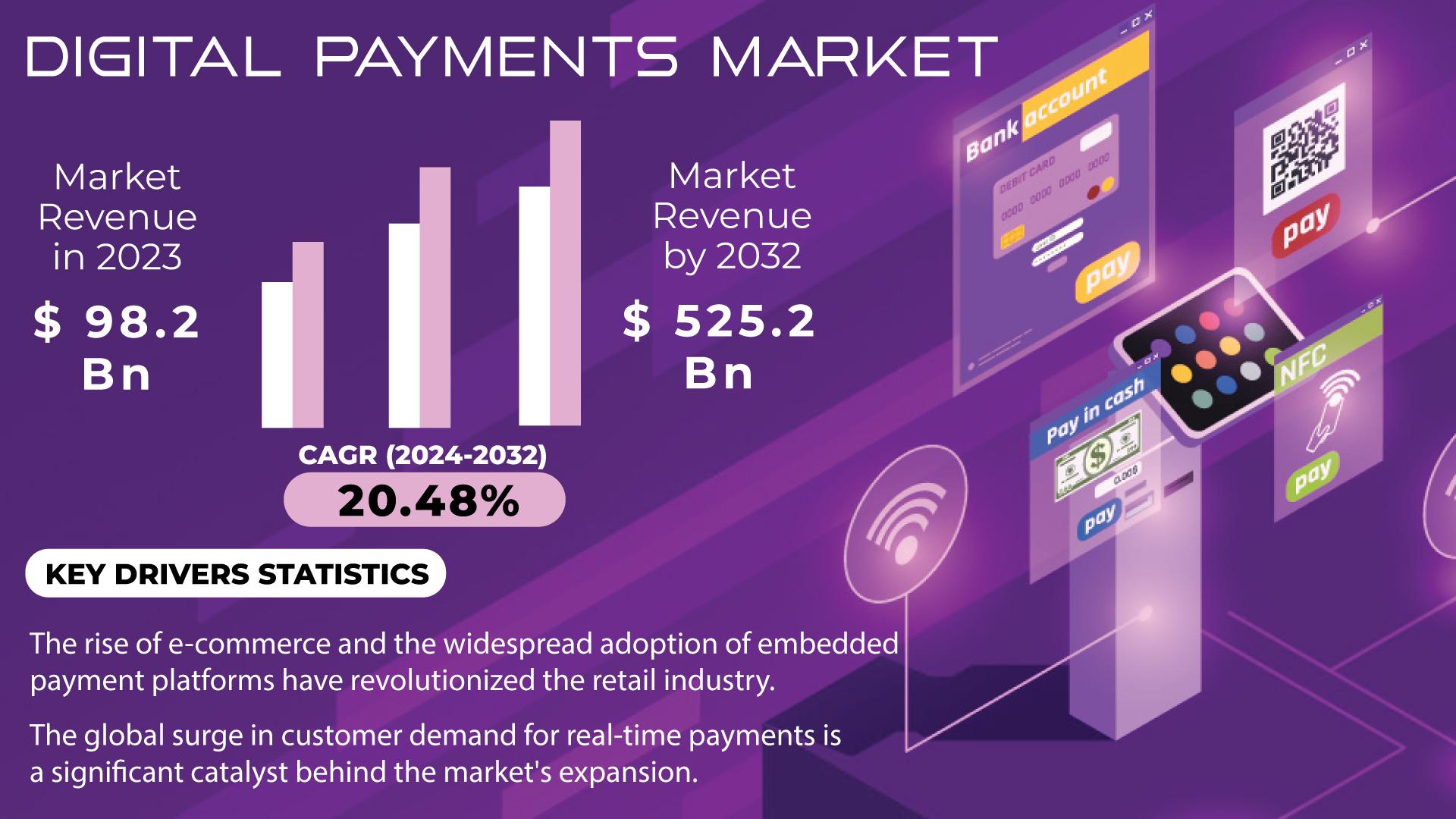

Digital Payments Market was valued at USD 98.2 Bn in 2023 and is expected to reach USD 525.2 Bn by 2032, growing at a CAGR of 20.48% over the forecast period 2024-2032. This impressive growth is a reflection of increasing consumer demand for faster, more convenient payment options, as well as the ongoing expansion of digital infrastructure and secure payment solutions. With the rise of e-commerce and mobile banking, digital payments are becoming a standard practice in both developed and emerging markets, providing new opportunities for businesses to streamline their operations and enhance customer experience.

The Convenience and Speed of Digital Payments

One of the main reasons behind the widespread adoption of digital payments is the convenience and speed they offer. Digital payment methods, such as credit and debit cards, mobile wallets like Apple Pay and Google Pay, and digital currencies, allow consumers to make transactions from anywhere at any time. Whether it’s shopping online, paying for services, or transferring money between individuals, digital payments simplify the process and save time. For consumers, this shift away from traditional cash transactions also reduces the need to carry physical money or visit ATMs, offering a more seamless payment experience.

From a business perspective, digital payments provide greater operational efficiency. Merchants can accept payments quickly and securely without the need for complex payment processing systems. Additionally, businesses can reduce the costs associated with handling cash and manual transaction recording. The growing reliance on mobile payment platforms further streamlines financial operations for both small businesses and large enterprises.

Security and Trust in Digital Payments

As the volume of digital payments continues to increase, security remains a top priority for both consumers and businesses. Payment service providers and financial institutions have implemented robust encryption and fraud protection technologies to safeguard sensitive information and prevent unauthorized transactions. The integration of biometric authentication, such as fingerprint and facial recognition, as well as multi-factor authentication, adds another layer of security, making digital payments safer for users.

Despite concerns about cybersecurity risks, the continued development of secure payment gateways and the implementation of regulatory standards like the Payment Card Industry Data Security Standard (PCI DSS) have contributed to building consumer trust in digital payments. The growing use of blockchain technology, particularly in cryptocurrency transactions, is also expected to enhance transparency and security in the digital payment ecosystem.

The Rise of Contactless and Mobile Payments

Contactless payments, enabled through Near Field Communication (NFC) technology, are becoming increasingly popular worldwide, offering a fast and secure way to pay. Users can simply tap their cards or smartphones on point-of-sale (POS) terminals to complete transactions, reducing the time spent at checkout. This method is particularly appealing in a post-pandemic world, where health and safety concerns have heightened the demand for touch-free payment solutions.

Mobile payments have also surged in popularity, with apps like Venmo, PayPal, and digital wallets facilitating seamless peer-to-peer transfers. The ease with which users can send money to friends and family, pay for goods and services, or donate to causes has revolutionized how we think about money transfer. The proliferation of smartphones and mobile applications has played a pivotal role in accelerating the growth of mobile payments, making it easier for consumers to manage their finances on the go.

Digital Payments and Financial Inclusion

Digital payments are also helping to drive financial inclusion in underbanked and unbanked regions. In many developing countries, mobile payment systems and mobile banking platforms are enabling individuals without access to traditional banking services to participate in the digital economy. By offering a convenient way to save, send, and receive money, digital payments are empowering people in remote areas to access financial services that were previously unavailable to them.

Governments and regulatory bodies are also supporting the adoption of digital payments by promoting cashless economies and offering incentives for businesses to adopt digital payment solutions. As a result, digital payments are playing a crucial role in reducing the barriers to financial inclusion, improving access to essential services, and fostering economic growth.

The Future of Digital Payments

As the digital payments landscape continues to evolve, we can expect even more innovation in payment methods. The rise of artificial intelligence (AI), machine learning, and big data analytics will enable more personalized and efficient payment experiences. For instance, AI-driven payment solutions could predict a consumer's payment preferences and automatically complete transactions. Additionally, the growing interest in cryptocurrency and decentralized finance (DeFi) solutions is likely to further transform the digital payments space, offering new avenues for cross-border payments and financial transactions.

In conclusion, digital payments are reshaping the financial ecosystem, offering benefits such as convenience, speed, security, and inclusivity. As the global market for digital payments expands, businesses, consumers, and governments are embracing this digital shift, driving the transition to cashless economies. With continued innovation and increased adoption of mobile and contactless payment methods, digital payments are poised to play an even more significant role in the future of global commerce.

Contact Us:

Akash Anand – Head of Business Development & Strategy

info@snsinsider.com

Phone: +1-415-230-0044 (US) | +91-7798602273 (IND)

About Us

S&S Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

Read Our Other Reports:

Reconciliation Software Market Growth

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Spiele

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness