Banking as a Service Market Regional Outlook, Impact of Recent Events, Competitive Landscape

Banking as a Service 2024

Banking as a Service (BaaS) is revolutionizing the financial sector by offering businesses the ability to integrate banking capabilities into their platforms through APIs and cloud-based solutions. This innovation allows non-banking entities such as fintech companies, e-commerce platforms, and even retailers to offer banking services like payments, lending, and account management directly to their customers. The convenience and scalability of BaaS have driven Banking as a Service Market Growth, enabling organizations to provide seamless financial experiences without the complexities of traditional banking infrastructure.

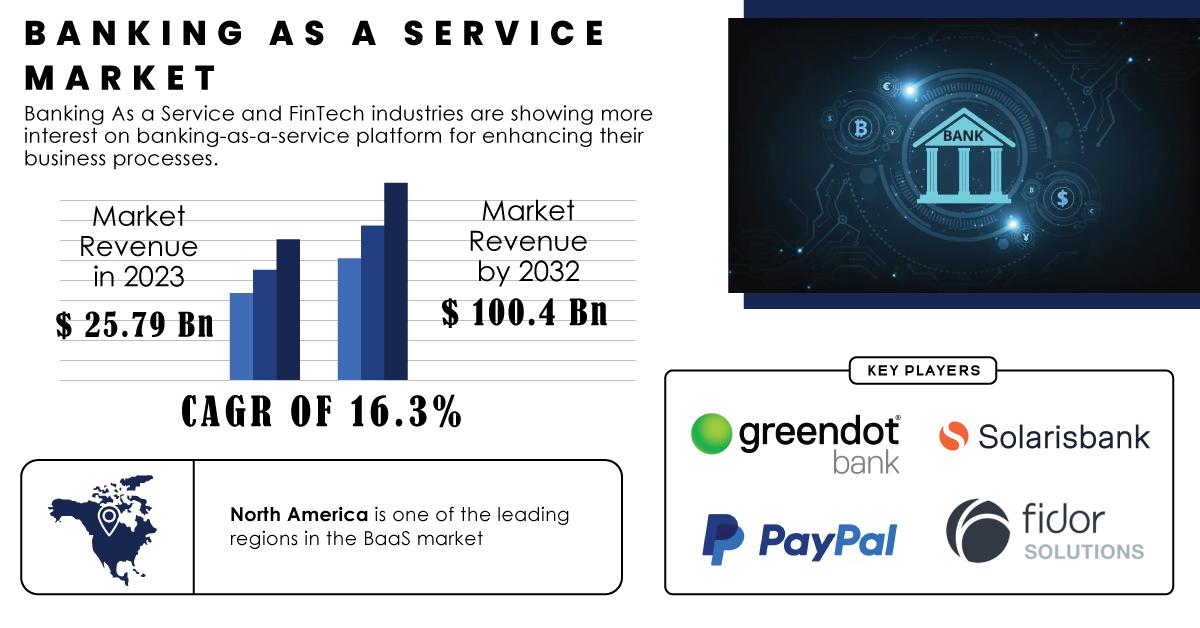

By leveraging BaaS, businesses can offer tailored financial products, enhance customer engagement, and tap into new revenue streams. This approach is not only transforming how financial services are delivered but also democratizing access to banking tools for underserved markets. Banking as a Service Market was USD 21.27 billion in 2023 and is expected to Reach USD 85.73 billion by 2032 and grow at a CAGR of 16.76% over the forecast period of 2024-2032.

Key Drivers of Banking as a Service

The rise of digital transformation is a significant driver of the BaaS market. As consumers demand more convenient and digital-first financial solutions, businesses are turning to BaaS platforms to integrate these services effortlessly. This demand is amplified by the widespread adoption of smartphones and the increasing preference for cashless transactions, which require seamless payment and banking capabilities embedded within apps and platforms.

The regulatory push for open banking has also played a pivotal role. By mandating banks to share customer data securely with third-party providers (with customer consent), open banking frameworks have paved the way for BaaS adoption. This collaboration fosters innovation and competition, enabling new entrants to offer innovative financial solutions while relying on the infrastructure of established banks.

Challenges in BaaS Adoption

While BaaS presents numerous opportunities, it also comes with challenges that organizations must navigate. One significant hurdle is data security and privacy. As BaaS platforms handle sensitive financial information, ensuring robust cybersecurity measures is paramount to prevent breaches and build trust with customers. Compliance with regulations like GDPR and PCI DSS adds another layer of complexity, requiring businesses to align their operations with stringent legal frameworks.

Integration complexities can also pose challenges. Embedding banking functionalities into existing systems requires expertise and significant technical resources, which might be a barrier for smaller businesses. Additionally, reliance on third-party providers can create dependencies that may affect service reliability and customer satisfaction.

The Future of Banking as a Service

The future of BaaS lies in its ability to facilitate the seamless blending of financial services into everyday digital experiences. Advancements in AI and machine learning are expected to enhance the capabilities of BaaS platforms, enabling personalized financial offerings, automated compliance management, and smarter risk assessments.

Emerging markets present significant growth opportunities for BaaS, particularly in regions where financial inclusion remains a challenge. By partnering with local businesses and leveraging mobile technologies, BaaS providers can help bridge the gap for unbanked and underbanked populations. Additionally, as the Internet of Things (IoT) evolves, BaaS could play a critical role in enabling payment solutions across connected devices.

In conclusion, banking as a service is reshaping the financial industry by making banking functionalities more accessible and customizable. As businesses across sectors embrace this model to enhance customer experiences and drive growth, the BaaS market is poised for remarkable expansion. By addressing challenges and leveraging technological advancements, BaaS will continue to empower businesses and consumers alike in the digital age.

Contact Us:

Akash Anand – Head of Business Development & Strategy

info@snsinsider.com

Phone: +1-415-230-0044 (US) | +91-7798602273 (IND)

About Us

S&S Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

Read Our Other Reports:

Small Cell 5G Network Market Size

- Banking_as_a_Service

- Banking_as_a_Service_Market

- Banking_as_a_Service_Market_Size

- Banking_as_a_Service_Market_Share

- Banking_as_a_Service_Market_Growth

- Banking_as_a_Service_Market_Trends

- Banking_as_a_Service_Market_Report

- Banking_as_a_Service_Market_Analysis

- Banking_as_a_Service_Market_Forecast

- Banking_as_a_Service_Market_Research

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Spellen

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness