Cyber Security Insurance Market Research | Recent Developments and Market Dynamics

Cyber Security Insurance 2024

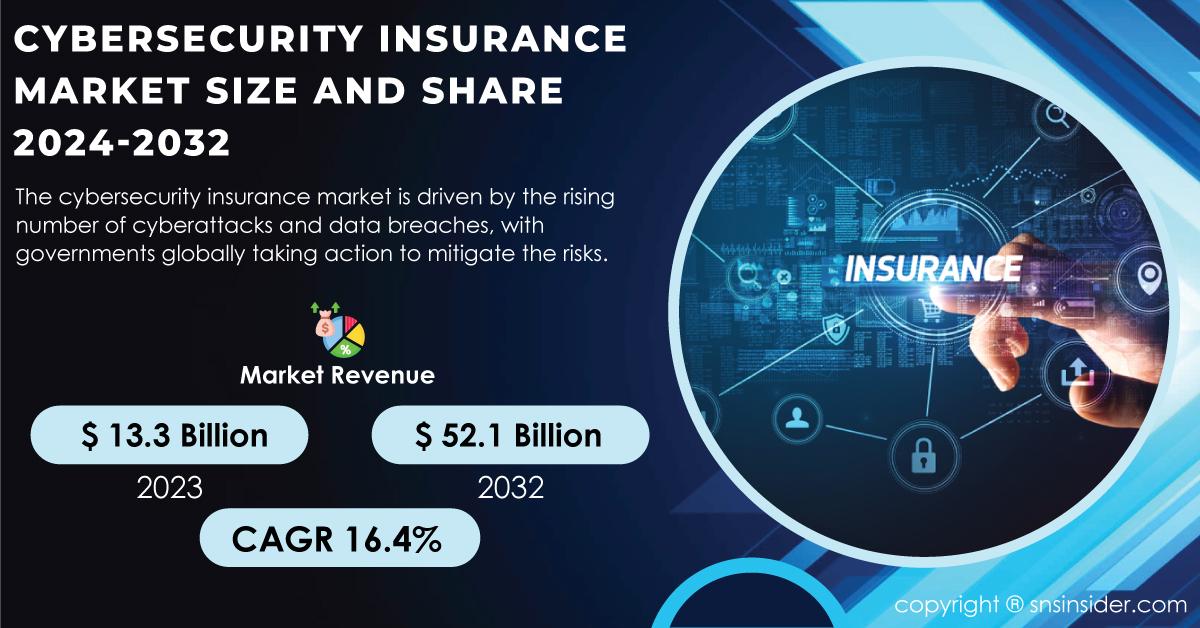

In an increasingly digital world, the importance of safeguarding sensitive information cannot be overstated. With businesses of all sizes relying heavily on technology, cyber threats have become a significant concern. Cybersecurity insurance has emerged as a critical tool for organizations looking to mitigate the financial impact of data breaches and other cyber incidents. The Cyber Security Insurance Market Growth reflects this need, with a valuation of USD 13.3 billion in 2023 and projected to reach USD 52.1 billion by 2032, growing at a compound annual growth rate (CAGR) of 16.4% over the forecast period from 2024 to 2032.

Understanding Cyber Security Insurance

Cybersecurity insurance, often referred to as cyber insurance, is a specialized type of insurance designed to help organizations recover from cyber incidents. It provides coverage for a variety of risks, including data breaches, ransomware attacks, business interruption, and even legal liabilities arising from the mishandling of sensitive information. By transferring some of the financial risks associated with cyber incidents to an insurance provider, organizations can better manage the potential fallout from a cyber attack.

The landscape of cyber threats is constantly evolving, with attackers employing increasingly sophisticated techniques to breach security defenses. As a result, organizations are recognizing the necessity of not only investing in robust cybersecurity measures but also having a comprehensive insurance policy in place. Cybersecurity insurance can cover various costs, including forensic investigations, legal fees, notification expenses, and credit monitoring services for affected individuals.

The Growing Importance of Cyber Security Insurance

The growing incidence of cyberattacks has heightened awareness of cybersecurity insurance among businesses. High-profile data breaches and ransomware attacks have underscored the potential financial devastation that such incidents can cause. As organizations face the prospect of substantial financial losses and reputational damage, many are turning to cyber insurance as a vital component of their risk management strategy.

One of the significant drivers of the cyber security insurance market is the increasing regulatory environment surrounding data protection. Laws such as the General Data Protection Regulation (GDPR) in Europe and various state-level regulations in the United States mandate strict data protection measures. Non-compliance with these regulations can result in hefty fines, further amplifying the need for insurance coverage.

Key Benefits of Cyber Security Insurance

Cyber security insurance offers several benefits that can help organizations navigate the complex landscape of digital risks. One of the most significant advantages is the financial protection it provides in the event of a cyber incident. By covering the costs associated with data breaches, organizations can minimize their financial exposure and avoid crippling expenses.

Moreover, many insurance providers offer additional services, such as risk assessment and incident response planning, as part of their cyber insurance policies. These services can help organizations enhance their cybersecurity posture, better prepare for potential threats, and respond effectively in the event of an incident. This proactive approach can significantly reduce the likelihood of a successful cyber attack and the associated costs.

Challenges in the Cyber Security Insurance Market

Despite its benefits, the cyber security insurance market faces challenges that can hinder its growth. One of the primary concerns is the lack of standardization in policy offerings. As the market evolves, insurers may offer varying coverage levels and terms, making it challenging for organizations to compare policies and choose the best fit for their needs.

Additionally, the rapid evolution of cyber threats presents a dilemma for insurers in accurately assessing risk. Cyber risks are not static; they change frequently as new vulnerabilities and attack vectors emerge. Insurers must continuously adapt their underwriting processes and pricing models to keep pace with the evolving threat landscape, which can lead to uncertainties for both insurers and policyholders.

The Future of Cyber Security Insurance

The future of cybersecurity insurance appears promising, driven by the increasing recognition of the need for comprehensive risk management strategies in the digital age. As more organizations acknowledge the importance of protecting their sensitive data and digital assets, the demand for cyber insurance is expected to continue growing.

Innovation within the insurance sector will also play a crucial role in shaping the future of cybersecurity insurance. Insurers may increasingly rely on advanced data analytics and machine learning algorithms to enhance risk assessment and pricing accuracy. By leveraging technology, insurers can better understand and mitigate the risks associated with cyber threats, ultimately providing more tailored and effective coverage options.

In conclusion, cybersecurity insurance is becoming an indispensable tool for organizations aiming to protect themselves against the rising tide of cyber threats. With the growing emphasis on data protection and regulatory compliance, businesses are turning to cyber insurance as a means of safeguarding their financial interests and ensuring resilience in the face of digital adversity. As the market continues to evolve, the collaboration between insurers, businesses, and cybersecurity experts will be essential in fostering a safer digital landscape for all.

Contact Us:

Akash Anand – Head of Business Development & Strategy

info@snsinsider.com

Phone: +1-415-230-0044 (US) | +91-7798602273 (IND)

About Us

S&S Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

Read Our Other Reports:

5G Fixed Wireless Access (FWA) Market Growth

- Cyber_Security_Insurance_Market

- Cyber_Security_Insurance_Market_Size

- Cyber_Security_Insurance_Market_Share

- Cyber_Security_Insurance_Market_Growth

- Cyber_Security_Insurance_Market_Trends

- Cyber_Security_Insurance_Market_Report

- Cyber_Security_Insurance_Market_Analysis

- Cyber_Security_Insurance_Market_Forecast

- Cyber_Security_Insurance_Industry

- Cyber_Security_Insurance_Market_Research

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jeux

- Gardening

- Health

- Domicile

- Literature

- Music

- Networking

- Autre

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness