Revenue Assurance Market Trends, Growth Drivers

Revenue Assurance 2024

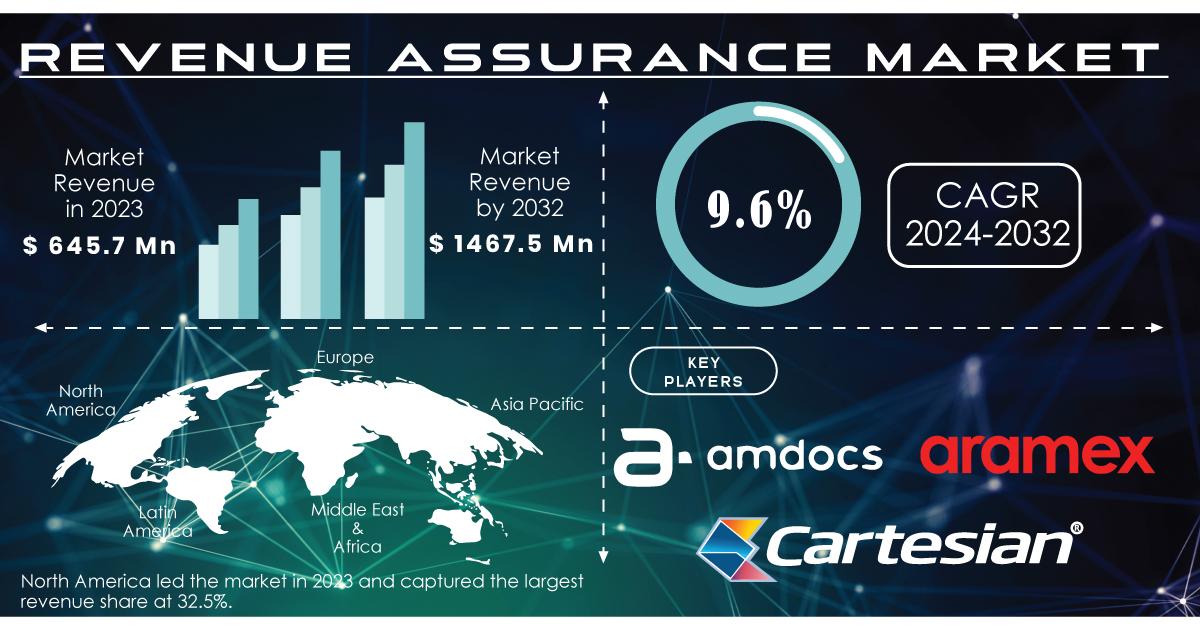

In today's fiercely competitive business environment, revenue assurance has become an essential focus for organizations seeking to maximize their income and minimize financial losses. Revenue assurance encompasses a series of processes and practices aimed at ensuring that all revenue generated by a business is accurately recorded, reported, and collected. This is particularly crucial in industries with complex billing structures, such as telecommunications, utilities, and finance. The Revenue Assurance Market Growth reflects this growing necessity, with a valuation of USD 645.7 million in 2023, projected to reach USD 1,467.5 million by 2032, and expected to grow at a compound annual growth rate (CAGR) of 9.6% from 2024 to 2032.

Understanding Revenue Assurance

Revenue assurance is a systematic approach that organizations use to identify, prevent, and rectify revenue leakage. Revenue leakage occurs when businesses fail to capture or bill for all the services or products they provide, leading to lost income. This can happen due to various reasons, including system errors, data inaccuracies, inadequate billing processes, or customer disputes. By implementing revenue assurance practices, companies can close these gaps and ensure that they are collecting the full amount owed for their services.

At its core, revenue assurance involves analyzing data across various departments, such as billing, operations, and customer service, to identify discrepancies and inefficiencies. This comprehensive approach allows organizations to gain insights into their revenue streams, monitor performance, and implement corrective actions as needed. As businesses increasingly adopt digital technologies and advanced analytics, revenue assurance has evolved into a more proactive discipline, leveraging data-driven strategies to enhance financial integrity.

The Role of Technology in Revenue Assurance

The rapid advancement of technology has significantly transformed revenue assurance practices. Organizations are now utilizing sophisticated software solutions that incorporate artificial intelligence (AI) and machine learning (ML) to analyze vast amounts of data in real time. These tools can identify patterns, flag anomalies, and automate routine processes, enabling businesses to detect potential revenue leakage more effectively.

Moreover, cloud-based solutions have made it easier for organizations to consolidate their data across different platforms, ensuring that all revenue-related information is accessible and accurate. This centralization of data not only streamlines revenue assurance processes but also enhances collaboration among departments. By breaking down silos, organizations can foster a more cohesive approach to revenue management, ultimately leading to better financial outcomes.

Benefits of Revenue Assurance

Implementing robust revenue assurance practices offers several key benefits for organizations. First and foremost, it helps to enhance financial accuracy and accountability. By regularly monitoring and reconciling revenue data, businesses can ensure that their financial reports reflect their actual performance. This accuracy is crucial for making informed strategic decisions and maintaining stakeholder confidence.

Additionally, effective revenue assurance can significantly improve cash flow management. By minimizing revenue leakage, organizations can ensure that they receive timely payments for the services they provide. This not only boosts immediate cash flow but also strengthens customer relationships by fostering trust and transparency in billing practices.

Furthermore, revenue assurance contributes to regulatory compliance. Many industries are subject to strict regulations regarding financial reporting and data management. By implementing robust revenue assurance practices, organizations can demonstrate their commitment to compliance, reducing the risk of legal penalties and reputational damage.

Challenges in Revenue Assurance

Despite its benefits, revenue assurance is not without challenges. One of the primary hurdles organizations face is the complexity of their billing systems. As businesses expand and diversify their service offerings, billing processes can become convoluted, increasing the likelihood of errors and discrepancies. To address this, organizations must continuously review and optimize their billing processes, ensuring that they remain efficient and transparent.

Another challenge is the need for cultural buy-in across the organization. Revenue assurance requires collaboration among various departments, and fostering a culture of accountability and transparency can be difficult. Organizations must invest in training and awareness programs to emphasize the importance of revenue assurance and encourage employees to adopt best practices.

The Future of Revenue Assurance

Looking ahead, the future of revenue assurance appears promising. As organizations continue to embrace digital transformation, the integration of advanced technologies will further enhance revenue assurance capabilities. Predictive analytics, for instance, can provide organizations with insights into future revenue trends, allowing them to proactively address potential issues before they arise.

Additionally, as regulatory environments become increasingly complex, the demand for robust revenue assurance practices will only grow. Organizations that prioritize revenue assurance will be better positioned to navigate these challenges and capitalize on new opportunities for growth.

In conclusion, revenue assurance plays a crucial role in safeguarding a business's financial health. By implementing effective practices and leveraging advanced technologies, organizations can minimize revenue leakage, enhance financial accuracy, and improve cash flow. As the Revenue Assurance Market continues to grow, businesses that invest in robust revenue assurance strategies will be well-equipped to thrive in an ever-evolving landscape.

Contact Us:

Akash Anand – Head of Business Development & Strategy

info@snsinsider.com

Phone: +1-415-230-0044 (US) | +91-7798602273 (IND)

About Us

S&S Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

Read Our Other Reports:

Reconciliation Software Market Growth

- Revenue_Assurance_Market

- Revenue_Assurance_Market_Size

- Revenue_Assurance_Market_Share

- Revenue_Assurance_Market_Growth

- Revenue_Assurance_Market_Trends

- Revenue_Assurance_Market_Report

- Revenue_Assurance_Market_Analysis

- Revenue_Assurance_Market_Forecast

- Revenue_Assurance_Industry

- Revenue_Assurance_Market_Research

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- الألعاب

- Gardening

- Health

- الرئيسية

- Literature

- Music

- Networking

- أخرى

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness