Key Features of Effective Insurance Management Software

In an increasingly competitive market, insurance companies are leveraging technology to streamline operations, enhance customer experience, and ensure compliance. Effective insurance management software plays a pivotal role in achieving these objectives, enabling businesses to manage policies, claims, and customer interactions efficiently. In this article, we will explore the key features of effective insurance management software, highlighting how they contribute to the overall success of insurance organizations and the importance of insurance software development in this process.

1. Policy Management

One of the core functions of any insurance management software is policy management. This feature allows insurers to create, modify, and manage insurance policies throughout their lifecycle. Effective policy management includes automated policy generation, tracking renewals, and issuing endorsements.

The capability to manage multiple policy types—such as auto, health, and life insurance—within a single platform is crucial. By utilizing insurance software development, companies can ensure that their software provides comprehensive policy management tools that simplify these processes, minimize errors, and enhance overall efficiency.

2. Claims Management

Claims processing is a critical aspect of insurance operations. An effective insurance management software should facilitate seamless claims management by allowing users to report, track, and resolve claims efficiently. Features such as automated claims routing, documentation uploads, and real-time status updates are essential for improving the claims experience for both agents and policyholders.

Insurance companies can greatly benefit from customized claims management modules developed through insurance software development. These modules can be tailored to meet the specific needs of the organization, ensuring that the claims process is as efficient and transparent as possible.

3. Customer Relationship Management (CRM)

In the insurance industry, building strong relationships with customers is vital for retention and growth. Effective insurance management software integrates robust CRM capabilities that enable companies to manage customer interactions, track communications, and analyze customer data.

By leveraging CRM functionalities, insurers can personalize customer experiences, streamline communication, and enhance service delivery. Features such as automated follow-ups, reminders for policy renewals, and customer feedback collection can be developed through insurance software development to create a holistic view of customer interactions, ultimately driving customer satisfaction and loyalty.

4. Reporting and Analytics

Data-driven decision-making is essential for the success of any insurance business. An effective insurance management software should offer comprehensive reporting and analytics features that provide insights into various aspects of the business, including sales performance, claims statistics, and customer demographics.

By utilizing advanced analytics tools, insurance companies can identify trends, uncover opportunities, and make informed strategic decisions. Insurance software development can help create customized reporting dashboards that cater to the specific needs of different stakeholders within the organization, ensuring that everyone has access to the information they need to perform their roles effectively.

5. Regulatory Compliance

The insurance industry is heavily regulated, with strict compliance requirements that companies must adhere to. Effective insurance management software should include features that help organizations maintain compliance with industry regulations and standards.

These features can include automated compliance checks, audit trails, and alerts for regulatory changes. By incorporating compliance management tools into their software through insurance software development, insurers can reduce the risk of non-compliance, avoid potential fines, and enhance their reputation within the industry.

6. Integration Capabilities

In today’s digital landscape, insurance companies often rely on various systems and applications to run their operations. Therefore, effective insurance management software must offer seamless integration capabilities with other platforms such as accounting software, customer portals, and third-party data providers.

Integrating various systems ensures that data flows smoothly across the organization, reducing redundancy and improving overall efficiency. Insurance software development can enable the creation of APIs and integration solutions that allow for real-time data exchange between systems, ultimately enhancing operational workflows.

7. Mobile Accessibility

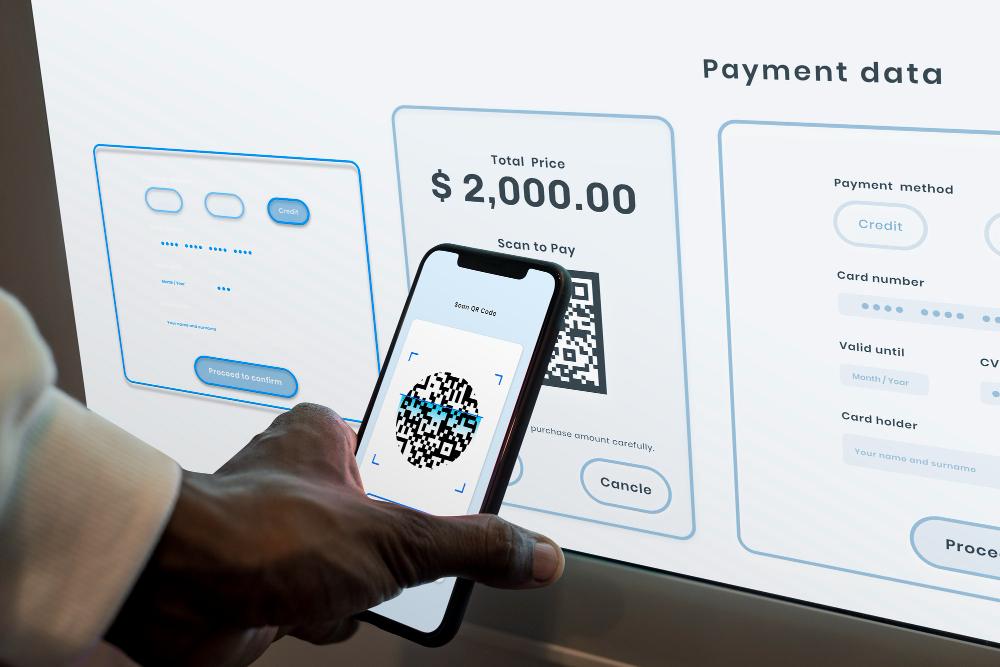

With the growing reliance on mobile technology, insurance management software must be accessible on various devices, including smartphones and tablets. Effective software solutions offer mobile applications that allow agents and customers to manage policies, submit claims, and access information on the go.

Mobile accessibility enhances customer experience and enables agents to provide timely service while in the field. The development of mobile-friendly insurance management software through insurance software development is crucial for meeting the demands of today’s tech-savvy customers.

8. Document Management

Managing documentation is a significant challenge in the insurance industry, with countless files and records generated throughout the policy lifecycle. Effective insurance management software should include robust document management features that allow users to store, organize, and retrieve documents easily.

With features like secure document uploads, automated document generation, and electronic signatures, insurers can streamline their workflows and enhance productivity. Incorporating advanced document management capabilities through insurance software development can help organizations maintain compliance and improve efficiency.

9. Customer Self-Service Portal

In an era where customers expect instant access to information, an effective insurance management software should provide a self-service portal. This portal allows customers to manage their policies, submit claims, and access documents without the need for direct interaction with agents.

Self-service capabilities empower customers, reduce administrative workload, and enhance overall satisfaction. Insurance software development can facilitate the creation of intuitive self-service platforms that improve customer engagement and streamline processes.

10. Customization and Scalability

Every insurance company has unique needs and workflows. Effective insurance management software should be customizable and scalable to adapt to the changing requirements of the organization.

Customization allows insurers to tailor the software to their specific processes, while scalability ensures that the software can grow alongside the business. Through insurance software development, companies can create solutions that evolve with their needs, ensuring long-term viability and effectiveness.

Conclusion

In conclusion, effective insurance management software is essential for the success of insurance organizations in today’s competitive landscape. By focusing on key features such as policy management, claims processing, customer relationship management, reporting and analytics, regulatory compliance, integration capabilities, mobile accessibility, document management, customer self-service, and customization, insurance companies can enhance their operations and improve customer experiences.

Investing in insurance software development is not just a trend; it is a strategic move that can significantly impact an organization’s efficiency, profitability, and long-term success. As the insurance industry continues to evolve, leveraging technology through effective software solutions will be crucial in meeting the demands of both customers and regulatory bodies.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jogos

- Gardening

- Health

- Início

- Literature

- Music

- Networking

- Outro

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness