Usage-Based Insurance Market Offers Customized Premiums for Safer Drivers and Cost Savings

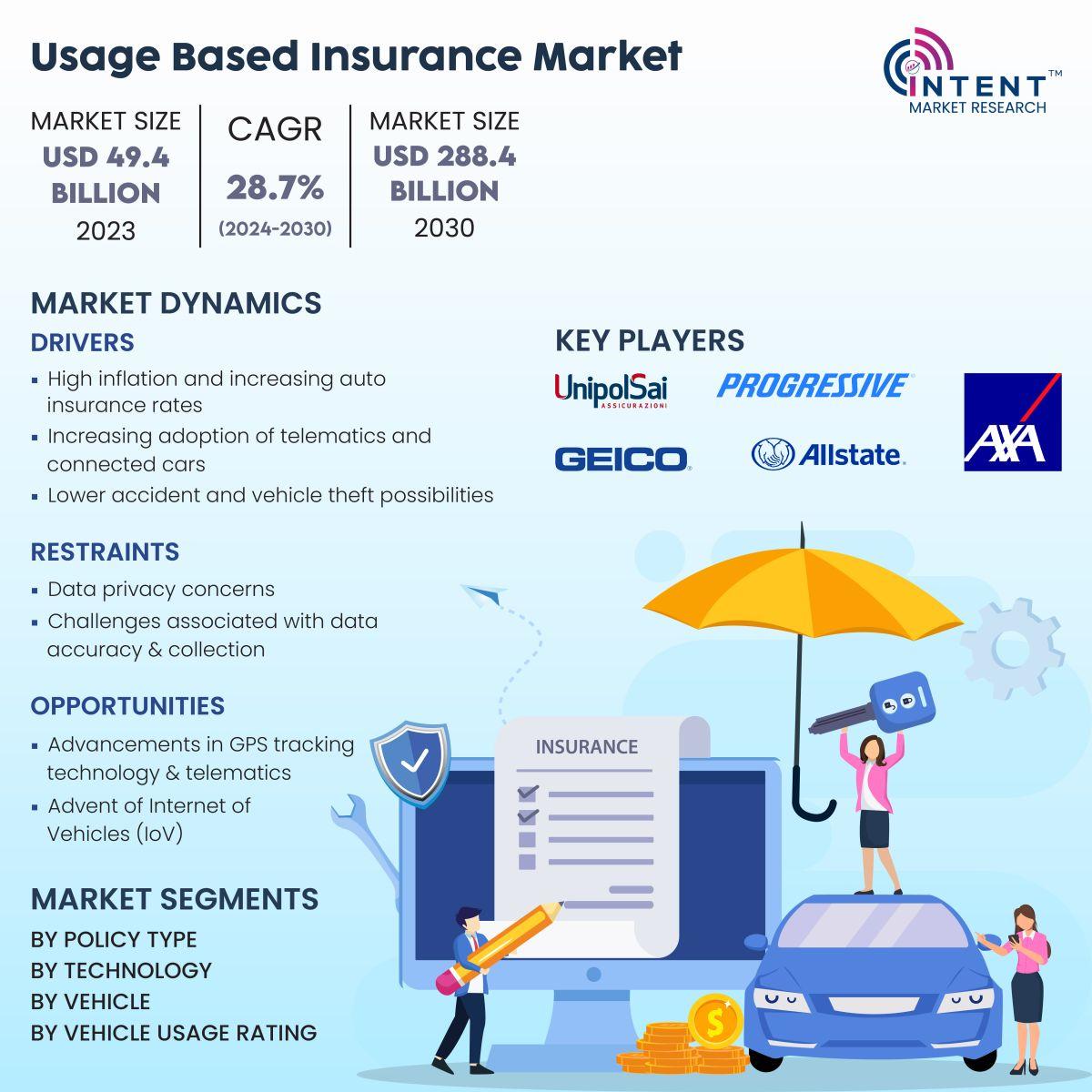

The Usage-Based Insurance market is experiencing explosive growth, poised to transform how insurance is delivered and consumed. With a value of USD 49.4 billion in 2023, this innovative market is expected to surge to USD 288.4 billion by 2030, achieving an impressive compound annual growth rate (CAGR) of 28.7%. Let's explore the key aspects driving this evolution, its applications, benefits, and challenges.

What is Usage-Based Insurance?

Usage-Based Insurance, also known as telematics insurance, is a model where premiums are determined by real-time driving behavior, mileage, or other individual usage metrics. By integrating technology like GPS trackers, onboard diagnostics, and mobile apps, insurers can assess risk profiles more accurately, offering customers customized premiums.

Download Sample Report @ https://intentmarketresearch.com/request-sample/usage-based-insurance-market-3090.html

Key Drivers of UBI Market Growth

-

Advancements in Telematics Technology

With connected devices and telematics becoming mainstream, insurers have unprecedented access to data that aids in analyzing driver behavior and risk. -

Growing Demand for Personalized Policies

Traditional insurance models often fail to accommodate individual driving habits. UBI fills this gap by offering tailored premiums, leading to increased customer satisfaction. -

Increased Adoption of Connected Vehicles

As smart vehicles become more common, they provide a perfect platform for seamless integration of usage-based insurance systems. -

Rising Focus on Cost Savings

UBI rewards safe drivers with lower premiums, appealing to customers keen on reducing their insurance costs.

Applications of Usage-Based Insurance

-

Pay-As-You-Drive (PAYD)

This model charges drivers based on the number of miles driven, ideal for those who travel infrequently. -

Pay-How-You-Drive (PHYD)

Focused on driving behavior, this type evaluates metrics such as speed, acceleration, and braking patterns to determine premiums. -

Manage-How-You-Drive (MHYD)

A hybrid approach, this model offers additional features like real-time coaching, alerts for risky behaviors, and maintenance recommendations.

Benefits of Usage-Based Insurance

-

Fair Pricing

UBI aligns insurance costs with actual usage, ensuring fairer pricing compared to traditional policies. -

Encouragement of Safer Driving

With incentives for good driving habits, UBI promotes road safety and reduces accident rates. -

Enhanced Transparency

Customers gain clarity on how their premiums are calculated, building trust with insurance providers. -

Cost Efficiency for Providers

Insurers benefit from improved risk assessment and reduced claim fraud through detailed data collection.

Access Full Report @ https://intentmarketresearch.com/latest-reports/usage-based-insurance-market-3090.html

Challenges Facing the UBI Market

-

Data Privacy Concerns

The collection and analysis of real-time driving data raise issues about personal privacy and data security. -

High Initial Investment

Setting up the necessary infrastructure for telematics integration can be costly for insurers. -

Regulatory Hurdles

Regulations regarding data usage, storage, and transparency can vary across regions, creating implementation challenges. -

Customer Skepticism

Some customers may resist adopting UBI due to distrust in how their driving data will be utilized.

The Road Ahead: Future of UBI

With the rise of electric and autonomous vehicles, the UBI market has vast potential for expansion. Collaboration between automakers and insurers is likely to intensify, driving innovation in insurance models. Emerging technologies like AI and big data analytics will further refine risk assessment, creating even more tailored solutions.

By 2030, UBI could become the standard for motor insurance, especially in developed markets where digital adoption is high.

FAQs

-

What is the projected market size of UBI by 2030?

The UBI market is expected to reach USD 288.4 billion by 2030, growing at a CAGR of 28.7%. -

What technologies enable UBI?

UBI relies on telematics, GPS, mobile apps, and connected vehicle platforms to collect and analyze data. -

How does UBI benefit drivers?

UBI offers fairer premiums, promotes safer driving habits, and provides transparency in insurance pricing. -

What are the primary challenges for UBI adoption?

Key challenges include data privacy concerns, high setup costs, and varying regional regulations. -

Is UBI suitable for all types of drivers?

UBI is particularly beneficial for low-mileage and safe drivers seeking cost-efficient and personalized insurance solutions.

About Us

Intent Market Research (IMR) is dedicated to delivering distinctive market insights, focusing on the sustainable and inclusive growth of our clients. We provide in-depth market research reports and consulting services, empowering businesses to make informed, data-driven decisions.

Our market intelligence reports are grounded in factual and relevant insights across various industries, including chemicals & materials, healthcare, food & beverage, automotive & transportation, energy & power, packaging, industrial equipment, building & construction, aerospace & defense, and semiconductor & electronics, among others.

We adopt a highly collaborative approach, partnering closely with clients to drive transformative changes that benefit all stakeholders. With a strong commitment to innovation, we aim to help businesses expand, build sustainable advantages, and create meaningful, positive impacts.

Contact Us

US: +1 463-583-2713

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness