Digital Banking Market Regional Analysis, Market Segmentation, Growth Drivers

Digital Banking 2024

Digital banking has rapidly transformed the way consumers and businesses manage their financial services. Over the past decade, financial institutions have embraced technology to streamline banking processes, enhance customer experience, and provide a range of services that are accessible anytime, anywhere. With the shift toward online banking platforms and mobile banking apps, digital banking has gained widespread acceptance among users who demand convenience and efficiency. Digital Banking Market Trends highlight a growing shift toward digital-first banking, with more customers opting for online services rather than traditional in-person visits. This transition is not only driven by consumer preferences but also by the need for banks to improve operational efficiency and stay competitive in an increasingly tech-driven financial landscape.

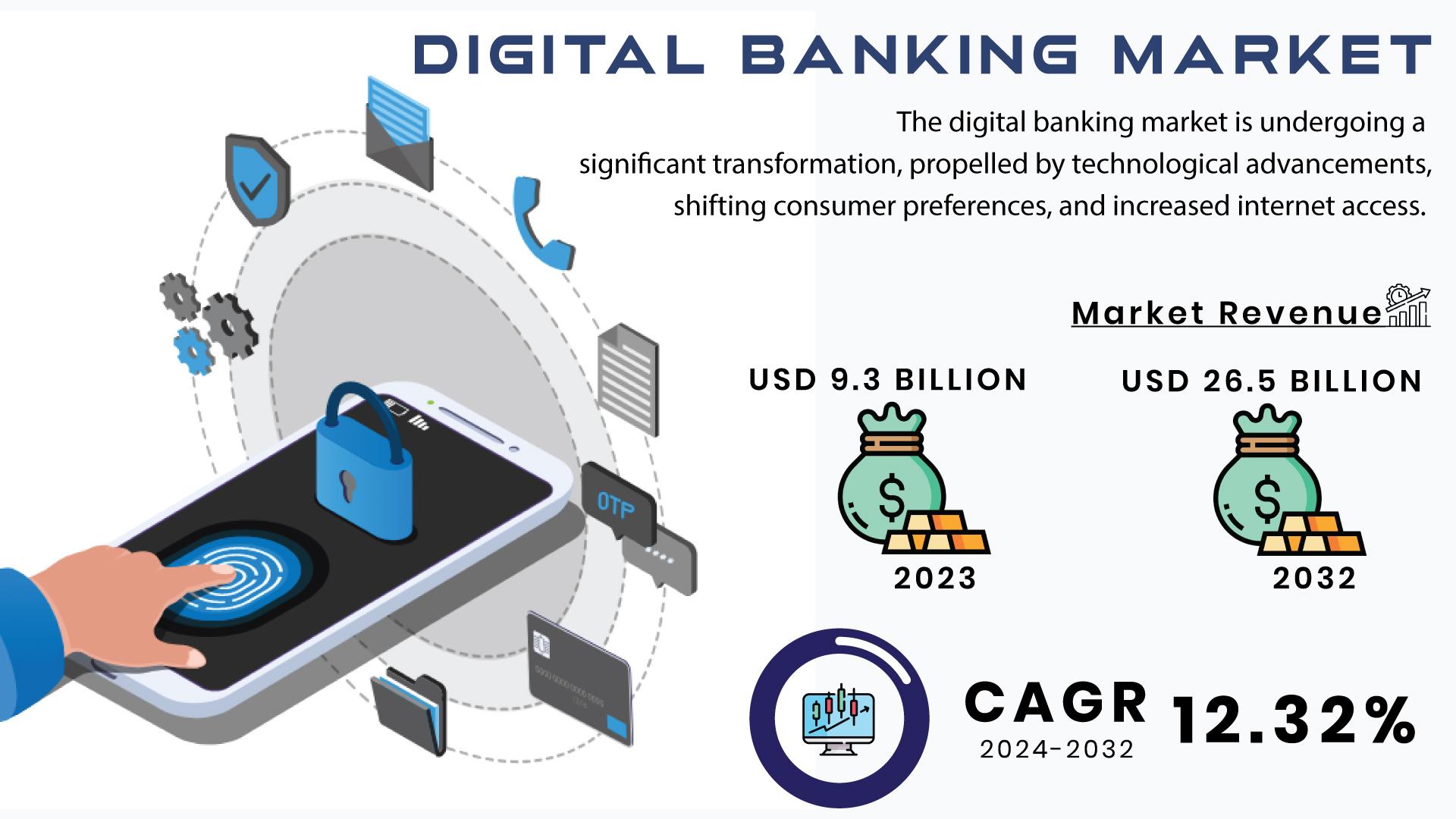

Digital Banking Market was valued at USD 9.3 billion in 2023 and is expected to reach USD 26.5 billion by 2032, growing at a CAGR of 12.32% from 2024-2032. This growth is reflective of the increasing adoption of digital banking solutions by both traditional financial institutions and fintech startups, which are reshaping the future of banking.

Advantages of Digital Banking

One of the main reasons for the success of digital banking is the convenience it offers. Customers can access their accounts, transfer funds, apply for loans, pay bills, and even manage investments through online platforms or mobile apps, all without needing to visit a physical branch. The round-the-clock availability of services, coupled with the ease of use, has made digital banking highly popular among consumers. Additionally, digital banking allows for faster transactions, which significantly reduces waiting times and increases the overall efficiency of financial processes.

Moreover, digital banking promotes financial inclusion by providing access to banking services for individuals in remote or underserved regions. With internet access and a mobile device, people can perform banking transactions, manage accounts, and access financial services that were once out of reach for many. This accessibility is opening up opportunities for millions of people worldwide who may not have had access to traditional banking systems.

Technological Advancements Driving Digital Banking

The rise of digital banking has been largely driven by advancements in technology. Innovations such as artificial intelligence (AI), machine learning, and blockchain are enhancing the way digital banking operates. AI and machine learning are used to personalize customer experiences by analyzing consumer behavior and offering tailored financial products and services. These technologies also play a crucial role in improving fraud detection, risk management, and customer support services. For example, AI-powered chatbots are increasingly used to provide customers with instant assistance, helping banks manage customer queries more efficiently.

Blockchain technology is also gaining traction in the digital banking space due to its potential to improve transparency, reduce transaction costs, and enhance security. With the ability to process secure and instant payments across borders, blockchain is paving the way for a more efficient and cost-effective global banking system. Additionally, the integration of biometric authentication, such as facial recognition and fingerprint scanning, is further enhancing the security of digital banking platforms, ensuring that only authorized users can access sensitive information.

The Role of Fintech in Digital Banking

Fintech startups have played a significant role in accelerating the growth of digital banking by introducing innovative solutions that challenge traditional banking models. These startups are creating new opportunities for financial services by leveraging digital platforms to offer everything from peer-to-peer payments to digital wallets and lending services. By focusing on simplicity, speed, and customer-centric approaches, fintech companies are reshaping the financial industry and providing more competitive alternatives to traditional banking services.

In addition, many traditional banks are embracing digital transformation by partnering with fintech companies or developing their own in-house solutions. This collaboration between banks and fintechs is helping to drive innovation and improve the digital banking experience for customers. As a result, consumers are benefiting from a wider range of financial products, more user-friendly platforms, and enhanced customer service.

Challenges in Digital Banking

Despite the many benefits of digital banking, there are also challenges that need to be addressed. Cybersecurity is a major concern for both banks and customers, as digital banking platforms become attractive targets for cybercriminals. Banks are investing heavily in security measures to protect sensitive financial data and prevent data breaches. Regulatory compliance is another challenge, as banks must adhere to strict financial regulations, including data protection laws, anti-money laundering (AML) requirements, and know-your-customer (KYC) guidelines. This requires a delicate balance between offering innovative services and maintaining compliance with government standards.

Additionally, the digital divide remains a barrier in some regions, where access to technology and the internet is limited. To fully unlock the potential of digital banking, efforts need to be made to ensure that more people, particularly in rural or underserved areas, can gain access to the necessary technology and infrastructure.

The Future of Digital Banking

The future of digital banking looks promising, with continuous advancements in technology and increasing customer demand for more seamless and secure banking experiences. As 5G networks and the Internet of Things (IoT) continue to expand, digital banking platforms will become faster, more responsive, and integrated into everyday life. The adoption of digital currencies and central bank digital currencies (CBDCs) is also expected to play a significant role in the evolution of digital banking, providing new opportunities for payment systems and financial services.

In conclusion, digital banking is transforming the financial services industry by offering greater convenience, accessibility, and innovation. With continued advancements in technology and an increasing focus on customer-centric services, digital banking is set to revolutionize the way people manage their finances, making banking more efficient and inclusive than ever before. As the market continues to grow, it will play a central role in shaping the future of the global financial system.

Contact Us:

Akash Anand – Head of Business Development & Strategy

Phone: +1-415-230-0044 (US) | +91-7798602273 (IND)

About Us

S&S Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

Read Our Other Reports:

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness