Digital Payment Processing Market: Opportunities and Forecast 2024–2031

The Digital Payment Processing Market sector is undergoing rapid transformation, with significant growth and innovations expected by 2031. In-depth market research offers a thorough analysis of market size, share, and emerging trends, providing essential insights into its expansion potential. The report explores market segmentation and definitions, emphasizing key components and growth drivers. Through the use of SWOT and PESTEL analyses, it evaluates the sector’s strengths, weaknesses, opportunities, and threats, while considering political, economic, social, technological, environmental, and legal influences. Expert evaluations of competitor strategies and recent developments shed light on geographical trends and forecast the market’s future direction, creating a solid framework for strategic planning and investment decisions.

Digital Payment Processing Market Industry Trends and Forecast to 2031

Brief Overview of the Digital Payment Processing Market:

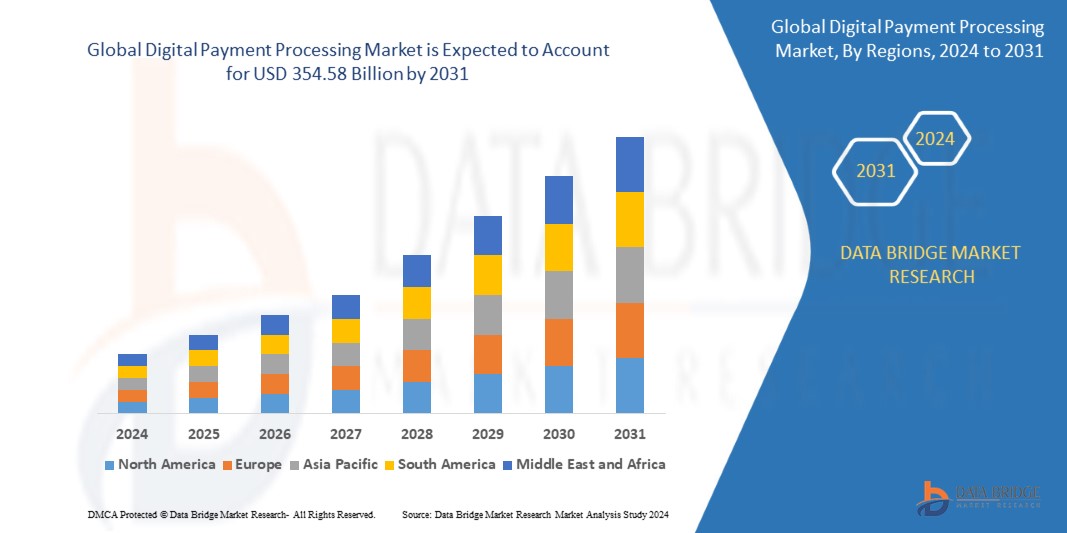

The global Digital Payment Processing Market is expected to experience substantial growth between 2024 and 2031. Starting from a steady growth rate in 2023, the market is anticipated to accelerate due to increasing strategic initiatives by key market players throughout the forecast period.

Get a Sample PDF of Report - https://www.databridgemarketresearch.com/request-a-sample/?dbmr=global-digital-payment-processing-market

Which are the top companies operating in the Digital Payment Processing Market?

The report profiles noticeable organizations working in the water purifier showcase and the triumphant methodologies received by them. It likewise reveals insights about the share held by each organization and their contribution to the market's extension. This Global Digital Payment Processing Market report provides the information of the Top Companies in Digital Payment Processing Market in the market their business strategy, financial situation etc.

Fiserv, Inc. (U.S.), FIS (U.S.), PayPal Payments Private Limited (Singapore), Global Payments Inc. (U.S.), Square Capital, LLC (U.S.), Visa Inc. (U.S.), Mastercard (U.S.), WEX Inc. (U.S.), ACI Worldwide, Inc. (U.S.), JPMorgan Chase & Co. (U.S.), Intuit Inc. (U.S.), Stripe (U.S.), Due Inc. (U.S.), Adyen (Netherlands), PayTrace (U.S.), Apple Inc. (U.S.), ALIANT PAYMENTS (U.S.), Aurus Inc. (U.S.), Fattmerchant Inc. (U.S.), 2Checkout (U.S.), Paysafe Holdings UK Limited (U.K.), PayU (Netherlands), SPREEDLY, INC. (U.S.)

Report Scope and Market Segmentation

Which are the driving factors of the Digital Payment Processing Market?

The driving factors of the Digital Payment Processing Market are multifaceted and crucial for its growth and development. Technological advancements play a significant role by enhancing product efficiency, reducing costs, and introducing innovative features that cater to evolving consumer demands. Rising consumer interest and demand for keyword-related products and services further fuel market expansion. Favorable economic conditions, including increased disposable incomes, enable higher consumer spending, which benefits the market. Supportive regulatory environments, with policies that provide incentives and subsidies, also encourage growth, while globalization opens new opportunities by expanding market reach and international trade.

Digital Payment Processing Market - Competitive and Segmentation Analysis:

**Segments**

- By Payment Type: Mobile Commerce, Digital Commerce

- By Deployment: On-Premises, Cloud

- By Organization Size: Large Enterprises, SMEs

- By End-User: BFSI, Retail, Healthcare, IT and Telecom, Government, Others

The digital payment processing market is experiencing significant growth driven by the increasing penetration of smartphones, rising adoption of digital payments, and the convenience offered by online payment solutions. Mobile commerce is one of the key segments within the market, as consumers are increasingly using their mobile devices to make payments for goods and services. Digital commerce is also a prominent segment, reflecting the shift towards online shopping and e-commerce platforms. The deployment models of on-premises and cloud offer businesses flexibility in choosing how they want to manage their payment processing infrastructure. In terms of organization size, both large enterprises and SMEs are investing in digital payment solutions to streamline their payment processes. The end-user industries driving the demand for digital payment processing include BFSI, retail, healthcare, IT and telecom, government, and others.

**Market Players**

- PayPal Holdings, Inc.

- Visa Inc.

- Mastercard

- Fiserv, Inc.

- Square, Inc.

- American Express Company

- Stripe

- Ant Group

- Adyen

- ACI Worldwide

The digital payment processing market is competitive, with key players such as PayPal Holdings, Visa Inc., and Mastercard leading the industry. These companies offer a range of digital payment solutions to cater to the diverse needs of businesses and consumers. Fiserv, Square, and American Express are also major players in the market, providing innovative payment processing tools and services. Stripe, Ant Group, Adyen, and ACI Worldwide are recognized for their expertise in online payment solutions and are driving innovation in the sector. As the demand for digital payment processing continues to grow, these market players are actively engaged in research and development to enhance their offerings and stay ahead in the competitive landscape.

https://wwwThe digital payment processing market is witnessing a revolution spurred by technological advancements and changing consumer preferences. Mobile commerce has emerged as a pivotal segment within the market, with the ubiquitous use of smartphones enabling consumers to make payments on the go seamlessly. This trend is further fueled by the convenience and speed offered by mobile payment solutions. On the other hand, digital commerce is gaining traction as more consumers shift towards online shopping and e-commerce platforms, driving the demand for secure and efficient payment processing services. The deployment models of on-premises and cloud solutions provide businesses with the flexibility to choose a payment infrastructure that aligns with their operational needs and scalability requirements.

In terms of organization size, both large enterprises and SMEs are increasingly recognizing the importance of digital payment solutions in streamlining their payment processes, enhancing customer experience, and gaining a competitive edge in the market. Large enterprises often leverage advanced payment processing platforms to handle a high volume of transactions efficiently, while SMEs opt for tailored solutions that cater to their specific needs and budget constraints. The versatility of digital payment solutions makes them suitable for a diverse range of industries, with key sectors such as BFSI, retail, healthcare, IT and telecom, government, and others driving the adoption of digital payment processing technology.

The market landscape is characterized by fierce competition among prominent players striving to innovate and differentiate their offerings to meet the evolving demands of businesses and consumers. Leading players such as PayPal Holdings, Visa Inc., and Mastercard have established strong market presence and brand recognition, offering a comprehensive suite of digital payment solutions that cater to various payment preferences and channels. Fiserv, Square, and American Express are also key players in the market, leveraging their expertise in payment processing technologies to provide secure, reliable, and user-friendly payment solutions.

Additionally, companies like Stripe, Ant Group, Adyen, and ACI Worldwide are at the forefront of driving innovation in online payment solutions, focusing on enhancing transaction security, accelerating payment processing speeds, and expanding the global reach of digital payments. These players**Market Players**

- Fiserv, Inc. (U.S.)

- FIS (U.S.)

- PayPal Payments Private Limited (Singapore)

- Global Payments Inc. (U.S.)

- Square Capital, LLC (U.S.)

- Visa Inc. (U.S.)

- Mastercard (U.S.)

- WEX Inc. (U.S.)

- ACI Worldwide, Inc. (U.S.)

- JPMorgan Chase & Co. (U.S.)

- Intuit Inc. (U.S.)

- Stripe (U.S.)

- Due Inc. (U.S.)

- Adyen (Netherlands)

- PayTrace (U.S.)

- Apple Inc. (U.S.)

- ALIANT PAYMENTS (U.S.)

- Aurus Inc. (U.S.)

- Fattmerchant Inc. (U.S.)

- 2Checkout (U.S.)

- Paysafe Holdings UK Limited (U.K.)

- PayU (Netherlands)

- SPREEDLY, INC. (U.S.)

The digital payment processing market is witnessing exponential growth driven by the increasing adoption of mobile and digital commerce, diverse deployment options, and demand across various industries. Mobile commerce, fueled by smartphone penetration, is reshaping how consumers make payments, emphasizing convenience and speed. Similarly, the rise of digital commerce reflects the shift towards online shopping, boosting the need for secure payment processing services. Companies can opt for on-premises or cloud-based solutions, providing flexibility in managing payment infrastructures

North America, particularly the United States, will continue to exert significant influence that cannot be overlooked. Any shifts in the United States could impact the development trajectory of the Digital Payment Processing Market. The North American market is poised for substantial growth over the forecast period. The region benefits from widespread adoption of advanced technologies and the presence of major industry players, creating abundant growth opportunities.

Similarly, Europe plays a crucial role in the global Digital Payment Processing Market, expected to exhibit impressive growth in CAGR from 2024 to 2031.

Global Digital Payment Processing Market Industry Trends and Forecast to 2031

Key Benefits for Industry Participants and Stakeholders: –

- Industry drivers, trends, restraints, and opportunities are covered in the study.

- Neutral perspective on the Digital Payment Processing Market scenario

- Recent industry growth and new developments

- Competitive landscape and strategies of key companies

- The Historical, current, and estimated Digital Payment Processing Market size in terms of value and size

- In-depth, comprehensive analysis and forecasting of the Digital Payment Processing Market

Geographically, the detailed analysis of consumption, revenue, market share and growth rate, historical data and forecast (2024-2031) of the following regions are covered in Chapters

The countries covered in the Digital Payment Processing Market report are U.S., Canada and Mexico in North America, Brazil, Argentina and Rest of South America as part of South America, Germany, Italy, U.K., France, Spain, Netherlands, Belgium, Switzerland, Turkey, Russia, Rest of Europe in Europe, Japan, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA

Explore Further Details about This Research Digital Payment Processing Market Report https://www.databridgemarketresearch.com/reports/global-digital-payment-processing-market

This Digital Payment Processing Market Research/Analysis Report Contains Answers to the Following Questions:

Who are the Key Players of Digital Payment Processing Market?

- Identify the major companies and entities leading the market, their market share, financial performance, geographic presence, and their role in driving industry trends.

What are the Digital Payment Processing Market Trends?

- Explore current and emerging trends shaping the market, including technological advancements, consumer preferences, and regulatory impacts.

What is the Digital Payment Processing Market Size and Growth Rate?

- Understand the current size of the market, its historical growth, and future projections, including key factors driving or hindering growth.

What are the Opportunities and Challenges?

- Identify potential opportunities for growth, innovation, and investment, as well as the challenges and risks that may affect market dynamics.

What are the Key Digital Payment Processing Market Segments?

- Breakdown the market into its major segments based on product types, applications, end-users, and geographic regions to highlight areas of significant activity and potential.

What are the Competitive Strategies?

- Analyze the strategies adopted by key players, including product development, partnerships, mergers and acquisitions, and marketing tactics that drive their competitive edge.

What is the Consumer Behavior?

- Gain insights into consumer preferences, purchasing patterns, and factors influencing buying decisions within the market.

What are the Regulatory and Compliance Requirements?

- Understand the legal and regulatory landscape governing the market, including compliance requirements that companies must adhere to.

What are the Digital Payment Processing Market Forecasts?

- Provide future market outlook with detailed forecasts, including expected growth rates, emerging trends, and potential disruptions over the next few years.

What are the Innovation and R&D Activities?

- Highlight key innovations and research and development activities by leading companies that are shaping the future of the market.

Explore a comprehensive Table of Contents (TOC) with detailed tables, figures, and charts spanning over 350+ pages. Gain exclusive access to crucial data, information, vital statistics, trends, and a detailed competitive landscape analysis within this specialized sector.

Detailed TOC of Digital Payment Processing Market Insights and Forecast to 2031

Part 01: Executive Summary

Part 02: Scope Of The Report

Part 03: Research Methodology

Part 04: Digital Payment Processing Market Landscape

Part 05: Pipeline Analysis

Part 06: Digital Payment Processing Market Sizing

Part 07: Five Forces Analysis

Part 08: Digital Payment Processing Market Segmentation

Part 09: Customer Landscape

Part 10: Regional Landscape

Part 11: Decision Framework

Part 12: Drivers And Challenges

Part 13: Digital Payment Processing Market Trends

Part 14: Vendor Landscape

Part 15: Vendor Analysis

Part 16: Appendix

Browse More Reports:

Global Smart Vending Machine Market – Industry Trends and Forecast to 2030

Global Well Cementing Services Market – Industry Trends and Forecast to 2028

Global Subscription Based Internet Protocol Television Market – Industry Trends and Forecast to 2028

Global Body-Worn Camera Market – Industry Trends and Forecast to 2028

Global Congenital Abnormalities Market – Industry Trends and Forecast to 2030

Global Gigantism Drugs Market - Industry Trends and Forecast to 2028

Global Etoricoxib Intermediate Market - Industry Trends and Forecast to 2028

Global Cannabis Medicine Market – Industry Trends and Forecast to 2030

Global Functional Dyspepsia Market - Industry Trends and Forecast to 2028

Global Small Hydropower Market – Industry Trends and Forecast to 2030

Data Bridge Market Research:

Today's trends are a great way to predict future events!

Data Bridge Market Research is a market research and consulting company that stands out for its innovative and distinctive approach, as well as its unmatched resilience and integrated methods. We are dedicated to identifying the best market opportunities, and providing insightful information that will help your business thrive in the marketplace. Data Bridge offers tailored solutions to complex business challenges. This facilitates a smooth decision-making process. Data Bridge was founded in Pune in 2015. It is the product of deep wisdom and experience.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC: +653 1251 1158

Email:- [email protected]

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness